Analysis

The Green Bond Building Gap: 99.2% of Financing Concentrated in Developed Markets

Insights for sustainability analysts and portfolio managers in fixed income markets

Dec 6, 2024 @ London

Latest data reveals a striking geographical imbalance in how these funds are allocated to building projects — one that raises important questions about impact optimisation in the green bond market.

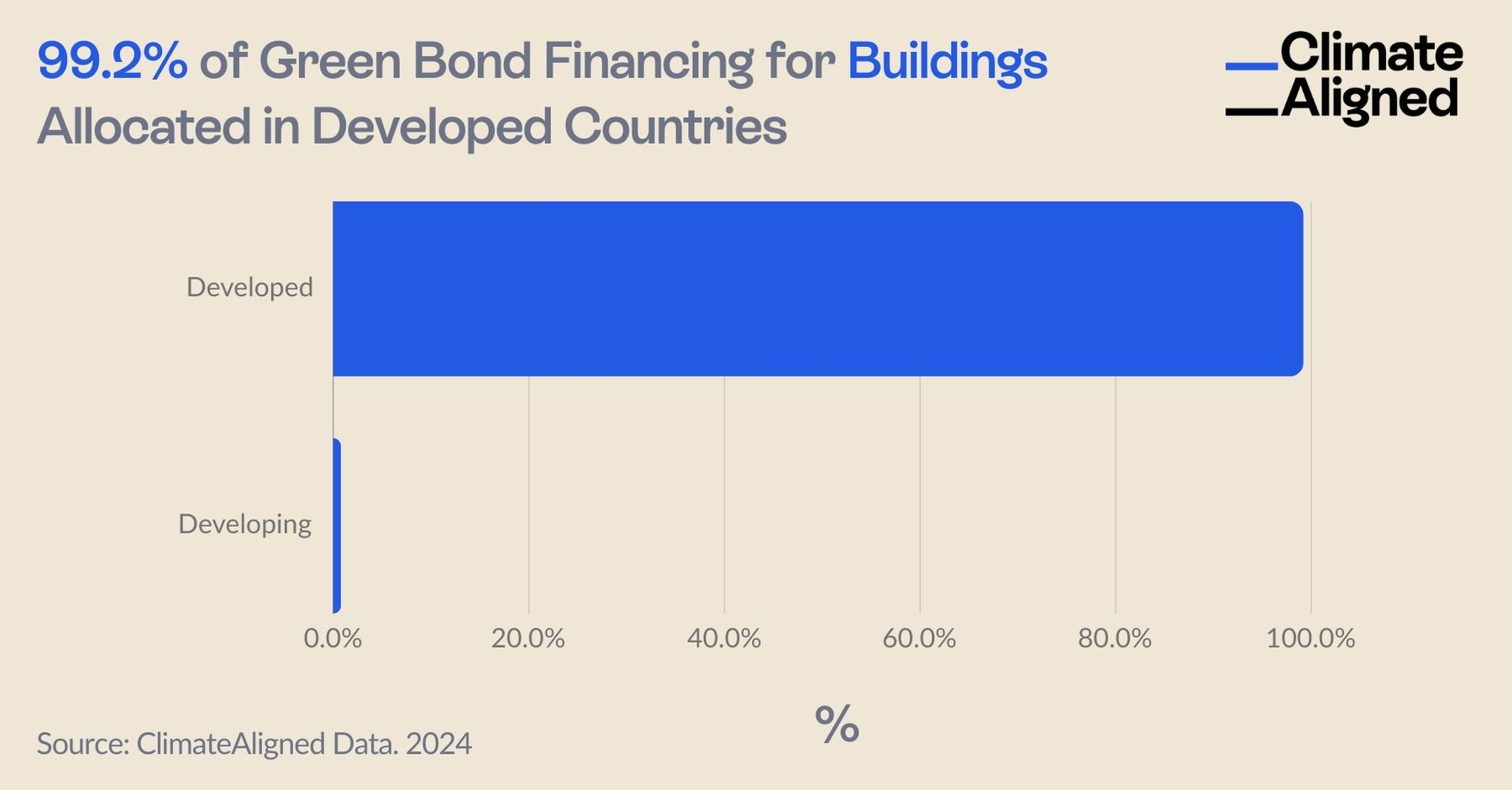

Green bonds have rapidly emerged as a cornerstone of climate finance, with the market surpassing $3 trillion in cumulative issuance. Yet our latest data reveals a striking geographical imbalance in how these funds are allocated to building projects — one that raises important questions about impact optimisation in the green bond market.

Source: ClimateAligned Data, 2024

Source: ClimateAligned Data, 2024

This imbalance becomes particularly significant when we consider that buildings and construction account for approximately 37% of global carbon emissions, according to the UN Environment Programme. Within the European Union alone, buildings contribute 34% of all energy-related emissions, making this sector critical to climate mitigation efforts.

The Allocation Challenge in Green Bond Frameworks

Our comprehensive analysis of the green bond market reveals that building-related projects currently capture about 13% of total green bond financing worldwide. However, the regional distribution of these funds presents a stark contrast: 99.2% of green building investments financed through green bonds are directed to developed countries, with just 0.8% reaching developing economies.

This allocation pattern has emerged through several factors:

- Many green bond frameworks in developed markets prioritise building refurbishment and energy efficiency upgrades

- Developed markets generally have more robust green building certification schemes that align with green bond criteria

- Property developers in advanced economies have been early adopters of green bond financing

- Institutional investors often prefer the perceived lower risk profile of developed market green building projects

For sustainable fixed income portfolio managers evaluating green bonds, this concentration creates both opportunities and challenges in ensuring optimal climate impact.

Impact Efficiency: The Emissions Reduction Equation

The central question for green bond investors and issuers becomes one of impact efficiency: are we allocating capital where it generates the maximum climate benefit?

When measured in tonnes of CO₂ equivalent (tCO₂e) avoided per million USD invested, building energy efficiency projects—particularly in developed markets—often yield lower impact returns than alternative investments. This efficiency gap becomes especially apparent when comparing building retrofits with renewable energy investments in developing countries, where each dollar can potentially deliver greater emissions reduction.

According to UN assessments, efficiency policies in developed countries can reduce building emissions by up to 90%, compared to 80% in developing countries. This suggests a slightly stronger imperative for developed nations to decarbonise their building sectors. However, with half the buildings that will exist in 2050 not yet constructed, establishing lower-carbon construction standards globally remains critical.

Strategic Considerations for Green Bond Investors

For investors constructing sustainable fixed income portfolios with green bonds, these findings suggest several strategic considerations:

- Impact Diversification: Ensuring exposure to a range of project types beyond building efficiency, including renewable energy, clean transportation, and climate adaptation

- Geographical Balance: Seeking opportunities to support high-impact building projects in developing markets, where they exist

- Framework Assessment: Evaluating green bond frameworks for their approach to measuring and reporting building-related emissions savings

- Engagement Potential: Considering how investor engagement might encourage expanded allocation to building projects in underrepresented markets

- Impact Measurement: Implementing more sophisticated impact measurement that considers both absolute emissions reduction and reduction per dollar invested

The Path Forward for Green Buildings in Green Bonds

The future development of the green bond market will likely require a more nuanced approach to building sector investments. Several emerging trends warrant attention:

Transition Bonds: Specialized instruments targeting hard-to-abate sectors, potentially including building decarbonisation in challenging markets or property types

Location-Based Metrics: More sophisticated impact reporting that considers the baseline emissions of the local grid when calculating building efficiency improvements

Whole Life Carbon: Growing emphasis on embodied carbon in addition to operational emissions, particularly in new construction projects

Blended Finance Structures: Innovative financial instruments that combine green bonds with concessional capital to support building projects in developing markets

The green bond market continues to evolve rapidly, with increasingly sophisticated approaches to impact assessment. For portfolio managers seeking to maximise climate impact, understanding these nuanced allocation patterns is becoming essential to effective sustainable fixed income strategy.

As the climate finance community works to scale funding across all sectors and geographies, building a more balanced approach to green building investments will be crucial. The challenge ahead lies not in choosing between sectors or regions, but in dramatically expanding the overall pool of climate finance to match the scale of the global challenge.

ClimateAligned provides comprehensive data analytics on green bond allocations, impact metrics, and market trends. Our technology delivers unprecedented visibility into sectoral and geographical distribution patterns, enabling more informed climate investment decisions.