Market Insight

The Evolution of Green Bonds: From Niche to Mainstream

A historical narrative of how green bonds transformed sustainable finance

Mar 11, 2025 @ London

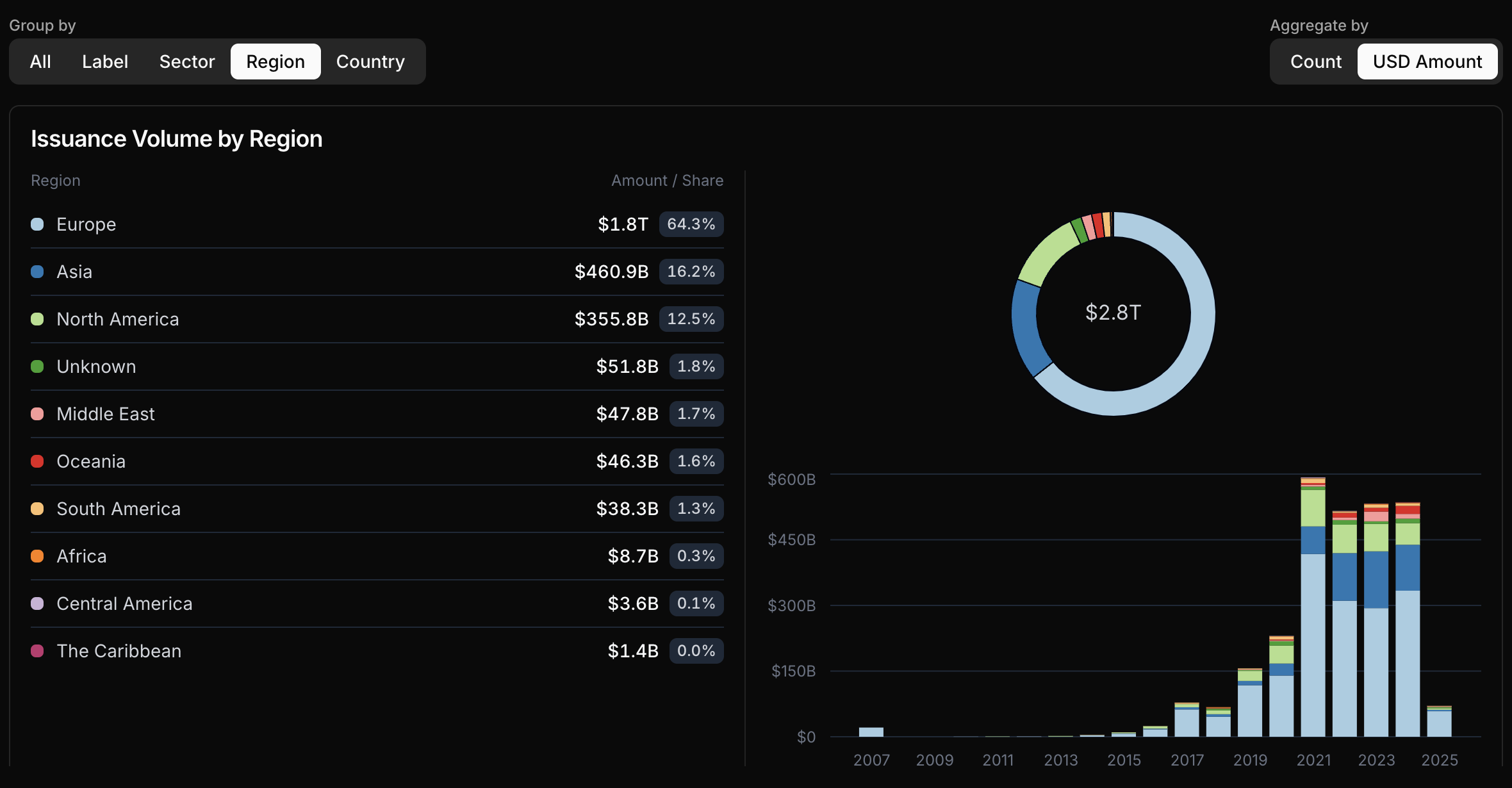

The green bond market has evolved from a singular issuance in 2007 to a sophisticated ecosystem representing hundreds of billions in annual issuance, reshaping how capital markets address sustainability challenges.

The sustainable finance landscape has undergone a remarkable transformation over the past two decades, with green bonds emerging as one of the most tangible and successful innovations. What began as a niche financial instrument has evolved into a cornerstone of the sustainable debt market, mobilising hundreds of billions in capital annually for environmentally beneficial projects. This evolution represents not just growth in volume, but a fundamental shift in how capital markets integrate sustainability considerations.

Pioneering Days: The First Green Bonds

The concept of green bonds took its first practical form in 2007 when the European Investment Bank (EIB) issued its €600 million "Climate Awareness Bond." This pioneering issuance established the fundamental premise that has defined the market since: raising capital specifically earmarked for projects with environmental benefits, particularly focused on climate change mitigation.

In these early years, multilateral development banks dominated issuance, with the World Bank following in 2008 with its first green bond. These institutions recognised the potential for these instruments to channel private sector capital toward climate solutions while offering investors transparent environmental impact alongside financial returns.

Market Standards and Infrastructure Development

A critical development in the green bond evolution came in 2011 when the Climate Bonds Initiative (CBI) launched the Climate Bond Standard, providing the market with its first dedicated certification scheme. This was followed by the publication of the Climate Bond Taxonomy in 2012, which established a classification system for projects and assets aligned with a low-carbon economy. These frameworks provided crucial guidance during the market's formative stage.

The standardisation process accelerated further with the 2014 publication of the Green Bond Principles by the International Capital Market Association (ICMA), establishing voluntary process guidelines around transparency, disclosure, and reporting. These principles have since evolved to become the primary market standard, providing a common language for issuers and investors alike.

This period also saw the emergence of second-party opinion providers and verification services, creating the ecosystem of supporting infrastructure needed for a credible, functioning market. Their role in providing assurance around framework quality and impact reporting has been crucial in building investor confidence.

From Development Banks to Corporate Adoption

For several years, green bonds remained primarily the domain of supranational, sovereign, and agency (SSA) issuers. The market saw modest but steady growth until 2013-2014, when corporate issuers began embracing the concept. This expansion beyond development banks marked a critical inflection point in market development.

Corporate pioneers included energy utilities facing transition challenges, property developers with green building portfolios, and banks looking to finance renewable energy projects. The entrance of corporate issuers not only expanded the market's size but also its sectoral diversity, creating new opportunities for investors to express environmental preferences across their portfolios.

The Growth Acceleration

Source: ClimateAligned Data, 2025

Source: ClimateAligned Data, 2025

From 2015 onwards, the green bond market entered a phase of exponential growth. Annual issuance volumes expanded from approximately $40 billion in 2015 to over $500 billion by 2021, representing one of the fastest-growing segments in global capital markets. This period witnessed numerous milestones:

- The first sovereign green bonds appeared, with Poland issuing the first in 2016, followed by France in 2017 with an unprecedented €7 billion issuance.

- Corporate participation broadened dramatically across sectors, from automotive to telecommunications.

- The UK launched its first sovereign green bond in 2021, raising £10 billion for projects ranging from clean transportation to biodiversity protection.

A landmark achievement came in November 2017 when the green bond market crossed the $100 billion threshold for the first time. As reported by Reuters, this milestone was fuelled significantly by Chinese issuance, with China Development Bank's $1.5 billion green bond pushing the market over this symbolic line. China established itself as the largest issuer that year with over $16 billion in green bonds, followed by France, the United States, and Germany.

This achievement prompted climate leaders, including former UN climate chief Christiana Figueres, to call for scaling the market to $1 trillion annually by 2020—an ambitious target that, while not yet reached, has helped drive market expansion.

Innovation Through Specialised Instruments

The green bond market has not only grown in volume but also in diversity and sophistication. The World Bank's 2019 "Rhino Bond" (formally known as the Wildlife Conservation Bond) exemplifies this innovation. This $150 million, five-year bond channelled investment toward protecting and increasing black rhino populations in South Africa, with returns tied to conservation success. Such outcome-based instruments demonstrate the potential for green bonds to address specific environmental challenges beyond climate change.

Source: World Bank, 2019

Source: World Bank, 2019

Market Maturation and Diversification

As the green bond market matured, it catalysed innovation across the broader sustainable debt landscape. Social bonds emerged to address social challenges, sustainability bonds combined both environmental and social objectives, and sustainability-linked bonds introduced performance-based structures where coupon payments are tied to achievement of sustainability targets.

The 2020-2022 period represented both peak volumes and increased scrutiny. As issuance reached new heights, questions around impact, additionality, and "greenwashing" became more prominent. The market showed signs of maturation through:

- More sophisticated impact reporting practices

- Greater emphasis on alignment with science-based targets

- Enhanced scrutiny of transition pathways, particularly for high-carbon sectors

The Current Landscape: Recovery and Quality Focus

After a brief contraction in 2023 amid broader bond market challenges, 2024 has seen the green bond market return to growth, setting new records for quarterly issuance. This resurgence reflects both improving market conditions and the enduring appeal of green bonds as a financing mechanism.

The current landscape is characterised by dual priorities: continued volume growth alongside increased focus on quality and impact. Not all green bonds are created equal, and market participants are becoming more discerning about what constitutes a credible green bond. This evolution includes:

- Greater emphasis on alignment with taxonomies and classification systems

- More rigorous expectations around transition strategies for high-carbon issuers

- Enhanced granularity in allocation and impact reporting

The Path Forward

As green bonds enter their third decade, several trends suggest the direction of future development:

- Standardisation and regulation will continue advancing, with the EU Green Bond Standard representing the most comprehensive regulatory approach to date.

- Technology-enabled transparency will transform how investors evaluate impact and allocation, with granular data becoming increasingly accessible through digital platforms.

- Integration with transition finance frameworks will allow green bonds to better address complex decarbonisation challenges across diverse sectors.

- Emerging market expansion will become increasingly central to market growth, with significant untapped potential in regions facing acute climate vulnerabilities.

The evolution of green bonds represents one of sustainable finance's most successful innovations—transforming a conceptual idea into a market mechanism that directs hundreds of billions toward environmental solutions annually. As the market continues maturing, the focus increasingly shifts from growth alone to ensuring these instruments deliver meaningful, verifiable environmental impact commensurate with their sustainable classification.

ClimateAligned's technology provides comprehensive data across the sustainable bond universe, enabling investors to track market trends, evaluate impact, and make informed allocation decisions.