Analysis

Forest Investment Gap: Analysis Reveals Packaging and Banking Sectors Lead Limited Green Bond Funding for Forest Projects

Insights for sustainability analysts and portfolio managers in fixed income markets

Jun 21, 2024 @ London

Despite the critical role forests play in climate regulation and biodiversity preservation, forest-related projects receive a remarkably small portion of green bond financing, with highly concentrated sectoral participation.

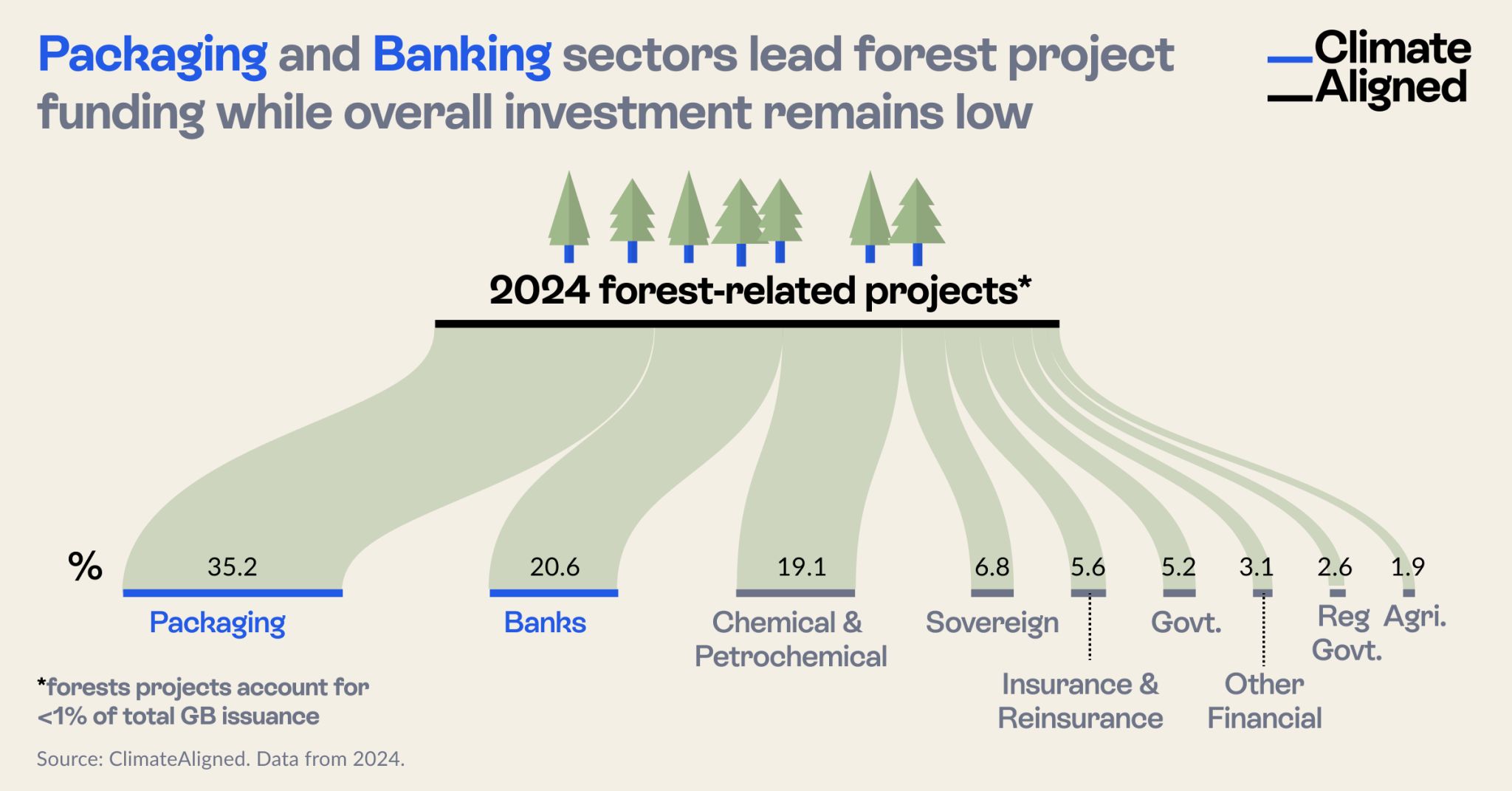

As World Rainforest Day approaches on June 22nd, new data analysis reveals concerning patterns in how the green bond market is allocating capital to forest conservation and restoration. Despite the critical role forests play in climate regulation and biodiversity preservation, forest-related projects receive a remarkably small portion of green bond financing, with highly concentrated sectoral participation.

Source: ClimateAligned, 2024.

Source: ClimateAligned, 2024.

Current State of Forest Financing in the Green Bond Market

Comprehensive analysis of the 2024 green bond market reveals that while 8% of total issuance is directed toward land-use related projects, only 11% of this allocation—less than 1% of total green bond issuance—specifically targets forest initiatives. This minimal allocation occurs despite growing recognition of forests as critical carbon sinks and biodiversity reservoirs essential to meeting global climate targets.

The sectoral breakdown of this limited forest financing reveals notable patterns:

- Packaging sector: Leads forest project funding with 35.2% of allocations, likely reflecting the sector's direct dependency on forest resources and increasing pressure to demonstrate sustainable sourcing practices

- Banking sector: Contributes 20.6% of forest project financing, suggesting growing recognition of deforestation as a material financial risk

- Chemical and petrochemical industry: Accounts for 19.1% of forest allocations, potentially motivated by carbon offsetting strategies

- Sovereign issuers: Represent only 6.8% of forest financing, despite their central role in natural resource management

- Insurance and reinsurance: Contribute 5.6%, reflecting emerging awareness of climate risk exposure

- Other sectors: Government (5.2%), other financial institutions (3.1%), regional governments (2.6%), and agriculture (1.9%) make up the remainder

This concentration shows that forest financing through green bonds remains primarily driven by sectors with direct forest dependencies or financial risk exposure, rather than representing a broader market commitment to forest preservation.

Project Type Analysis: Commercial Forestry Dominates

Further examination of forest-related allocations reveals concerning imbalances in project type distribution. Nearly 100% of forest-related green bond proceeds are directed toward commercial forestry and agroforestry ventures. This concentration leaves critical project categories severely underfunded:

- Natural forest maintenance

- Afforestation of previously non-forested land

- Reduced Emissions from Deforestation and Forest Degradation (REDD+) initiatives

- Forest biodiversity conservation

- Community forestry projects

This imbalance suggests that green bond financing for forests remains primarily oriented toward commercial timber production rather than broader ecosystem preservation goals, potentially limiting the climate and biodiversity benefits realized from these investments.

Strategic Implications for Market Participants

For Issuers

The limited allocation to forest projects in the green bond market presents several strategic considerations for potential issuers:

First-Mover Advantage: Organizations outside the currently dominant sectors have opportunities to differentiate themselves by pioneering forest-focused issuances, particularly for underrepresented project types like natural forest preservation.

Framework Development: Issuers developing or updating green bond frameworks should consider explicit inclusion of diverse forest project categories, including those with stronger biodiversity and community benefits beyond commercial forestry.

Impact Reporting Enhancement: Given the limited overall allocation, issuers can distinguish their forest-related bonds through particularly robust impact reporting that quantifies both carbon and non-carbon benefits.

Cross-Sector Partnerships: The concentrated nature of current financing suggests opportunities for cross-sector collaboration to develop more comprehensive forest conservation approaches.

For Investors

For fixed income investors and portfolio managers, the data on forest project allocation provides several insights:

Due Diligence Focus: When evaluating forest-related green bonds, investors should pay particular attention to project type, seeking opportunities that support natural forest protection rather than solely commercial forestry.

Engagement Opportunities: The limited overall allocation to forests presents a clear focus area for investor engagement with issuers across sectors, encouraging expanded consideration of forest projects.

Impact Measurement Challenges: The concentration in commercial forestry suggests investors should develop more sophisticated approaches to evaluating biodiversity and community impacts of forest-related bonds.

Portfolio Gap Analysis: Investors committed to climate and biodiversity goals should assess whether their green bond portfolios reflect the importance of forests in addressing both challenges.

Barriers to Expanded Forest Investment

Several factors may contribute to the limited allocation of green bond proceeds to forest projects:

Measurement Complexity: Carbon sequestration in forests involves more complex measurement methodologies than emissions reduction in energy projects, potentially deterring issuers.

Permanence Concerns: Risks related to forest fires, disease, and land-use change create challenges in ensuring the permanence of forest carbon benefits.

Land Rights Issues: Many potential forest projects involve complex land tenure questions that create additional due diligence requirements.

Revenue Generation Limitations: Natural forest preservation often lacks clear revenue streams, making it more challenging to incorporate into traditional bond structures.

Long Timeframes: Forest projects typically require decades to reach maturity, creating temporal mismatches with typical bond tenors.

Addressing these barriers will be essential to expanding the role of green bonds in forest conservation and restoration.

The Path Forward: Expanding Forest Finance

Despite current limitations, several developments suggest potential for growth in forest-related green bond financing:

Biodiversity Focus: Growing investor attention to biodiversity loss as a material financial risk may drive increased interest in natural forest preservation projects.

Carbon Market Maturation: Evolving voluntary and compliance carbon markets may create more reliable revenue streams for forest conservation projects.

Blended Finance Models: Innovative structures combining concessional and commercial capital can help address the revenue challenges of natural forest projects.

Sovereign Leadership: Public sector issuers have opportunities to pioneer approaches to forest bond financing that private sector issuers can subsequently adopt.

Improved Monitoring Technology: Advances in satellite monitoring and blockchain verification are reducing the monitoring costs and verification challenges associated with forest projects.

As these enabling factors develop, the green bond market has significant potential to expand its contribution to forest conservation and restoration, better aligning financing flows with the critical role forests play in addressing both climate change and biodiversity loss.

Conclusion: A Call for Increased Ambition

The analysis of forest-related green bond allocations reveals a significant gap between the recognized importance of forests for climate stability and biodiversity and the financial flows currently directed to their preservation. With less than 1% of green bond proceeds supporting forest projects, and those heavily concentrated in commercial forestry, there remains substantial room for expanded ambition.

As World Rainforest Day reminds us of the crucial ecosystem services that forests provide, the sustainable finance market has an opportunity to significantly scale its contribution to forest preservation. Doing so will require addressing current barriers through innovative financial structures, improved measurement methodologies, and stronger integration of biodiversity considerations into green bond frameworks.

For the green bond market to fully realize its potential in addressing global environmental challenges, forest financing must move from its current peripheral position to become a core focus area, with greater attention to natural forest preservation alongside responsible commercial forestry.

ClimateAligned provides comprehensive data analytics on green bond allocations across project types and sectors. Our AI-powered platform enables unprecedented visibility into financing patterns for forests and other critical environmental priorities.