Market Insight

The Green Bond Files: A Financial Detective Story

Unraveling the mysteries behind sustainable finance's most successful case

Mar 18, 2025 @ London

What began as a curious financial anomaly has evolved into a $500 billion annual market that's redefining how capital flows toward environmental solutions.

It began like any investment mystery does - with a curious anomaly in the capital markets. The year was 2007, and while Wall Street was obsessed with mortgage-backed securities, a small team at the European Investment Bank quietly launched something unprecedented: a €600 million "Climate Awareness Bond."

The Origin Case: 2007-2013

I'd been tracking traditional bonds for years when this peculiar financial instrument crossed my desk. The premise was unorthodox - capital specifically earmarked for environmental projects? The skeptic in me needed evidence.

The trail led first to the European Investment Bank, then to the World Bank in 2008. These weren't fly-by-night operations; these were institutional heavyweights. They had uncovered something significant: a method to channel private sector capital toward climate solutions while delivering transparent environmental impact alongside financial returns.

A significant breakthrough came in 2011 when the Climate Bonds Initiative launched the Climate Bond Standard - the first attempt to create verification criteria for environmental credentials. The following year, they published the Climate Bond Taxonomy, essentially creating a classification system that defined what qualified as 'green.' For a detective like me, this was crucial - you can't solve a case without defining the parameters.

For years, I watched as supranational, sovereign, and agency issuers dominated this curious market segment. The volumes were modest but consistent - like following footprints that gradually became more defined.

Source: Green Bond Case Files, 2025

Source: Green Bond Case Files, 2025

The Corporate Breakthrough: 2013-2014

The real break in the case came in 2013. After years of institutional dominance, corporate players suddenly entered the scene. Energy utilities with transition challenges. Property developers with green building portfolios. Banks looking to finance renewable energy projects.

This wasn't coincidence - this was pattern recognition. The green bond concept had proven viable enough that profit-driven corporations saw opportunity. My investigation board expanded with new sectors, new players, new motives. The market wasn't just growing - it was diversifying.

Following the Paper Trail: Market Standardization

Any good detective knows that without rules, chaos ensues. The 2014 publication of the Green Bond Principles by the International Capital Market Association (ICMA) changed everything. Finally, we had a common language - voluntary process guidelines around transparency, disclosure, and reporting that connected all the players.

The evidence became more organized: second-party opinion providers emerged, verification services established credibility, reporting frameworks created accountability. The supporting infrastructure for a legitimate market was taking shape before my eyes.

The Global Alliance: The Paris Agreement

December 2015. The world's nations gathered in Paris. As a financial detective, I've learned to watch for watershed moments that shift market dynamics. This was one of them.

The Paris Agreement wasn't just another climate accord - it was a global commitment to limit warming to well below 2°C above pre-industrial levels. More importantly for our investigation, it required significant financial flows "consistent with a pathway towards low greenhouse gas emissions."

This was the smoking gun - nations had collectively agreed that capital needed redirection. Green bonds suddenly had political momentum behind their market momentum. The Agreement effectively deputized the financial markets in the fight against climate change.

Follow-up inquiries revealed telling evidence: countries began integrating Paris targets into national policy frameworks. Financial institutions started aligning portfolios with climate scenarios. Corporations faced increasing pressure to disclose climate risks. The green bond market had found powerful allies.

The Money Trail Explodes: 2015-2021

Then came the exponential phase - the case broke wide open. Annual issuance volumes surged from approximately $40 billion in 2015 to over $500 billion by 2021. The timeline was no coincidence - the post-Paris era unleashed unprecedented growth. The clues were everywhere:

- Poland issued the first sovereign green bond in 2016

- France followed in 2017 with an unprecedented €7 billion issuance

- Corporations across sectors from automotive to telecommunications joined the movement

- The UK entered in 2021, raising £10 billion for environmental projects

Source: ClimateAligned Data Platform, 2025

Source: ClimateAligned Data Platform, 2025

The $100 Billion Milestone: The China Connection

November 2017 brought a significant milestone in our investigation. Green bond issuance hit the $100 billion mark for the first time, with a critical piece of evidence coming from an unexpected source: a $1.5 billion green bond from the China Development Bank tipped the scales.

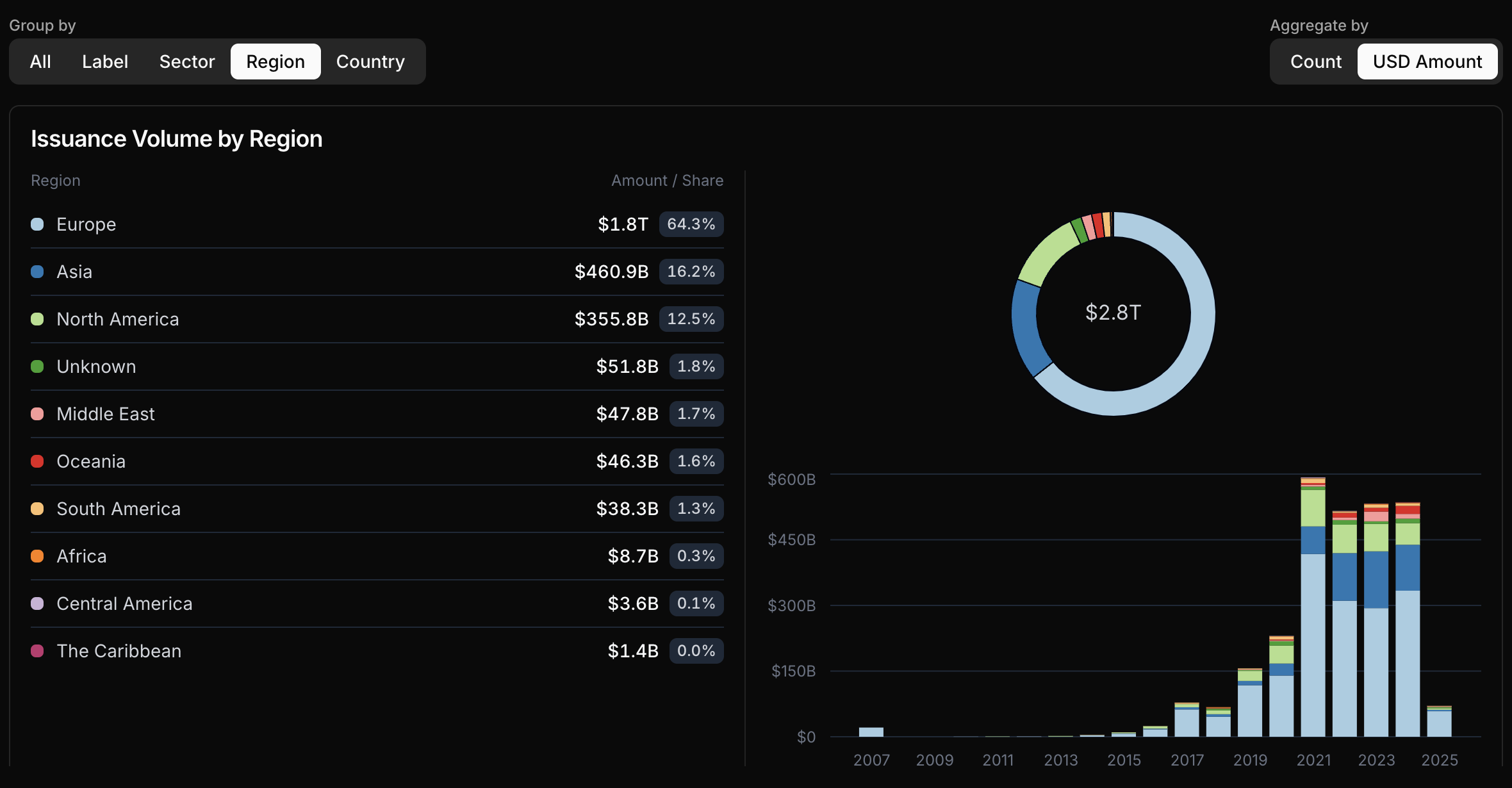

Like any good detective, I followed the money. China had become the biggest issuer that year at over $16 billion, followed by France, the United States, Germany, and others. My investigation revealed that Chinese banks had become major players, fundamentally altering the market's geography.

The Reuters wire I intercepted confirmed my suspicions: the market was on track to reach $130 billion by year-end. Climate finance leaders were already setting their sights higher – calling for a tenfold increase to $1 trillion by 2020. The game was changing rapidly.

New Players, New Angles: Market Diversification

As I continued tracking the green bond market, it spawned new variations - social bonds, sustainability bonds, sustainability-linked bonds with performance-based structures. The case had evolved beyond its original parameters.

Between 2020-2022, we reached both peak volumes and peak scrutiny. As with any financial innovation that attracts significant capital, questions emerged:

- Were the impacts real?

- Was there true additionality?

- Was "greenwashing" contaminating the evidence?

The market responded with more sophisticated reporting, greater emphasis on science-based targets, and enhanced scrutiny of transition pathways.

The Current Puzzle: Quality and Growth

After a brief contraction in 2023 amid broader market turbulence, 2024 has brought resurgence. My latest financial forensics show new records for quarterly issuance.

But the mystery has evolved. It's no longer just about following the money; it's about evaluating the impact. Not all green bonds are created equal. The market participants - the key witnesses in this case - have become more discerning about what constitutes credibility:

- Alignment with taxonomies and classification systems

- Rigorous expectations around transition strategies

- Enhanced granularity in allocation and impact reporting

The Case Continues

What began as a curious anomaly has become one of sustainable finance's most successful innovations. The case of green bonds remains open - not because the mystery hasn't been solved, but because the story continues to unfold, directing hundreds of billions toward environmental solutions annually.

The evidence is conclusive: green bonds have transformed from concept to market mechanism. But the greatest mystery may be what they ultimately become as they mature from growth alone to delivering meaningful, verifiable environmental impact.

I close this case file for now, but keep it on my desk. In this line of work, the most interesting stories never truly end – they just reveal new mysteries to solve.

Case notes compiled by ClimateAligned Investigations, providing comprehensive data across the sustainable bond universe.