Analysis

Green Bond Allocation Analysis: Familiar Categories Dominate as Hard-to-Abate Sectors Struggle for Financing

Insights for sustainability analysts and portfolio managers in fixed income markets

May 24, 2024 @ London

As the sustainable bond market surpasses the significant milestone of $5 trillion in cumulative issuance, a comprehensive analysis of 2024 green bond allocations reveals a striking imbalance in how capital is distributed across project categories.

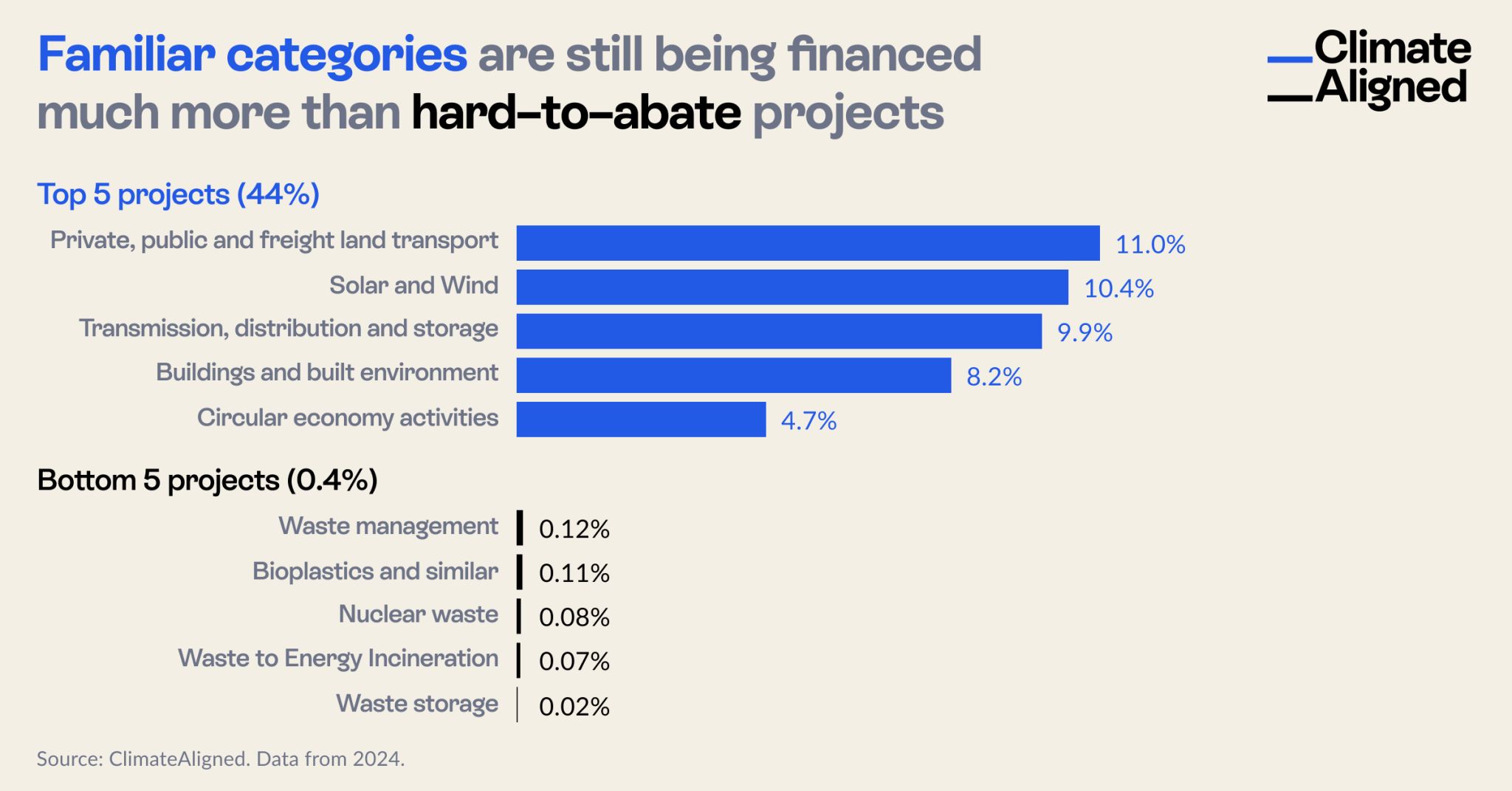

As the sustainable bond market surpasses the significant milestone of $5 trillion in cumulative issuance, a comprehensive analysis of 2024 green bond allocations reveals a striking imbalance in how capital is distributed across project categories. While familiar environmental sectors continue to attract substantial financing, the critical hard-to-abate sectors essential for achieving net zero targets remain severely underfunded.

Source: ClimateAligned. Data from 2024.

Source: ClimateAligned. Data from 2024.

Concentration in Established Categories

Analysis of green bond allocations in 2024 shows a significant concentration of capital in established environmental categories. The top five project types collectively account for 44% of total green bond proceeds:

- Private, public, and freight land transport: 11.0% of allocations, maintaining its position as the leading category for green bond financing

- Solar and wind energy: 10.4%, reflecting the continued strong investor appetite for renewable energy projects

- Transmission, distribution, and storage: 9.9%, highlighting the growing recognition of grid infrastructure as critical to energy transition

- Buildings and built environment: 8.2%, encompassing energy efficiency and green building initiatives

- Circular economy activities: 4.7%, representing a growing but still modest allocation to resource efficiency projects

This concentration pattern suggests that green bond financing continues to follow established pathways, with investors and issuers prioritizing project categories with well-developed frameworks, clear metrics, and established impact measurement methodologies.

The Hard-to-Abate Financing Gap

In stark contrast to the top categories, the bottom five project types together receive just 0.4% of total green bond allocations:

- Waste management: 0.12%, despite its critical role in reducing emissions and environmental pollution

- Bioplastics and similar materials: 0.11%, indicating minimal financing for alternatives to fossil fuel-based plastics

- Nuclear waste management: 0.08%, reflecting the broader challenges in financing nuclear-related projects

- Waste-to-energy incineration: 0.07%, showing limited support for technologies that convert waste to usable energy

- Waste storage: 0.02%, receiving the smallest allocation among all tracked categories

This minimal financing of waste-related categories is particularly noteworthy given the significant environmental and climate impacts of waste management practices. The severe underrepresentation suggests substantial barriers to channeling green bond capital toward these critical but potentially more complex or controversial project types.

Hard-to-Abate Industrial Sectors: The Middle-Ground Challenge

Beyond the bottom five categories, several other hard-to-abate sectors receive minimal financing despite their critical importance to achieving net zero targets:

- Cement production: 0.21% of allocations

- Steel manufacturing: 0.20%

- Aviation: 0.17%

These industrial sectors represent some of the most challenging decarbonization pathways and collectively account for a substantial portion of global emissions. Their limited representation in green bond allocations highlights a critical gap in transition finance that must be addressed for comprehensive climate progress.

Strategic Implications for Market Participants

For Issuers

The concentration of financing in established categories presents both challenges and opportunities for green bond issuers:

Diversification Opportunities: Issuers with exposure to hard-to-abate sectors have opportunities to differentiate their offerings by developing frameworks that specifically address these underrepresented categories.

Framework Innovation: Developing more innovative approaches to integrating hard-to-abate activities into green bond frameworks could help channel more capital toward these critical transition areas.

Impact Measurement Enhancement: More sophisticated approaches to measuring and reporting the climate impact of projects in hard-to-abate sectors could help overcome investor hesitancy.

Transition Bond Development: For companies in sectors like cement, steel, and aviation, transition-labeled bonds may offer a more appropriate instrument than traditional green bonds for financing decarbonization pathways.

For Investors

For fixed income investors committed to climate objectives, the allocation patterns suggest several strategic considerations:

Portfolio Balance Assessment: Investors should evaluate whether their green bond holdings adequately address hard-to-abate sectors that are critical to comprehensive climate transition.

Due Diligence Enhancement: More sophisticated due diligence approaches may be needed to evaluate green bonds targeting hard-to-abate sectors, recognizing that traditional environmental metrics may not fully capture transition value.

Engagement Strategy: Targeted engagement with issuers from underrepresented sectors could help catalyze more green bond issuances addressing critical decarbonization challenges.

Impact Diversification: Deliberately diversifying impact objectives to include hard-to-abate sectors could enhance the overall climate effectiveness of sustainable fixed income portfolios.

Barriers to Financing Hard-to-Abate Sectors

Several factors likely contribute to the limited green bond financing for hard-to-abate sectors:

Technological Uncertainty: Many hard-to-abate sectors rely on emerging or unproven technologies for decarbonization, creating challenges in defining eligible green projects.

Transition vs. Green Distinctions: Activities that reduce rather than eliminate emissions may face challenges fitting within traditional green bond frameworks focused on "pure green" activities.

Measurement Complexity: Emissions reductions in industrial processes can be more complex to measure and verify than those in renewable energy or transportation.

Investor Preferences: Investor mandates may explicitly prioritize established green categories, limiting demand for bonds financing more complex transition activities.

Reputational Considerations: Both issuers and investors may have concerns about potential greenwashing accusations when financing activities in traditionally high-emission sectors.

The Path Forward: Bridging the Allocation Gap

Addressing the current imbalance in green bond allocations will require coordinated efforts from multiple market participants:

Taxonomy Development: Further development of transition taxonomies that specifically address hard-to-abate sectors could provide clearer guidelines for eligible activities.

Blended Finance Approaches: Combining green bonds with other financing instruments could help address the higher risks or lower returns associated with some hard-to-abate decarbonization projects.

Platform and Sector Collaboration: Industry-specific collaborations could develop standardized approaches to green bond issuance for hard-to-abate sectors, reducing transaction costs and uncertainty.

Regulatory Support: Policy frameworks that specifically recognize transition activities in hard-to-abate sectors could enhance their attractiveness within sustainable finance instruments.

Data and Transparency Enhancement: Better data on the climate impact potential of hard-to-abate sector projects could help demonstrate their value within green bond portfolios.

Conclusion: Balancing the Green Bond Portfolio

As the sustainable bond market continues its impressive growth trajectory, the current allocation patterns present both challenges and opportunities. While the concentration in established categories has helped the market achieve scale and credibility, the relative absence of hard-to-abate sectors creates a significant gap in climate finance.

For the green bond market to maximize its contribution to global climate objectives, a more balanced allocation approach will be necessary—one that maintains support for established environmental categories while significantly increasing financing for the challenging but essential decarbonization of hard-to-abate sectors.

The coming years will likely see increasing focus on this balance, with potential evolution in frameworks, standards, and investor expectations to ensure that green bonds fulfill their potential as comprehensive instruments for financing the transition to a low-carbon economy.

ClimateAligned provides comprehensive data analytics on green bond allocation patterns across project categories. Our AI-powered platform enables unprecedented visibility into financing patterns and capital flows toward climate solutions.