Analysis

Biodiversity Finance Breakthrough: Green Bonds Channel $10 Billion to Nature-Based Solutions in 2024

Insights for sustainability analysts and portfolio managers in fixed income markets

Oct 24, 2024 @ London

As global leaders convene at COP16 in Cali to address the biodiversity crisis, the sustainable finance market is responding with unprecedented capital mobilisation.

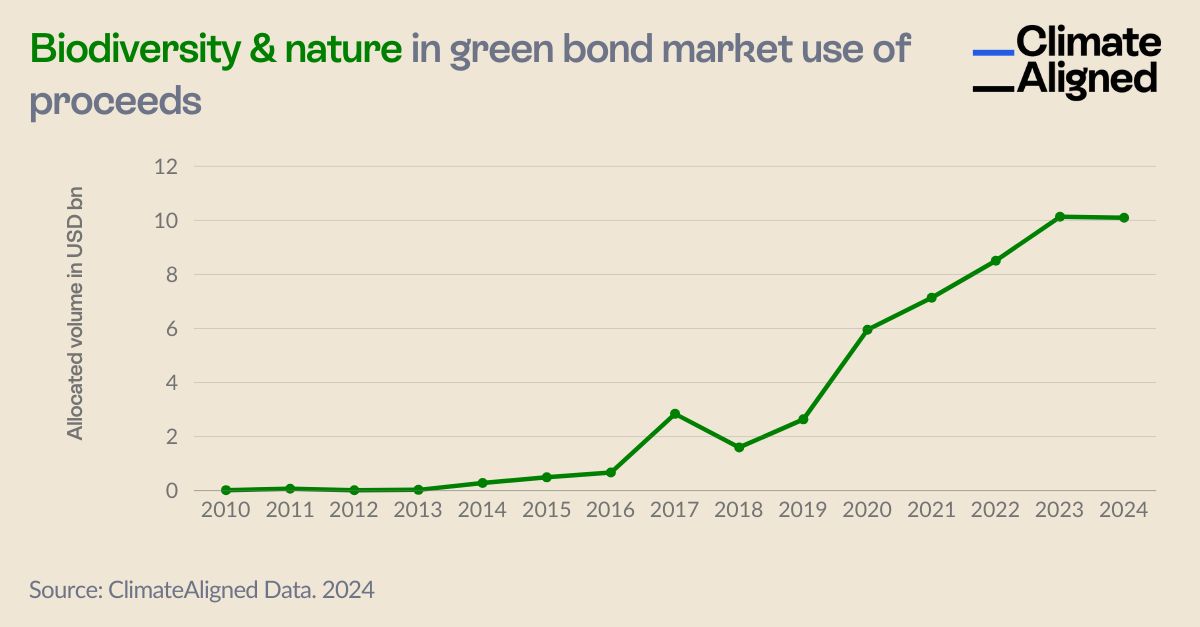

As global leaders convene at COP16 in Cali to address the biodiversity crisis, the sustainable finance market is responding with unprecedented capital mobilisation. New comprehensive data analysis reveals that green bonds have emerged as a significant funding channel for biodiversity conservation and nature-based solutions, with allocations reaching a milestone $10 billion in 2024 alone.

Source: ClimateAligned Data, 2024

Source: ClimateAligned Data, 2024

The Acceleration of Nature-Focused Green Bond Allocations

The data reveals a remarkable growth trajectory for biodiversity-related green bond allocations. From negligible volumes prior to 2014, nature-focused investments have grown exponentially, particularly since 2020, when allocations began to increase dramatically from approximately $2.5 billion to the current $10 billion milestone.

This acceleration coincides with several market developments that have elevated biodiversity on the sustainable finance agenda:

- The establishment of the Taskforce on Nature-related Financial Disclosures (TNFD) framework, providing standardised guidance for assessing nature-related risks and opportunities

- Growing investor recognition of biodiversity loss as a material financial risk

- Enhanced taxonomies and standards, such as the Climate Bonds Initiative (CBI) criteria, that provide clear guidelines for qualifying projects

- Increased corporate commitments to nature-positive outcomes following the Global Biodiversity Framework established at COP15

Identifying Biodiversity Allocations in the Green Bond Market

Capturing accurate data on biodiversity-focused allocations presents unique challenges due to the diverse nature of such projects and inconsistent reporting practices. To develop this comprehensive analysis, ClimateAligned's research team employed advanced AI capabilities to systematically identify and categorise nature-related investments across the entire green bond universe.

The methodology involved analysing multiple document types across the green bond lifecycle:

- Green bond frameworks outlining eligible project categories

- Second-party opinions (SPOs) verifying alignment with standards

- Post-issuance allocation reporting detailing actual fund deployment

- Impact reporting providing performance metrics

This comprehensive approach allowed for the identification of a wide spectrum of biodiversity and nature-based solution investments aligned with established taxonomies, including:

- REDD+ projects focused on reducing emissions from deforestation and forest degradation

- Sustainable forestry initiatives implementing responsible management practices

- Afforestation and reforestation programmes expanding forest coverage

- Land remediation projects restoring degraded ecosystems

- Marine conservation efforts protecting coastal and ocean biodiversity

- Other nature-based solutions addressing climate change while supporting biodiversity

Noteworthy Projects Advancing Biodiversity Conservation

Several issuers have demonstrated leadership in channelling green bond proceeds to innovative biodiversity-focused initiatives:

Eastman Chemical Company has prioritised sustainable water management with an emphasis on protecting coastal and marine ecosystems. Their green bond proceeds support projects that not only address water efficiency but also contribute to preserving aquatic biodiversity in areas where they operate.

Tornator Oyj, a leading European forestry company, has directed green bond funding toward responsible land management with investments in FSC and PEFC certified forestry operations. Their projects emphasise sustainable harvesting practices that maintain forest ecosystem integrity while providing economic returns.

Anglian Water Services has taken a direct approach to biodiversity enhancement through investments in habitat restoration, ecosystem remediation, and conservation initiatives throughout their operational region. Their projects demonstrate how utility companies can integrate biodiversity considerations into core infrastructure operations.

These examples represent a broader trend of issuers expanding beyond traditional green categories to incorporate biodiversity considerations into their frameworks and allocations.

Market Implications for Green Bond Investors

For fixed income investors and portfolio managers, the growth in biodiversity-focused allocations presents both opportunities and considerations:

Portfolio Diversification: Biodiversity-focused bonds offer diversification within green portfolios previously dominated by renewable energy and clean transportation projects.

Impact Measurement Challenges: Investors should be aware that biodiversity impacts often involve more complex measurement methodologies than carbon-focused investments, potentially requiring more sophisticated monitoring approaches.

Alignment with Regulatory Developments: As frameworks like the EU Taxonomy evolve to include more specific biodiversity criteria, bonds with established nature-focused allocations may benefit from regulatory recognition.

Double Materiality Considerations: Biodiversity investments often address both transition and physical risks, potentially offering more resilient long-term performance as climate impacts intensify.

The Path Forward: Scaling Biodiversity Finance

The $10 billion milestone, while significant, represents only the beginning of the potential for green bonds to channel capital toward nature-positive outcomes. Several factors are likely to accelerate this trajectory in coming years:

Standardisation Improvements: The ongoing development of biodiversity metrics and reporting frameworks will enhance transparency and comparability across nature-focused investments.

Blended Finance Models: Innovative structures combining green bonds with other instruments may help address the higher risk profiles and longer timeframes often associated with biodiversity projects.

Sovereign Leadership: National and sub-national green bonds are increasingly incorporating biodiversity elements, potentially setting benchmarks for corporate issuers.

Agricultural Integration: The convergence of sustainable agriculture and biodiversity conservation represents a significant growth opportunity for green bond allocations.

As COP16 discussions advance global biodiversity targets, green bonds are positioned to serve as a critical implementation mechanism, translating policy commitments into funded projects. The market's rapid expansion in this area demonstrates how quickly sustainable fixed income can adapt to emerging environmental priorities when supported by clear taxonomies and investor demand.

For investors seeking to align portfolios with nature-positive outcomes, the growing universe of biodiversity-focused green bonds offers increasingly diverse opportunities to support conservation while potentially hedging against nature-related risks that may impact broader market performance.

ClimateAligned provides comprehensive data analytics on biodiversity allocations across the green bond market, enabling investors to identify nature-focused investment opportunities and measure their contributions to global conservation efforts.