Analysis

Blue Finance in Green & Sustainability Bonds: Framework Pledges vs. Actual Allocations

Insights for sustainability analysts and portfolio managers in fixed income markets

Mar 4, 2025 @ London

Water and marine-related investments—collectively known as "blue finance" are gaining significant traction within the sustainable bond universe.

The sustainable finance market continues to evolve with increasing diversification across environmental themes. While climate mitigation and energy transition projects have traditionally dominated green bond allocations, water and marine-related investments—collectively known as "blue finance" are gaining significant traction within the sustainable bond universe.

The Growing Blue Streak in Green Bond Frameworks

Our comprehensive analysis of 1,071 recent green and sustainability bonds with a combined value of $610 billion reveals a noteworthy trend: if proceeds were allocated strictly according to their frameworks, 13.8% would flow to blue categories. This finding reinforces a pattern we identified several months ago, suggesting a sustained market evolution toward integrating marine and water-related initiatives into mainstream sustainable finance.

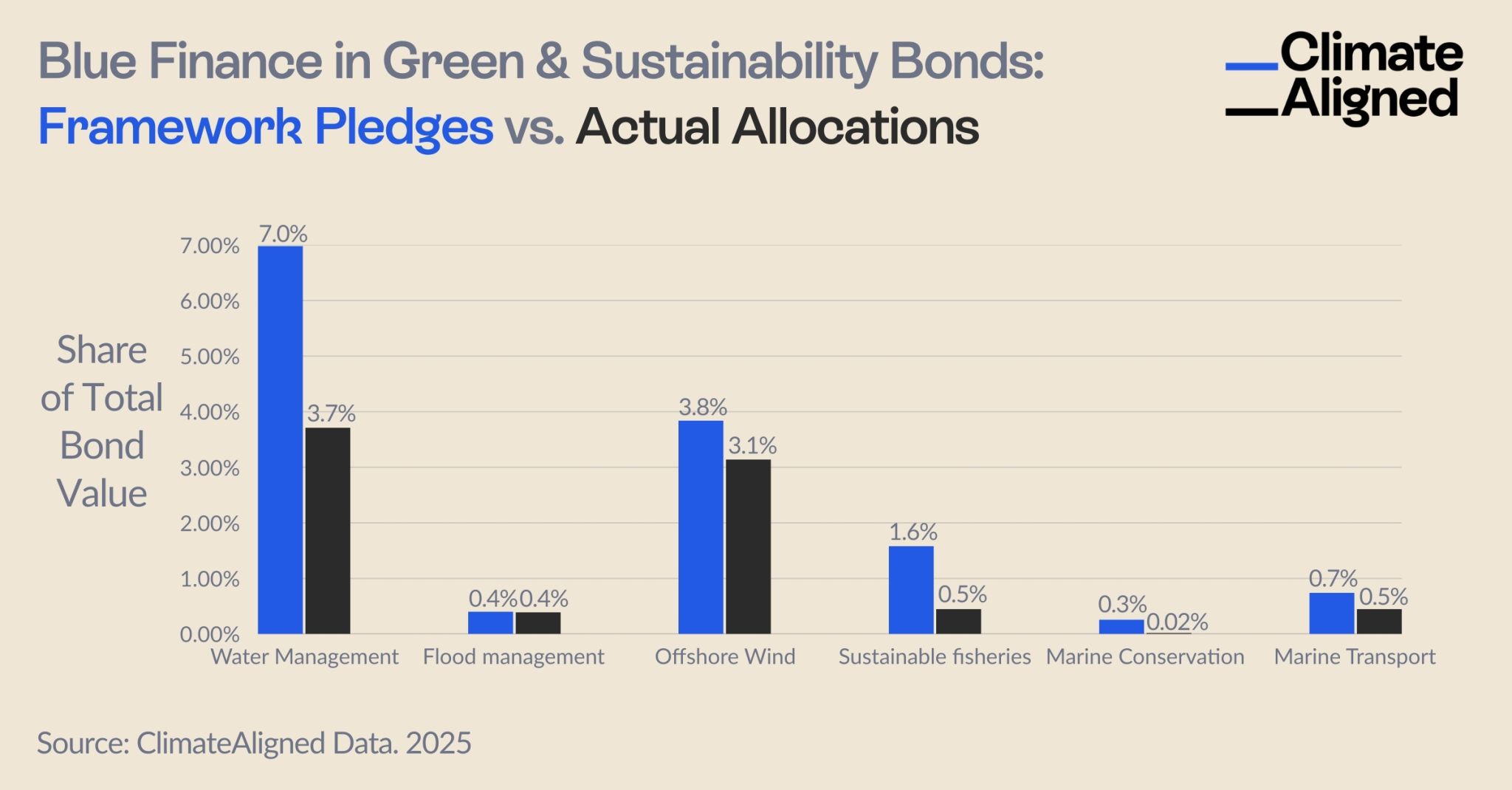

However, examining post-issuance reporting data reveals a meaningful disparity between framework pledges and actual capital flows. In practice, approximately 8% of proceeds reach these critical blue projects—representing a 42% gap between eligible categories and funds actually deployed.

Sector-by-Sector Performance

Our granular analysis of allocation data shows varying levels of alignment between commitments and execution across blue finance categories:

Strong Performers

Coastal flood protection and offshore wind energy demonstrate the strongest alignment, with actual allocations coming within 20% of framework commitments. This suggests these sectors have well-established project pipelines and implementation mechanisms that facilitate effective capital deployment.

Largest Impact Area

Sustainable water and wastewater management represents the largest blue finance category by volume, receiving $22 billion in allocations (3.71% of total bond proceeds). This significant capital flow supports essential infrastructure development with direct environmental and social benefits.

Challenge Areas

Marine conservation initiatives face persistent funding gaps, receiving only $149.5 million (0.02% of total allocations)—substantially less than promised in bond frameworks. This shortfall highlights ongoing challenges in scaling conservation projects to absorb large-scale institutional capital.

Source: ClimateAligned Data, 2025

Source: ClimateAligned Data, 2025

Market Implications for Investors

For institutional investors and sustainability teams evaluating sustainable fixed income opportunities, these findings carry several important implications:

- The blue finance trend is substantive. Despite execution gaps, meaningful capital is flowing to water and marine-related investments, confirming blue finance as an emerging focus area within sustainable bonds.

- Due diligence matters. The 42% gap between framework commitments and actual allocations underscores the importance of robust post-issuance analysis when evaluating environmental impact potential.

- Sector selection influences execution risk. Categories with well-established project pipelines (water infrastructure, flood management) demonstrate stronger alignment between commitments and execution than emerging areas like marine conservation.

- Transparency drives accountability. Access to comprehensive allocation data enables investors to differentiate between issuers based on their track record of delivering on framework commitments.

The Path Forward

The expansion of blue finance within green and sustainability bonds represents a positive market development, channeling much-needed capital toward water security, coastal resilience, and marine protection. As the market matures, we expect to see improved alignment between framework commitments and actual allocations, particularly as reporting standards evolve and investor scrutiny increases.

For portfolio managers and sustainability teams, tracking actual allocation data remains essential to ensure investments deliver the environmental impacts that underpin sustainable investment strategies.

ClimateAligned's technology captures pre- and post-issuance allocation data at scale and in real time, providing the transparency investors need to drive capital where it's needed most.