Analysis

Africa Leads in Nature-Related Green Bond Allocations

Insights for asset managers and portfolio strategists specialising in sustainable fixed income

Feb 20, 2025 @ London

ClimateAligned's comprehensive analysis reveals fascinating regional disparities in how green bond proceeds support nature-based solutions.

The global green bond market has expanded rapidly in recent years, directing substantial capital toward environmental projects worldwide. While much attention focuses on renewable energy and clean transportation, nature-related investments represent a crucial but often overlooked segment of this market. ClimateAligned's comprehensive analysis reveals fascinating regional disparities in how green bond proceeds support nature-based solutions.

Nature-Related Allocations: Regional Leadership

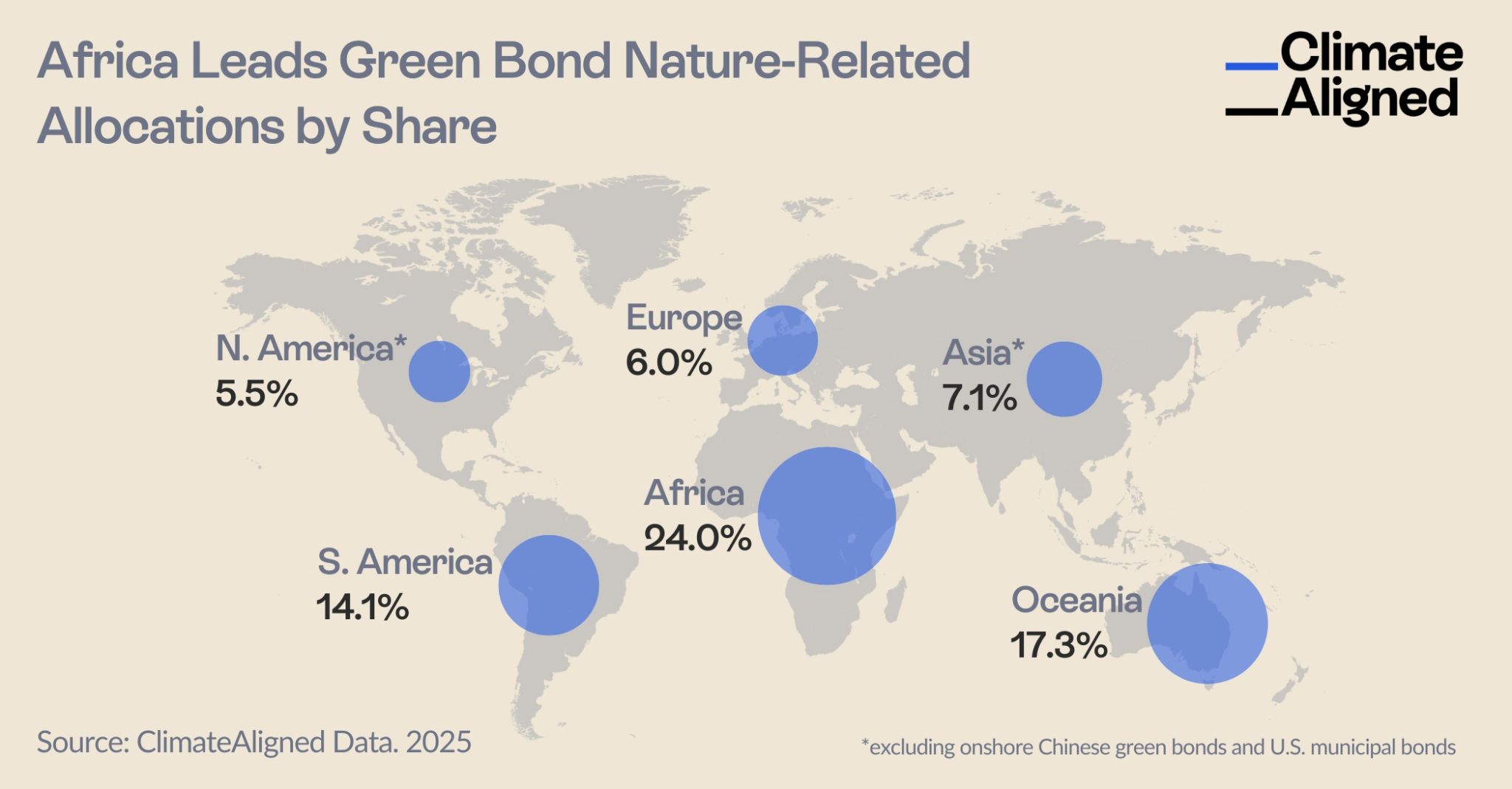

Our extensive research, examining post-issuance reporting from over 3,000 green bonds with a combined value of $1.1 trillion, shows that approximately $74.6 billion (6.6% of total proceeds) has been allocated to nature-related investments globally. However, these allocations are not distributed evenly across regions.

Africa stands out with an impressive 24% of its green bond proceeds directed to nature-related projects—the highest proportion of any continent. This remarkable prioritisation reflects the continent's recognition of nature-based solutions as fundamental to both climate resilience and sustainable development.

Regional Distribution of Nature-Related Allocations

The geographical distribution of nature-related investments reveals distinct regional priorities:

- Africa: 24.0% of regional green bond proceeds ($3.6 billion)

- Oceania: 17.3% of regional green bond proceeds

- South America: 14.1% of regional green bond proceeds

- Asia: 7.1% of regional green bond proceeds (excluding onshore Chinese green bonds)

- Europe: 6.0% of regional green bond proceeds ($46.1 billion)

- North America: 5.5% of regional green bond proceeds (excluding U.S. municipal bonds)

Source: ClimateAligned Data, 2025

Source: ClimateAligned Data, 2025

Development Banks: Catalysts for Nature-Based Investments in Africa

The leadership role of development banks in driving Africa's nature-related investments cannot be overstated. Our analysis identifies three multilateral development banks—the African Development Bank (AfDB), the Netherlands Development Finance Company (FMO), and the French Development Agency (AFD)—as particularly influential, accounting for 86% ($13.1 billion) of nature-related allocations in our African sample.

These institutions have strategically prioritised sustainable agriculture, water management, and natural resource conservation projects across the continent. Notably, all three development banks' green bonds with proceeds allocated in Africa include multiple nature investments, demonstrating a consistent commitment to integrating nature-based solutions into their climate finance strategies.

Contextualising Africa's Leadership

While Africa leads in proportional terms, allocating nearly a quarter of its green bond proceeds to nature-related projects, it's important to note that the continent receives just 1.35% of global green bond allocations. This places Africa's nature-related investments in a nuanced context:

- Proportional Excellence: Africa's 24% allocation rate to nature-related investments demonstrates exceptional prioritisation of these critical solutions.

- Volume Challenge: Europe, despite its lower relative share (6.0%), channels $46.1 billion into nature-based solutions—the largest absolute volume globally—reflecting its dominant 69% share of the total green bond market.

- Market Development Opportunity: Africa's high proportional commitment to nature-related investments, coupled with its small share of the global green bond market, suggests significant potential for scaled investment that maintains this nature-positive focus.

Market Implications for Investors

For institutional investors looking to optimise their sustainable fixed income allocations, these findings present several strategic considerations:

1. Thematic Alignment: Investors seeking exposure to nature-based solutions may find particularly high concentration in African green bonds, offering efficient thematic alignment.

2. Development Bank Leadership: The strong presence of development banks in Africa's nature-related investments provides institutional-grade issuers with robust impact reporting practices.

3. Diversification Potential: The distinctive nature focus of African green bonds offers portfolio diversification benefits compared to developed markets with higher concentrations in renewable energy and clean transportation.

4. Growth Prospects: Africa's nature-related green bond market, while proportionally advanced, has substantial growth potential given the continent's limited share of global green bond issuance.

Future Trajectory

As the sustainable finance market continues to evolve, Africa's leadership in prioritising nature-based investments offers valuable insights into regional approaches to climate finance. The continent's emphasis on natural resource conservation, sustainable agriculture, and water management reflects both ecological necessities and development priorities.

For the broader market, Africa's example demonstrates how green bonds can effectively channel capital toward nature-related investments, providing a potential model as global attention increasingly focuses on biodiversity conservation and nature-positive finance.

ClimateAligned's advanced analytics platform provides unprecedented visibility into where sustainable bond proceeds are actually deployed, moving beyond framework categories to reveal real-world capital flows.