Analysis

Global Green Bond Impact Reporting: Regional Disparities Reveal Market Maturity Gaps

Insights for sustainability analysts and portfolio managers in fixed income markets

Aug 9, 2024 @ London

New comprehensive analysis of recent market activity reveals significant insights into reporting practices across global regions, with implications for investors, issuers, and regulators alike.

The transition to a sustainable global economy requires not just financing through instruments like green bonds, but also transparent reporting on how these investments deliver environmental impact. New comprehensive analysis of recent market activity reveals significant insights into reporting practices across global regions, with implications for investors, issuers, and regulators alike.

Source: ClimateAligned. Data from 2022, 2023.

Source: ClimateAligned. Data from 2022, 2023.

The Global Impact Reporting Landscape

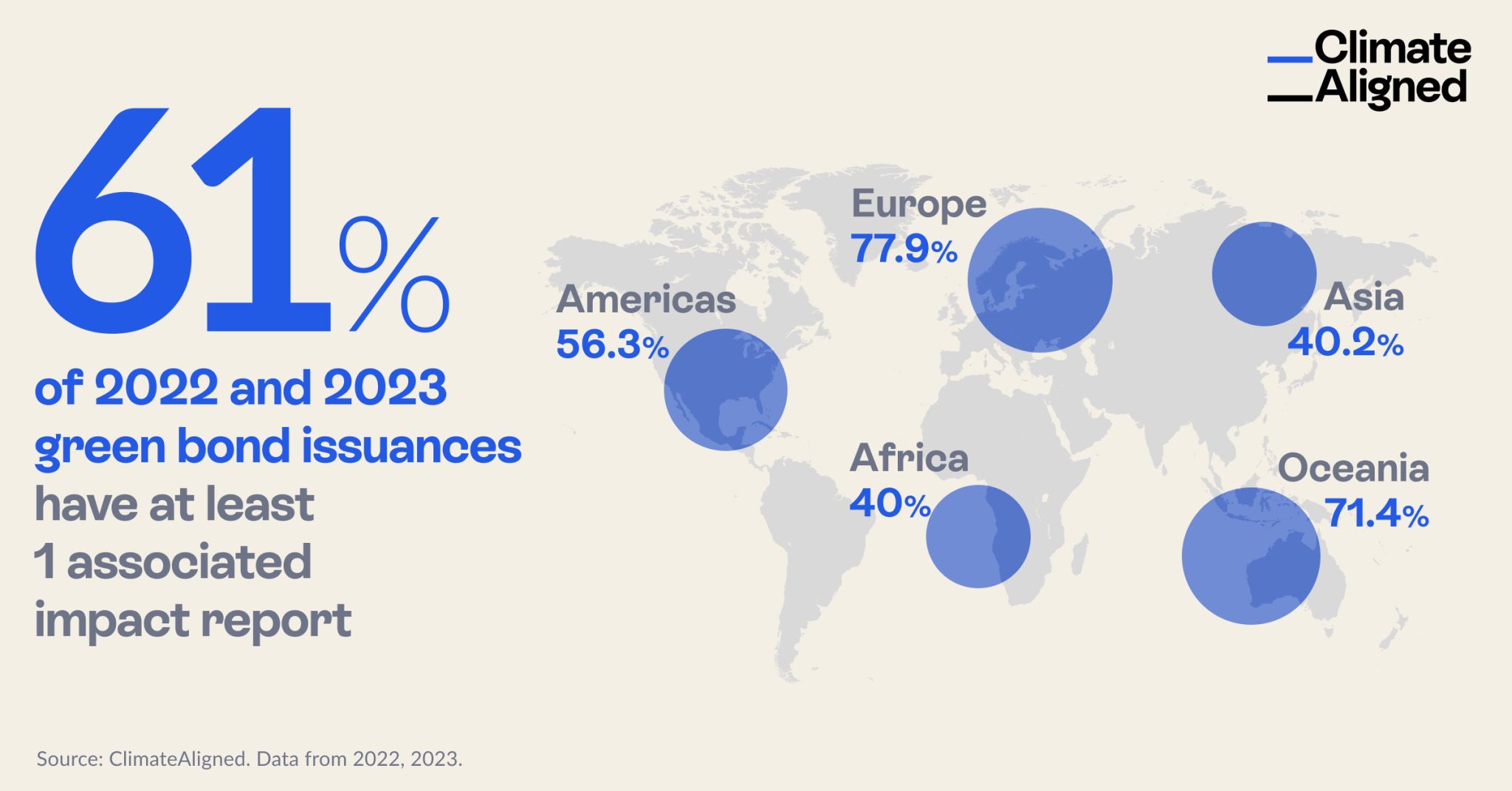

Recent analysis of the entire green bond market for 2022 and 2023 reveals that 61% of issuances have published associated impact reports. This figure represents a significant milestone in market transparency but also highlights that nearly four in ten recent green bonds still lack formal impact documentation.

The global average, however, masks substantial regional disparities that provide insight into varying levels of market development and regulatory influence:

- Europe leads with 77.9% of green bonds accompanied by formal impact reporting, reflecting the region's advanced regulatory framework and investor expectations

- Oceania follows at 71.4%, demonstrating strong reporting practices despite a smaller overall market

- The Americas show moderate adoption at 56.3%, falling slightly below the global average

- Asia and Africa both register at approximately 40%, significantly trailing other regions

These disparities reveal how regional market maturity, regulatory environments, and investor expectations shape reporting practices across the global green bond landscape.

Implications for Market Participants

For Investors and Asset Managers

For sustainable fixed income investors and portfolio managers, these findings present several strategic considerations:

Due Diligence Adjustments: The regional variations suggest a need for differentiated due diligence approaches based on issuance geography. Bonds from regions with lower reporting rates may warrant additional scrutiny or engagement.

Portfolio Transparency Challenges: Asset managers with global portfolios face particular challenges in providing consistent impact reporting to their clients when underlying holdings have varying reporting quality.

Engagement Opportunities: The data highlights specific regions where investor engagement on reporting practices could yield significant improvements in market transparency.

Benchmark Development: The global average of 61% and regional figures provide quantitative benchmarks against which to evaluate individual holdings and issuer practices.

For Issuers

Green bond issuers can extract several insights from this analysis:

Competitive Positioning: Issuers in regions with below-average reporting rates can differentiate themselves by exceeding local norms and adopting reporting practices aligned with global leaders.

Investor Expectations: The high reporting rates in Europe and Oceania signal evolving investor expectations that are likely to spread to other regions as the market matures.

Best Practice Evolution: The regional variations highlight different stages of market evolution, allowing issuers to anticipate how reporting requirements in their regions may develop.

Market Access Considerations: As investors increasingly factor reporting quality into investment decisions, issuers in regions with lower reporting rates may face growing pressure to enhance transparency to maintain market access.

Regulatory Implications and Market Development

The striking regional differences in reporting rates correlate strongly with regulatory environments:

European Leadership: Europe's high reporting rate aligns with the region's advanced sustainable finance regulatory framework, including the EU Taxonomy and forthcoming EU Green Bond Standard.

Emerging Market Challenges: The lower reporting rates in Asia and Africa highlight the need for capacity building and technical assistance to enhance transparency in these growing markets.

Harmonisation Opportunities: The global variations underscore the importance of international reporting standards that can accommodate different market stages while driving convergence toward best practices.

Policy Effectiveness: The data provides empirical evidence on the effectiveness of various policy approaches in promoting market transparency.

The Technology Enabling Market Intelligence

Traditional approaches to market analysis have made it challenging to develop comprehensive visibility into global reporting practices. The scale of the green bond market—now exceeding $3 trillion cumulatively—means that manual analysis of reporting patterns across thousands of issuances is impractical.

Advanced artificial intelligence specifically designed for sustainable fixed income analysis now enables unprecedented market visibility. This technological approach allows for:

- Systematic identification of impact reports across all issuances

- Consistent classification of reporting practices across regions

- Regular updates as new reports are published

- Granular analysis by additional factors such as sector, issuer type, and use of proceeds

For market participants seeking to understand evolving best practices, this data-driven approach provides objective benchmarks against which to evaluate individual issuances and issuer commitments.

Looking Forward: The Evolution of Impact Transparency

The current global reporting rate of 61% represents a market in transition rather than a steady state. Several factors suggest continued improvement in reporting practices:

Regulatory Momentum: Emerging regulations such as the EU Green Bond Standard will further institutionalise reporting expectations in key markets.

Investor Pressure: Growing investor sophistication regarding impact measurement is likely to drive enhanced reporting requirements across regions.

Market Competition: As reporting becomes a competitive differentiator, issuers will face increased pressure to match or exceed market norms.

Technology Adoption: Lower-cost, technology-enabled reporting solutions may reduce barriers to comprehensive impact disclosure, particularly in emerging markets.

The regional variations revealed in this analysis provide a valuable baseline against which to measure future market development. Progress in regions currently showing lower reporting rates will be a key indicator of the green bond market's overall maturation.

For investors, issuers, and policymakers committed to enhancing market transparency, these findings highlight both progress made and opportunities for continued improvement in the pursuit of genuine, measurable environmental impact through green bond financing.

ClimateAligned provides comprehensive data analytics on green bond impact reporting practices across global markets. Our AI-powered platform enables unprecedented visibility into reporting trends and standards evolution.