Educational

Navigating the Maze: The Complex World of Labelled Bond Allocation Reporting

Essential knowledge for newcomers to sustainable finance and fixed income analysts

Mar 31, 2025 @ London

Labelled bonds are cornerstone instruments in sustainable finance, but understanding how proceeds are actually allocated requires navigating through vastly different reporting approaches across issuers.

Sustainable finance professionals often assume that when a green, social, or sustainability bond is issued, tracking its environmental or social impact is straightforward. The reality is starkly different. The world of labelled bond allocation reporting—the critical documentation that shows where bond proceeds are actually spent—is characterised by an astounding lack of standardisation that challenges even experienced market participants.

Our analysts have looked at thousands of allocation reports across the global labelled bond market, revealing a landscape of remarkable complexity that makes direct comparisons between issuers nearly impossible without sophisticated data processing capabilities.

The Reporting Level Spectrum

Perhaps the most fundamental difference in allocation reporting is the basic unit of analysis issuers choose to report against. This creates immediate challenges for anyone attempting to understand the actual impact of specific bonds:

Single Bond Precision vs. Portfolio Aggregation

At one end of the spectrum, some issuers provide meticulous reporting for each specific bond they issue. This approach offers the greatest transparency, allowing investors to connect particular investments directly to specific bonds in their portfolios.

At the opposite extreme, many issuers report only at the aggregate portfolio level, combining all their green, social, and/or sustainability bonds into a single allocation report. This approach makes it virtually impossible to attribute specific projects or impacts to individual bonds.

The Middle Ground: Grouped Reporting

Between these extremes lies a variety of intermediate approaches:

- Annual cohort reporting: Some issuers report allocations for all bonds issued within a specific calendar year

- Arbitrary groupings: Many issuers create somewhat arbitrary clusters of bonds, sometimes pairing issuances with similar characteristics

- Label-specific aggregation: Other issuers separate reporting by label type (e.g., green bond portfolio vs. social bond portfolio)

Further complicating matters, some financial institutions report on allocations to their green loan portfolios or other sustainable financing instruments that are funded by labelled bond proceeds. These values don’t add up to the number bonds they’ve issued, creating additional layers of complexity in tracing the flow of capital.

Allocation Specificity: From Pinpoint Precision to Vague Categories

The granularity of allocation information varies dramatically across the market, creating significant challenges for impact analysis:

Project-Level Detail vs. Category Percentages

The most transparent issuers provide exhaustive project-level allocation data, listing each individual investment with specific monetary allocations. This approach gives investors clear visibility into exactly which projects their capital supports.

By contrast, many issuers report only category-level allocations, providing percentages or aggregate figures for broad categories like "renewable energy" or "affordable housing" without identifying specific projects. Other issuers fall somewhere between these approaches, offering illustrative project examples but reporting allocations only at the category level.

Geographic Reporting Variations

Geographic reporting demonstrates similar inconsistency:

- Some issuers report geography on a per-project basis

- Others report geographic distribution at the category level

- Many provide overall geographic percentages for their entire portfolio

- Some report specific values for primary countries of investment but only percentages for secondary markets

The specificity range is remarkable—from detailed reporting on individual solar farms with specified capacity in precise locations to vague statements like "Renewable energy allocation: 23%."

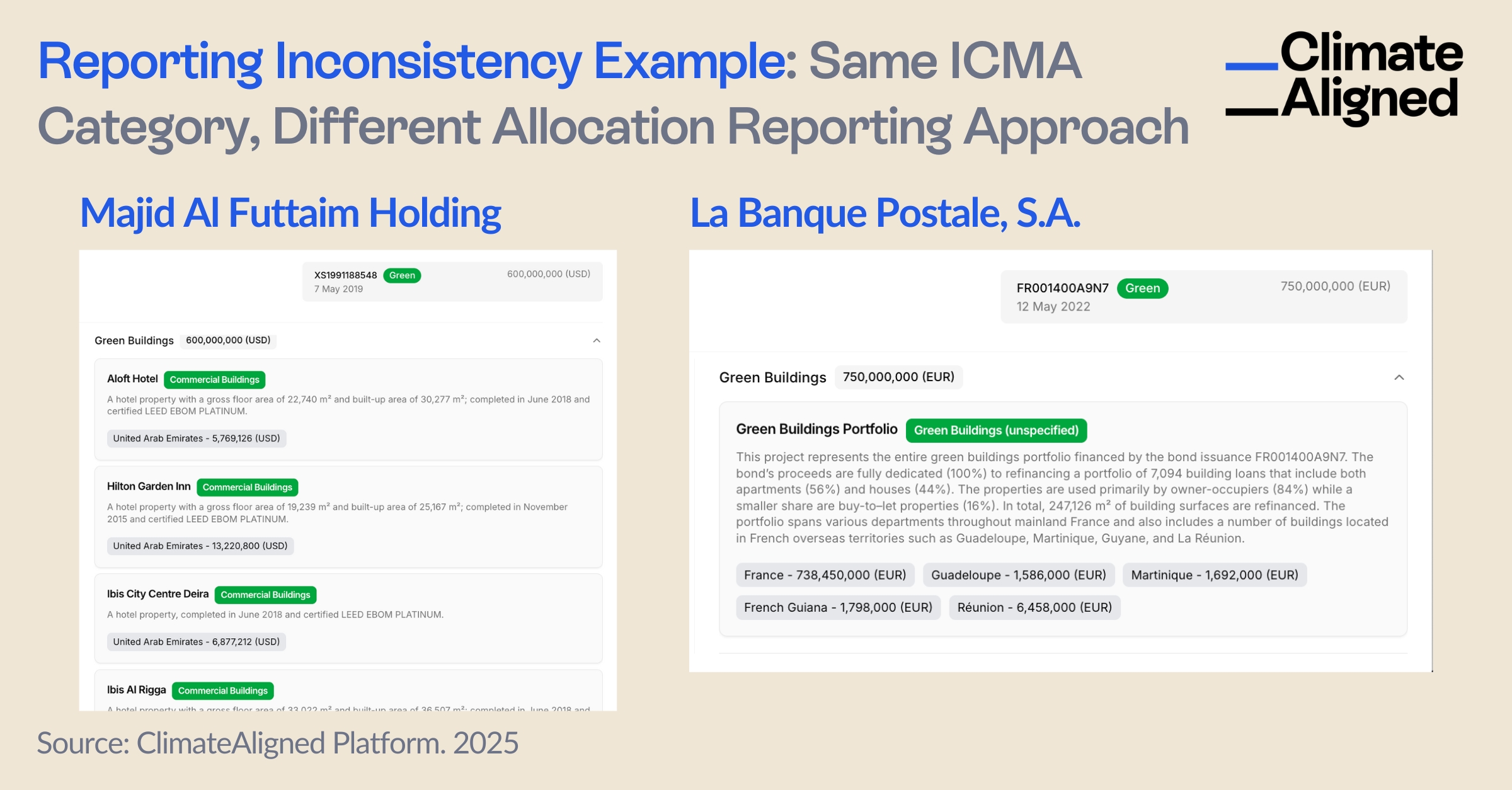

The example below illustrates the considerable variation in reporting practices among portfolios with full allocation toward green buildings. Majid Al Futtaim provides detailed disclosures on precise allocations for designated projects under a specific bond. In contrast, La Banque Postale adopts a holistic approach, reporting on green building investments collectively while using percentage breakdowns to demonstrate the distribution of their investment portfolio.

Source: ClimateAligned Data, 2025

Temporal Challenges: Annual vs. Cumulative Reporting

Time frame representation adds another layer of complexity to allocation reporting:

- Annual snapshots: Many issuers report allocations only for the current reporting year, requiring investors to track multiple reports to understand total allocations

- Cumulative reporting: Some report total cumulative allocations up to the reporting date without breaking out annual figures

- Combined approaches: Others provide both annual and cumulative allocation data

This temporal inconsistency makes it particularly challenging to track allocation progress over time and compare deployment efficiency across issuers.

Critical Transparency Gaps

Beyond these structural differences, several critical information elements are inconsistently reported:

Allocated vs. Unallocated Proceeds

Transparency regarding unallocated proceeds—a key indicator of deployment efficiency—varies significantly:

- Some issuers clearly report unallocated amounts on a per-bond basis

- Others report only on an annual basis, requiring manual calculation to determine total allocation status

- For many issuers, allocation status is implied but not explicitly stated

Financing vs. Refinancing

Despite the material difference between financing new projects and refinancing existing ones, this distinction is often obscured:

- Many issuers do not consistently report the financing/refinancing split

- Some report this breakdown at the project level

- Others report only at the portfolio or category level

Implications for Sustainable Finance Participants

For investors, analysts, and other sustainable finance stakeholders, these reporting inconsistencies create significant challenges:

- Impact assessment difficulties: The lack of standardisation makes it nearly impossible to directly compare impact efficiency across issuers without sophisticated data processing

- Due diligence complexity: Thorough due diligence requires navigating multiple reporting formats and structures, creating substantial analytical burdens

- Greenwashing vulnerability: Reporting opacity can mask low-impact allocations or delays in capital deployment

- Data-driven insights barriers: Developing market-level insights requires normalising vastly different reporting approaches

The ClimateAligned Solution

The extreme variation in reporting approaches explains why traditional manual analysis of labelled bond allocations has been so challenging. At ClimateAligned, we've used our human understanding of green bond allocation to properly train AI technology to specifically designed to address these challenges:

- Standardising diverse formats: Our advanced natural language processing systems can identify and extract key allocation data regardless of reporting structure, creating a consistent dataset from inconsistent source documents. By automatically processing allocation reports across their many different formats, we enable apples-to-apples comparisons previously impossible with manual analysis.

- Reconciling temporal differences: ClimateAligned's technology tracks allocation progression across multiple reports to build complete allocation histories for bonds. This allows analysts to understand the full lifecycle of capital deployment without manually piecing together information from years of separate reports.

- Unmatched data granularity: Our AI extracts allocation data at multiple levels—from broad categories down to individual projects—providing users with unprecedented flexibility in how they analyse sustainable bond allocations. This multi-layered approach ensures no detail is lost while still enabling portfolio-level analytics.

- Enabling market-wide analysis: ClimateAligned's technology enables comprehensive comparison across the entire labelled bond universe despite reporting inconsistencies, providing investors with a truly holistic view of the sustainable bond market for the first time.

Our approach combines large language models with expert human oversight to deliver data accuracy levels far beyond what traditional providers can achieve. By testing our systems on thousands of allocation reports across different issuers, sectors, and regions, we've created technology that understands the nuanced ways that allocation information is presented and can extract it with remarkable precision.

Looking ahead, while regulatory and market-led standardisation efforts may gradually improve reporting consistency, the current reality demands technological solutions to extract meaningful insights from the labelled bond market. For investors and analysts navigating this complex landscape, ClimateAligned's ability to systematically process diverse allocation reports at scale provides an essential capability for effective sustainable fixed income analysis—turning reporting complexity from a barrier into a source of competitive advantage.

ClimateAligned's AI technology standardises and extracts allocation data from diverse reporting formats, providing unprecedented transparency into how sustainable bond proceeds are actually deployed.