Analysis

Emerging Market Sustainability Data: Bridging the Information Gap

Exploring how AI-powered approaches are transforming ESG data access in developing economies

Mar 10, 2025 @ London

Emerging markets represent both the greatest opportunity and the most significant challenge for ESG-focused investors, with AI-driven solutions now addressing critical data gaps.

In today's rapidly evolving sustainability landscape, emerging markets represent both tremendous growth potential and significant data challenges for ESG-focused investors. While these economies constitute an increasingly vital portion of the global investment universe, they have traditionally been characterised by critical information deficits in sustainability reporting.

The Untapped Potential in Emerging Market Sustainability

The numbers tell a compelling story about the scale of the opportunity. Emerging markets now account for over half of global GDP and contain some of the world's fastest-growing economies. This economic significance makes their sustainability practices increasingly material to global environmental and social outcomes.

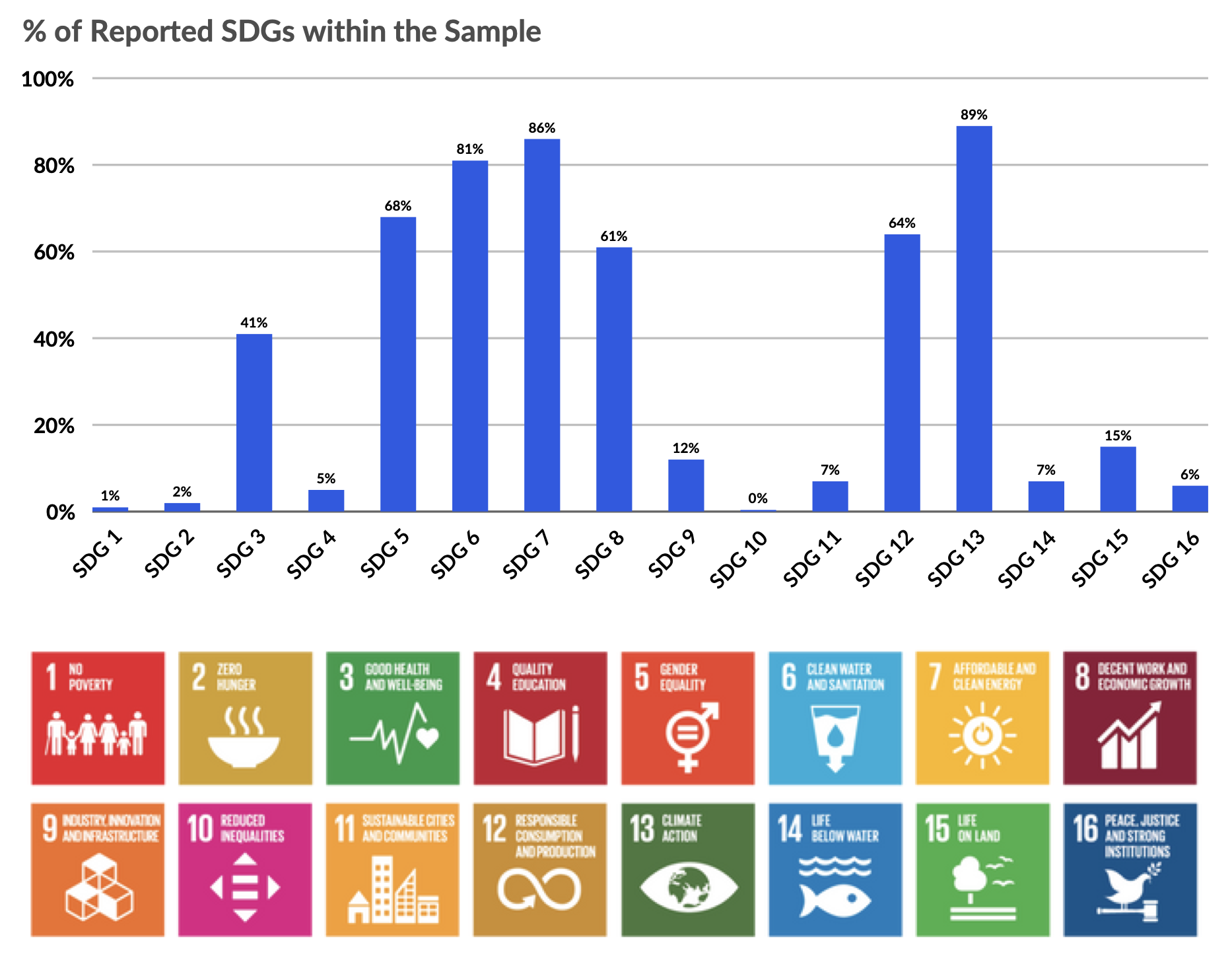

Our recent analysis for COP29, Bridging the Implementation Gap: Analysing SDG Disclosure Readiness in US$12 Trillion of Emerging Market Companies revealed notable patterns in sustainability disclosure across these markets. Among the most striking findings was the significant variability in SDG reporting, with certain goals—particularly SDG 13 (Climate Action), SDG 7 (Affordable and Clean Energy), and SDG 8 (Decent Work and Economic Growth)—receiving substantially more attention than others.

Source: ClimateAligned Data, 2024

Source: ClimateAligned Data, 2024

This uneven reporting landscape creates both challenges and opportunities for investors seeking to incorporate sustainability considerations into their emerging market allocations.

Why Traditional Data Collection Falls Short

The obstacles to comprehensive sustainability data collection in emerging markets are multifaceted:

Document Accessibility and Language Barriers: Corporate sustainability disclosures are frequently published in local languages and formats that make systematic analysis challenging. Traditional data providers often lack the linguistic capabilities to efficiently process these diverse document types.

Inconsistent Reporting Standards: Unlike developed markets with established reporting frameworks, emerging market companies follow varied approaches to sustainability disclosure. This inconsistency makes comparison across companies and regions particularly difficult.

Evolving Regulatory Landscapes: Sustainability reporting requirements in emerging markets are developing rapidly but unevenly, creating a complex patchwork of disclosure practices that conventional data collection methods struggle to navigate effectively.

Resource Constraints: Many emerging market issuers lack the dedicated resources for comprehensive sustainability reporting, creating significant gaps in available data.

AI-Powered Solutions: A New Paradigm

The limitations of traditional approaches have created significant blind spots in emerging market sustainability analysis—until now. Recent advances in artificial intelligence and natural language processing are revolutionising how this data can be accessed and utilised.

Modern AI systems can process thousands of documents across multiple languages, identifying relevant sustainability disclosures even when they don't follow standardised formats or terminology. This capability is particularly valuable given the diversity of reporting approaches across emerging markets and the complex web of sustainability frameworks companies may reference.

As highlighted by the Impact Taskforce Guidance, entity reporting may draw from numerous external sources, including Global Reporting Initiative (GRI) Sector Standards, the Harmonised Framework for Impact Reporting (ICMA), SASB Standards, and various SDG-related metrics. AI-powered systems can recognise and categorise disclosures across these different frameworks, creating structured, comparable datasets from disparate sources.

From Data Gaps to Decision-Useful Insights

The application of AI to emerging market sustainability data is already yielding tangible benefits for investors:

Comprehensive Market Coverage: AI-enhanced approaches enable analysis of significantly broader universes of emerging market companies, including mid-cap and smaller issuers often overlooked by traditional data providers.

Timely Updates: Machine learning systems can process new disclosures as they become available, providing investors with more current information than manual collection methods allow.

Contextual Understanding: Advanced natural language processing can interpret sustainability information within its local context, recognising regional variations in reporting practices and terminology.

Identification of Leading Practices: By analysing thousands of reports, AI systems can identify emerging best practices in sustainability disclosure across different markets and sectors.

Real-World Applications for Investors

The practical implications of enhanced emerging market sustainability data are substantial:

Portfolio Construction: Investors can move beyond crude exclusionary approaches to incorporate positive sustainability criteria even in emerging market allocations.

Risk Management: Better data enables more sophisticated assessment of sustainability risks specific to emerging market contexts.

Engagement Strategies: Investors can develop more informed engagement approaches based on comprehensive understanding of company disclosure practices.

Impact Measurement: Enhanced data supports more rigorous measurement of sustainability impacts in markets where such impacts may be most significant.

The Future of Emerging Market Sustainability Analysis

While AI-powered approaches represent a significant advance in addressing the emerging market data gap, the most effective solutions combine technological innovation with domain expertise—understanding both the technical capabilities of AI and the nuanced sustainability contexts of diverse markets.

As emerging markets continue to grow in economic importance, their sustainability practices will increasingly influence global environmental and social outcomes. By harnessing the power of AI to overcome traditional barriers to data collection and analysis, investors can make more informed decisions that help direct capital toward sustainable development across these vital economies.

For investors seeking to enhance their understanding of sustainability practices in emerging markets, we recommend exploring our comprehensive report "Bridging the Implementation Gap," which provides detailed analysis of SDG reporting patterns across a representative sample of emerging market corporations. To discuss how our emerging market sustainability data solutions can support your specific investment needs, reach out to our team directly.

ClimateAligned's technology processes thousands of multilingual documents to extract and structure sustainability data, providing unprecedented insights into markets traditionally characterised by information deficits.