Analysis

GHG Emissions Reduction Dominates Sustainable Bond Impact Reporting

Insights for sustainability analysts and portfolio managers in fixed income markets

Feb 6, 2025 @ London

Portfolio managers still face the challenge of aggregating disparate metrics across numerous issuers — a task that has traditionally required manual data collection from hundreds of PDF reports.

For sustainable finance professionals navigating the labelled bond market, standardised impact reporting remains an elusive goal. Despite significant industry progress through initiatives like ICMA's Harmonised Framework, portfolio managers still face the challenge of aggregating disparate metrics across numerous issuers — a task that has traditionally required manual data collection from hundreds of PDF reports.

Our analysis reveals clear patterns in how issuers report impact, with greenhouse gas emissions reduction emerging as the dominant metric across the sustainable bond landscape. This presents both opportunities and challenges for investors seeking to build comprehensive impact narratives across diversified fixed income portfolios.

Key Findings: Impact Metric Prevalence in Green and Sustainable Bonds

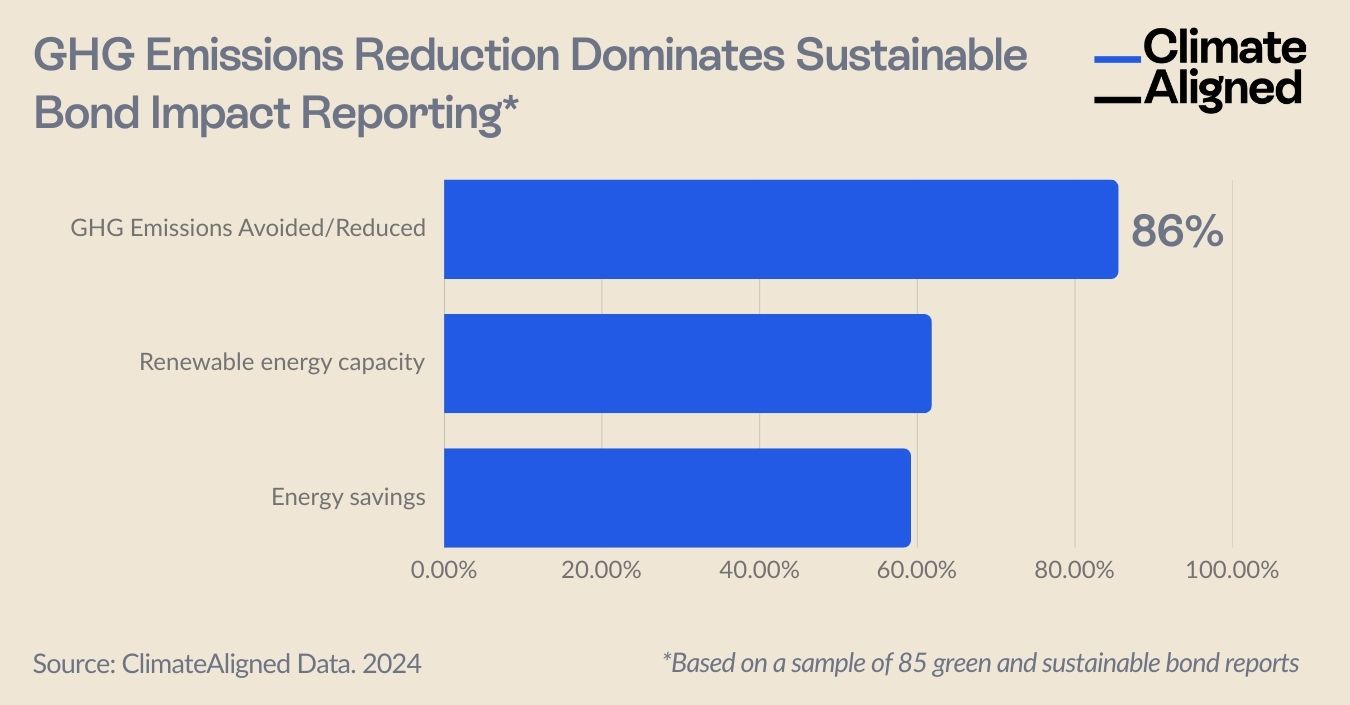

ClimateAligned's recent analysis of 85 green and sustainable bond impact reports, representing USD 180 billion in issuances, revealed significant patterns in issuer reporting practices. As shown in our data visualisation below, there are clear preferences for specific ICMA Harmonised Framework metrics:

- Greenhouse Gas Emissions Reduction/Avoidance: 86% of issuers report this metric, making it the most universally adopted impact measurement across the sustainable bond market

- Renewable Energy Generation Capacity: 62% of bonds include reporting on additional renewable energy capacity created

- Energy Savings: 59% of issuers quantify energy efficiency improvements resulting from bond proceeds

This concentration around climate mitigation metrics is noteworthy, particularly as the market continues to diversify into social and sustainability-linked structures with broader impact objectives.

Beyond the Headlines: The Metrics Diversity Challenge

While the top three metrics show consistency, our deeper analysis reveals the true scale of the reporting fragmentation challenge. A single impact report can contain dozens of measurements—some highly specific to particular projects or geographies.

For example, one French sovereign green bond report includes metrics as granular as "Number of international scientific publications per Météo-France researcher, 2023"—precisely 1.8. While valuable for specific stakeholders, such niche measurements create significant aggregation challenges for portfolio managers responsible for comprehensive impact analysis.

Market Implications: The Value of Standardisation

The dominance of GHG emissions metrics represents an important step toward standardisation in a market that has struggled with reporting consistency. For fixed income investors, this convergence offers several advantages:

- Portfolio-Level Aggregation: With 86% of issuers reporting GHG reductions, investors can more readily calculate portfolio-wide climate impact

- Performance Benchmarking: Common metrics enable meaningful comparisons between issuers and sectors

- Regulatory Alignment: Greenhouse gas metrics align with broader regulatory reporting requirements under frameworks like SFDR and TCFD

However, the variation beyond these core metrics highlights the continued need for advanced data aggregation capabilities, particularly as portfolios diversify beyond purely environmental impact objectives.

The Evolution of Impact Standardisation

As the labelled bond market matures, we anticipate continued evolution in impact reporting standards. Several developing trends merit attention:

- The emergence of double materiality considerations, connecting financial and impact performance

- Increasing granularity in emissions reporting, particularly Scope 3 value chain emissions

- Greater emphasis on social impact quantification, especially in sustainability and social bonds

- Integration of impact reporting with broader sustainability disclosure requirements

For portfolio managers, the ability to efficiently aggregate and analyse these evolving metrics will become increasingly valuable as reporting requirements grow more complex while stakeholder expectations for transparent impact narratives intensify.

The clear preference for GHG emissions reporting demonstrates that while impact measurement in the labelled bond market remains fragmented, areas of standardisation are emerging. This presents an opportunity for investors who can efficiently access and analyse this data at scale.

Rather than spending hours extracting individual metrics from scattered PDF reports, forward-thinking portfolio managers are leveraging technology to unlock instant insights across their holdings—transforming a traditionally arduous data collection exercise into a strategic advantage.

ClimateAligned uses AI-powered data extraction to aggregate labelled bond impact data at scale, providing investors with instant access to standardised metrics across their portfolios.