Analysis

DNB Bank ASA Green Bond: Real-Time Analysis of Norway's Latest Sustainable Finance Initiative

Analysis for portfolio managers and sustainable fixed income specialists

Mar 27, 2025 @ London

DNB Bank ASA announces a new €400 million green bond with focus on clean transportation, energy efficiency, green buildings, and renewable energy, revealing Nordic sustainable finance priorities.

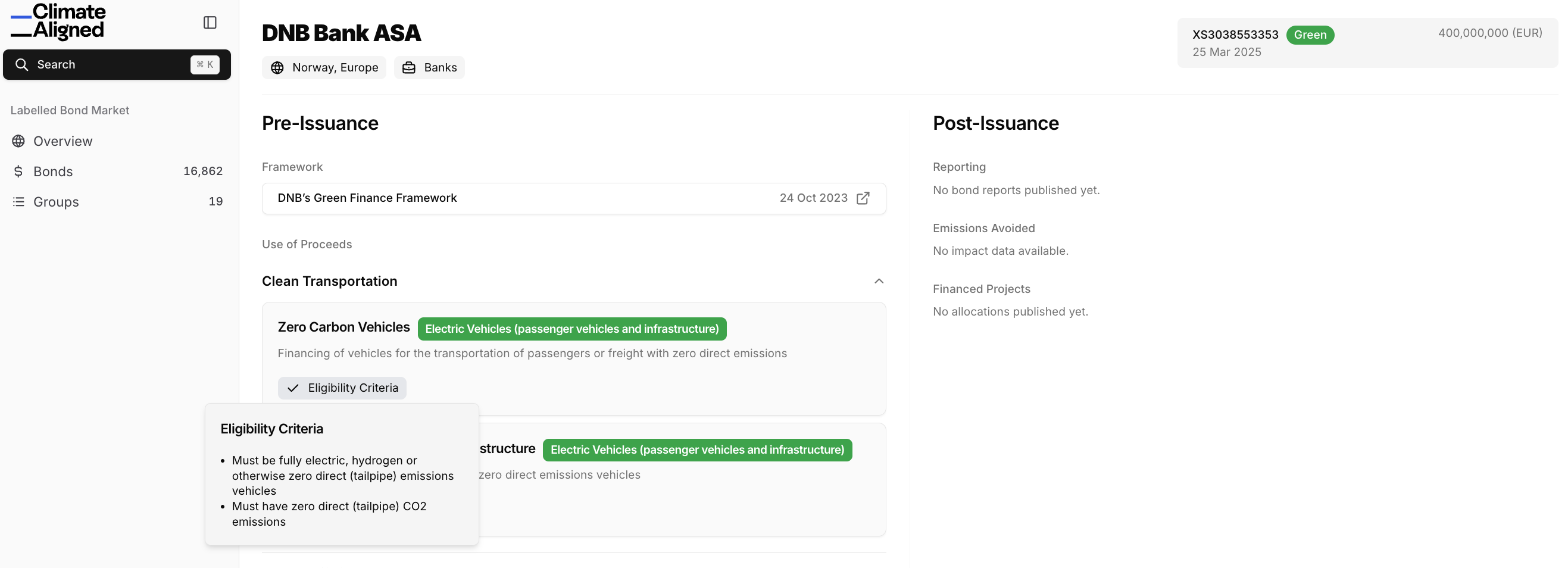

In the fast-moving world of sustainable finance, staying ahead requires immediate access to comprehensive data. As DNB Bank ASA announces its latest €400 million green bond (ISIN: XS3038553353), ClimateAligned's real-time data capabilities allow us to provide immediate insights into what this means for the market and potential investors.

Breaking Down DNB's New Green Bond

DNB Bank ASA, Norway's largest financial services group, has announced a new €400 million green bond currently in pre-issuance stage (as of March 25, 2025). This represents another significant step in the Nordic region's robust sustainable finance market development.

Our platform has already integrated the bond's key details and framework context:

Source: ClimateAligned Data, 2025

Source: ClimateAligned Data, 2025

Framework Analysis: What Sets This Bond Apart

The bond follows DNB's Green Finance Framework (November 2024), which our platform has automatically extracted and fully mapped to ICMA Green Bond Principles. Unlike traditional data providers who might take weeks to manually collect and update this information, our AI-powered systems extract and process this framework data in real-time, providing immediate analysis.

The framework focuses on four key categories:

- Clean Transportation

- Zero Carbon Vehicles

- Zero Carbon Transportation Infrastructure

- Energy Efficiency

- Electricity Transmission, Distribution and Storage

- Includes battery storage and grid improvements

- Green Buildings

- Green Residential Buildings in Norway (pre-2021)

- Green Residential Buildings in Norway (2021 onwards)

- Renewable Energy

- Solar Power

- Wind Power

- Hydro Power

Predictive Insights: What to Expect Based on Previous Allocations

While traditional data providers might wait for the first allocation report, ClimateAligned's platform already offers predictive insights based on DNB's historical allocation patterns. Our system has collected and organized all previous DNB bond reports, making them easily accessible and digestible in one centralized location.

According to DNB's January 2025 allocation report - readily available in our platform - their green loan portfolio shows a consistent distribution pattern that may indicate future allocations:

Historical Green Loan Portfolio Breakdown:

- Clean Transportation: NOK 43,591 million (42.4%)

- Renewable Energy: NOK 36,145 million (35.2%)

- Green Buildings: NOK 22,965 million (22.4%)

The renewable energy portfolio is particularly diverse, with investments spanning multiple geographies including Norway, Poland, Sweden, UK, Australia, Chile, United States, and Uruguay.

Geographic Distribution Insights

Our data reveals clear patterns in DNB's geographic allocation strategy:

- Green Buildings: Concentrated in Norway

- Renewable Energy: EEA focus (Norway, Poland, Sweden) with global diversification (UK, Australia, Chile, USA, Uruguay)

- Clean Transportation: Nordic-focused (Norway, Sweden, Denmark, Finland)

This geographic distribution offers important insights for investors looking to understand the regional impact and risk profile of DNB's sustainable initiatives.

What This Means for Investors and the Market

For portfolio managers and ESG analysts making rapid decisions about new issuances, several insights stand out:

- Nordic Clean Transportation Focus: DNB's historical emphasis on clean transportation (42.4% of previous allocation) suggests a continued commitment to this sector, particularly within Nordic countries.

- Growing Renewable Portfolio: With approximately NOK 28 billion in operational facilities and NOK 8 billion in facilities under construction, DNB demonstrates an active expansion in renewable energy financing.

- New vs. Refinancing Balance: Previous allocation patterns show substantial new financing, with NOK 110,817 million of new loans added to the portfolio since January 2022, indicating DNB's commitment to expanding their green financing rather than just refinancing existing projects.

ClimateAligned's Data Advantage

While traditional data providers might take weeks or months to provide this level of analysis, ClimateAligned's AI-powered platform delivers these insights in real time. This represents our fundamental difference in the market:

- Immediate Integration: New bonds are integrated into our platform immediately upon announcement

- Automatic Framework Extraction: Latest framework data is extracted, processed, and made accessible instantly

- Historical Report Access: All previous bond reports are collected, organized, and presented in easily digestible formats

- Predictive Analysis: Historical patterns inform likely future allocations

- Framework Mapping: Automated alignment with international standards like ICMA Green Bond Principles

- Comprehensive Coverage: Complete data across all sustainable bond categories

Stay Ahead with ClimateAligned

For sustainable finance professionals who need to make informed decisions quickly, this real-time data advantage is crucial. Whether you're analyzing potential investments, building sustainable portfolios, or researching market trends, our platform provides the immediate, comprehensive insights traditional data providers simply can't match.

Want to explore the full details of DNB's new green bond and see how our platform can transform your sustainable finance data experience? Request a demo today to experience the ClimateAligned difference.

ClimateAligned's AI-powered platform extracts framework data and allocation reports in real-time, providing immediate insights traditional data providers simply can't match.