Market Insight

Bloomberg's Green Bond Data: A Welcome Addition to Market Transparency

How post-issuance reporting accessibility is evolving and what's next for allocation data

Mar 14, 2025 @ London

Bloomberg's recent launch of green bond use of proceeds data represents another important step toward transparency in sustainable finance, signaling broader market maturation.

The sustainable finance market continues to mature with Bloomberg's recent announcement of enhanced green bond use of proceeds data. This development marks another significant milestone in the industry's journey toward greater transparency and accountability—a journey that began more than a decade ago with the first green bond issuances.

The Evolution of Green Bond Allocation Transparency

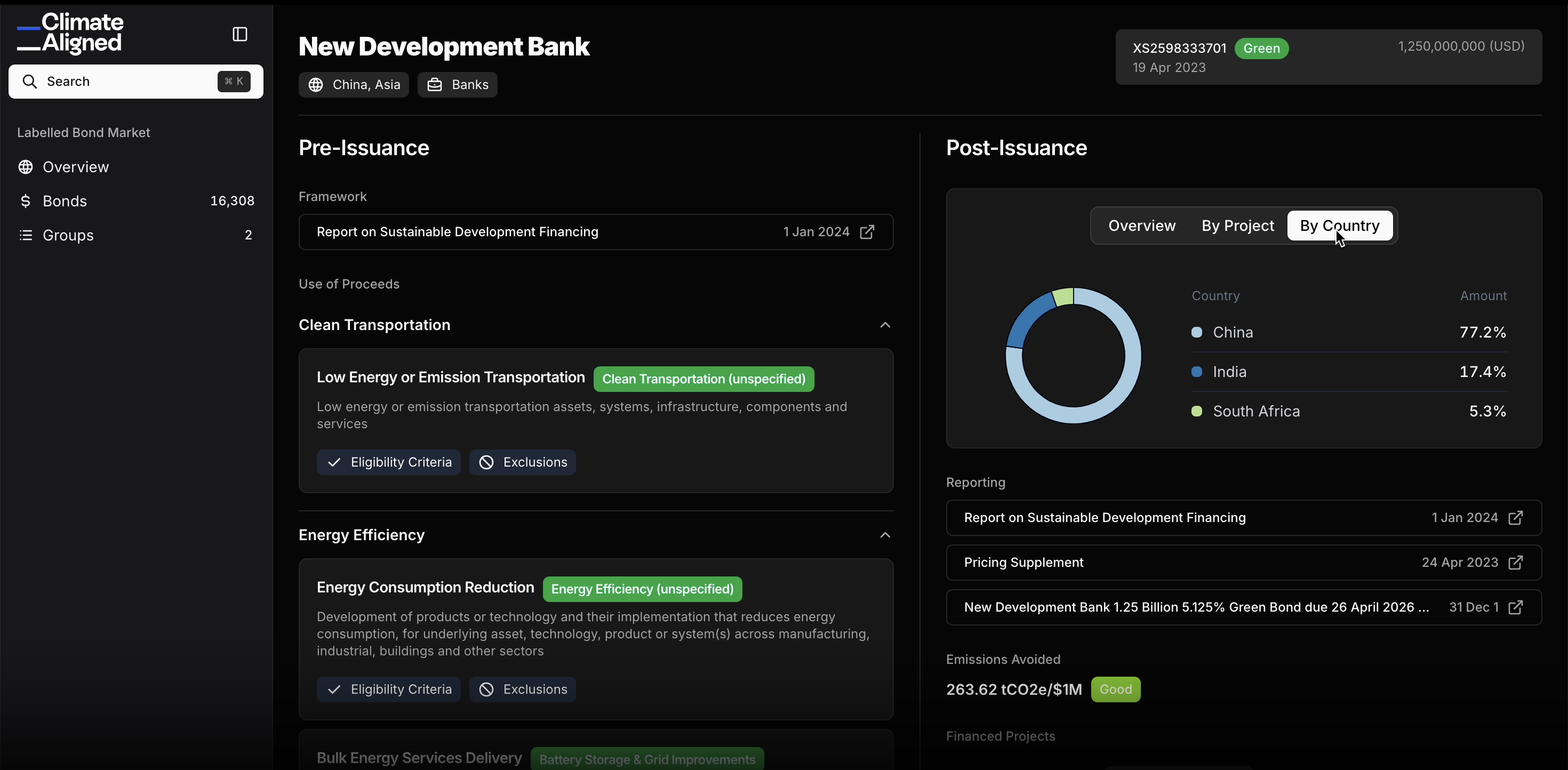

The addition of use of proceeds tracking to Bloomberg's terminal reflects growing investor demand for visibility into how green bond proceeds are actually deployed. This evolution follows a natural progression in market maturity: from the initial focus on frameworks and pre-issuance commitments to the current emphasis on post-issuance verification and impact reporting.

For sustainable finance practitioners and ESG-focused investors, access to allocation data has historically been fragmented and cumbersome. Information has typically been scattered across various formats including PDF reports, issuer websites, and third-party verifications—creating significant barriers to consistent analysis and comparison.

Bloomberg's move to centralise this information represents a positive step for the industry overall. When major data providers incorporate sustainable finance metrics into their platforms, it signals both mainstream acceptance and growing demand from institutional investors.

The Importance of Post-Issuance Data

Post-issuance allocation data serves several critical functions in the green bond ecosystem:

- It enables verification that proceeds are deployed as promised in bond frameworks

- It provides the foundation for impact reporting and outcomes assessment

- It creates accountability for issuers and transparency for investors

- It supplies crucial information for portfolio carbon accounting and climate alignment

In essence, post-issuance data transforms green bonds from instruments of intention to instruments of verified action. This transparency helps combat greenwashing concerns and strengthens the credibility of sustainable finance as a whole.

Source: ClimateAligned Data Platform, 2025

Source: ClimateAligned Data Platform, 2025

Beyond Static Data: The Next Frontier

While centralising allocation information represents progress, the ultimate goal extends beyond simply having the data available. The true challenge—and opportunity—lies in making this information truly actionable for investment decision-making.

Traditional approaches to green bond data have several limitations that still need to be addressed:

Update frequency limitations: Annual or semi-annual reporting cycles create significant lags between project implementation and data availability

Format inconsistency: Even within centralised platforms, allocation categories and impact metrics often lack standardisation

Granularity challenges: Aggregated allocation data may mask important project-specific details that influence environmental impact

Contextual analysis: Raw allocation percentages require additional interpretation to assess alignment with climate targets or taxonomies

The frontier of green bond data now extends toward dynamic, customisable analysis that can be integrated directly into investment workflows. This includes the ability to aggregate across portfolios, compare allocations between different issuers in the same sector, and link allocation data to actual environmental outcomes.

Making Impact Data Truly Decision-Useful

For sustainability professionals evaluating green bond investments, several considerations will determine how valuable these new data resources actually become:

Integration capabilities: Can the data be extracted and incorporated into proprietary analysis systems?

Customisation options: Is it possible to filter and view allocations according to specific environmental categories or SDG alignment?

Historical tracking: Does the data capture changes in allocation patterns over time?

Comparative analysis: Can allocations be easily compared across issuers, sectors, or regions?

As the sustainable finance market continues to evolve, we expect to see growing demand for these more sophisticated data capabilities—moving beyond simple data aggregation toward truly decision-useful analytics.

The growing availability of green bond allocation data represents an important milestone, but it's just one step in the broader evolution toward comprehensive, dynamic sustainability information. The most forward-thinking investors are already looking beyond static allocation reporting toward integrated impact assessment frameworks that connect financial instruments directly to environmental and social outcomes.

For those seeking to stay ahead of this curve, the key lies in developing flexible, customisable approaches to sustainable finance data that can adapt to evolving standards while delivering actionable insights for portfolio management and impact reporting.

ClimateAligned's technology already provides comprehensive post-issuance data and allocation tracking across the entire labelled bond universe, offering customisable, on-demand access to impact metrics.