Analysis

African Banks Match or Exceed European Peers in Climate Strategy Implementation

Insights for sustainability analysts and portfolio managers in fixed income markets

May 17, 2024 @ London

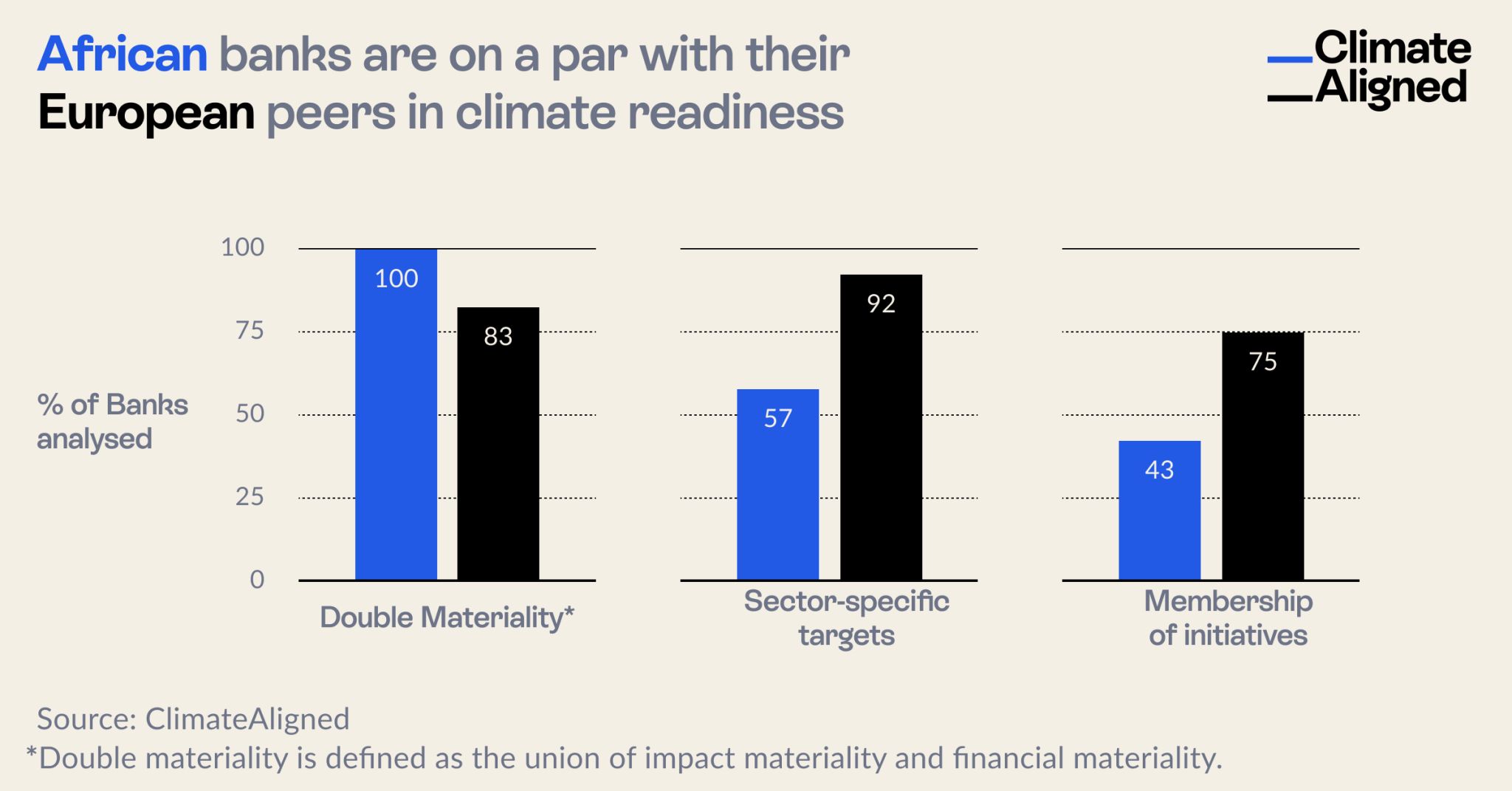

A collaborative benchmark study between ClimateAligned and the International Finance Corporation (IFC) reveals that African banks are matching or exceeding their European counterparts in several critical dimensions of climate strategy implementation.

New comprehensive analysis of climate-related disclosures challenges conventional assumptions about the readiness of financial institutions across different regions to address climate risks and opportunities. A collaborative benchmark study between ClimateAligned and the International Finance Corporation (IFC) reveals that African banks are matching or exceeding their European counterparts in several critical dimensions of climate strategy implementation.

Source: ClimateAligned, 2024

Source: ClimateAligned, 2024

Benchmark Study Methodology and Scope

The analysis examined 25 sets of annual disclosures from banks across Africa and Europe, evaluating 34 key elements aligned with Task Force on Climate-related Financial Disclosures (TCFD) recommendations. This rigorous assessment—encompassing 850 question-answer pairs—provides unprecedented visibility into the comparative climate readiness of financial institutions across these regions.

The benchmark focused on three critical dimensions of climate strategy: double materiality considerations, sector-specific target setting, and participation in collaborative climate initiatives. The results challenge prevailing narratives about a North-South divide in climate finance readiness.

Key Findings: African Leadership in Climate Strategy

The benchmark analysis revealed several areas where African banks are demonstrating notable strength in climate strategy implementation:

Universal Adoption of Double Materiality

Perhaps most striking is the finding that 100% of analysed African banks explicitly reference double materiality in their climate disclosures—surpassing the 83% adoption rate among their European counterparts. This comprehensive approach—which considers both how climate change affects a financial institution's performance (financial materiality) and how the institution's activities impact climate change (impact materiality)—represents best practice in climate-related reporting.

The universal adoption of double materiality frameworks among African banks suggests a sophisticated understanding of climate risks and opportunities that integrates both financial and environmental dimensions.

Comprehensive Climate Strategy Development

The analysis indicates that African banks are implementing comprehensive climate strategies at a rate exceeding 80%, demonstrating parity with European financial institutions in strategic climate response. This high level of strategic development challenges assumptions about disparities in institutional readiness between developed and emerging markets.

Universal TCFD Alignment

All African banks included in the sample report alignment with TCFD recommendations, indicating widespread adoption of internationally recognised climate disclosure frameworks. This universal alignment facilitates comparability and demonstrates a commitment to transparency regarding climate-related risks and opportunities.

Areas for Continued Development

While the benchmark reveals impressive progress among African financial institutions, it also identifies specific areas where further development would strengthen climate response:

Sector-Specific Target Setting

Approximately 57% of African banks have established sector-specific climate targets, compared to 92% of European peers. This represents the most significant gap identified in the analysis. Sector-specific targets—which establish differentiated decarbonisation pathways for high-emission sectors like energy, transportation, and heavy industry—enable more strategic allocation of capital toward transition activities.

The implementation of granular, sector-specific targets would enhance African banks' ability to effectively prioritise financing activities and manage climate transition risks across their portfolios.

Participation in Collaborative Initiatives

Only 43% of African banks in the sample participate in key climate initiatives such as the Net Zero Banking Alliance, compared to 75% of European institutions. These collaborative platforms facilitate knowledge sharing, harmonise approaches to climate-related risks, and accelerate the development of best practices in sustainable finance.

Increased participation in such initiatives could accelerate African banks' climate capabilities through peer learning and collective action while amplifying their influence in shaping global climate finance frameworks.

Strategic Implications for Financial Institutions and Stakeholders

The benchmark findings have significant implications for various stakeholder groups:

For African Financial Institutions

African banks can leverage their demonstrated strengths in climate strategy while addressing specific gaps:

- Build upon strong foundations in double materiality by developing more granular sector-specific decarbonisation targets

- Increase participation in international climate finance initiatives to share learnings and shape frameworks that address African market contexts

- Communicate leadership in climate readiness to counter potential misperceptions about regional capabilities

For Regulators and Policymakers

The analysis provides valuable insights for financial regulatory authorities:

- Recognise the advanced state of climate strategy implementation among many African financial institutions

- Consider how regulatory frameworks can build upon existing voluntary implementation to establish consistent expectations

- Address potential barriers to participation in international climate initiatives

For Investors and International Financial Institutions

For entities providing capital to or partnering with African banks:

- Acknowledge the sophisticated climate risk management already present in many African financial institutions

- Target capacity-building support toward specific identified gaps rather than assuming fundamental deficiencies

- Consider how investment criteria might better recognise the climate readiness demonstrated by many African banks

The Path Forward: Building on Strong Foundations

The benchmark results suggest several key priorities for continued advancement of climate strategy implementation across African financial institutions:

Sectoral Analysis Enhancement: Developing more granular understanding of transition pathways for key African economic sectors to enable more precise target setting

Cross-Regional Collaboration: Creating more platforms for knowledge exchange between African and European financial institutions, leveraging complementary strengths

Contextualised Implementation: Adapting global frameworks to address the specific climate challenges and opportunities present in African markets

Demonstration and Communication: More effectively showcasing African banks' climate leadership to counteract potential biases in international financial markets

Conclusion: Recognising Leadership and Potential

The benchmark analysis delivers a clear message: African banks have established strong foundations in climate strategy that match or exceed their European counterparts in several critical dimensions. While specific areas for further development exist, the overall picture is one of sophisticated engagement with climate-related risks and opportunities.

This finding challenges simplistic narratives about regional disparities in climate finance readiness and highlights the potential for African financial institutions to play leadership roles in financing the transition to a low-carbon economy. With targeted enhancement of sector-specific approaches and increased participation in collaborative initiatives, African banks are well-positioned to strengthen their already impressive climate strategy implementation.

ClimateAligned and the International Finance Corporation collaborated on this comprehensive benchmark of climate strategy implementation across African and European banks. The analysis of 850 data points across 25 financial institutions was completed in a single day using ClimateAligned's AI-powered analytics platform, dramatically accelerating the pace of insight generation compared to traditional methods.