Analysis

Emerging Market Green Bonds: The Undisputed Champions of Climate Impact Efficiency

Insights for sustainability analysts and portfolio managers in fixed income markets

Dec 4, 2024 @ London

Not all green bonds deliver equal environmental impact. New comprehensive data reveals a striking efficiency gap between emerging and developed market green bonds that has significant implications for impact-focused investors.

The green bond market has surpassed $3 trillion in cumulative issuance, establishing itself as a cornerstone of climate finance. However, not all green bonds deliver equal environmental impact. New comprehensive data from ClimateAligned reveals a striking efficiency gap between emerging and developed market green bonds that has significant implications for impact-focused investors.

Source: ClimateAligned Data, 2024

Source: ClimateAligned Data, 2024

The Impact Efficiency Revelation

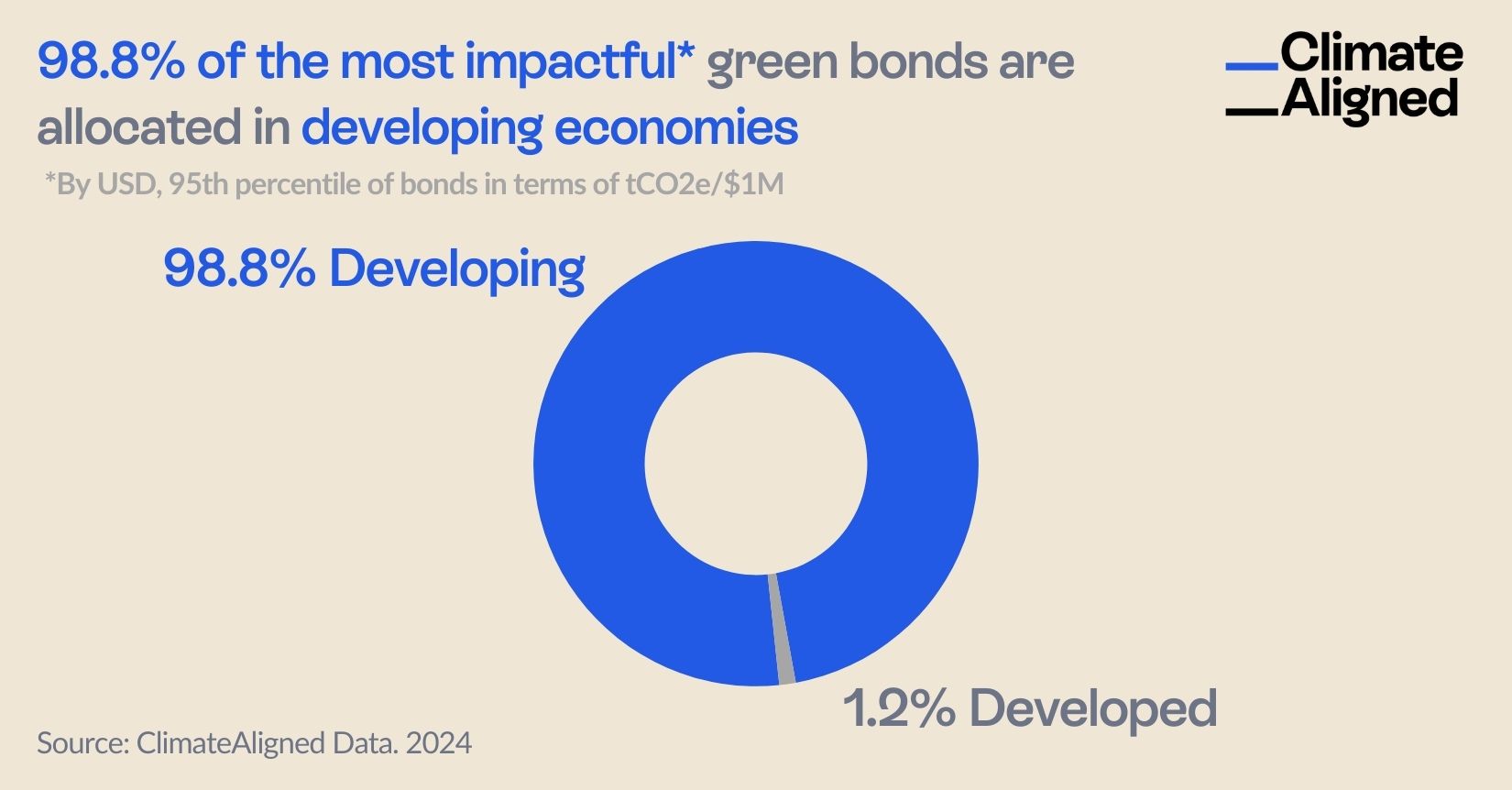

Our analysis of the global green bond market has uncovered a compelling pattern: 98.8% of investment in the highest-impact green bonds—those in the 95th percentile measured by CO₂e emissions avoided per dollar invested—is directed to projects in emerging markets. This represents an extraordinary concentration of impact efficiency in developing economies.

This finding becomes even more significant when we consider that emerging markets represent just 18.6% of green bond country allocations overall. Yet these markets dominate the most impactful bond category, representing 60% by count and 98.8% by dollar value of the top-performing instruments.

The magnitude of this performance gap is substantial. The highest-impact bonds deliver an average of 1,002 tonnes of CO₂e avoided per million dollars invested—approximately ten times the median green bond's impact. Meanwhile, only 0.3% of developed market project allocations by dollar value reach this top performance tier.

Understanding the Emerging Market Advantage

The remarkable impact efficiency of emerging market green bonds stems from several structural advantages:

High-Impact Project Selection: The vast majority (93.4%) of these high-performing bonds finance renewable energy projects, which typically deliver more quantifiable emissions reductions than other green categories.

Carbon-Intensive Baselines: These projects are predominantly located in countries with carbon-intensive electricity grids, such as India, Indonesia, South Africa, and Uzbekistan. When renewable energy displaces fossil fuel generation in these markets, the emissions reduction per unit of clean energy is substantially higher than in markets with already decarbonised grids.

Technology Leapfrogging: Many emerging economies can bypass older, less efficient technologies, implementing state-of-the-art renewable solutions that maximise impact.

Cost Efficiency: Lower project development costs in many emerging markets may contribute to higher emissions reduction per dollar invested.

Case Study: Masdar's Multi-Market Approach

The standout example of this impact efficiency comes from Masdar (Abu Dhabi Future Energy Company), whose green bond finances renewable energy projects across Azerbaijan, UAE, and Uzbekistan. This strategic allocation to markets with carbon-intensive grids creates exceptional emissions reduction potential.

Masdar's approach exemplifies how strategic project selection in high-impact markets can dramatically amplify the climate benefit of green bond proceeds. Their focus on renewable energy in markets with significant carbon intensity has positioned their bonds among the most impactful in the global green bond market.

Market Implications for Green Bond Investors

These findings have profound implications for sustainable fixed income portfolio managers and investors:

Impact Optimisation: Investors seeking to maximise climate impact per dollar invested should consider increasing allocation to emerging market green bonds, particularly those financing renewable energy projects.

Portfolio Construction: Impact-focused investors might consider a "barbell" approach—balancing lower-risk developed market instruments with higher-impact emerging market bonds to optimise both financial and climate returns.

Due Diligence Enhancement: Investors should incorporate baseline grid carbon intensity and project type into their impact assessment frameworks when evaluating green bonds.

Engagement Opportunity: Developed market issuers could be encouraged to direct more proceeds to projects in emerging economies to enhance their impact efficiency.

Reporting Standards: This data highlights the importance of standardised impact reporting that includes emissions avoided per dollar invested, not just absolute reductions.

Policy and Market Development Perspectives

As COP29 emphasises the importance of scaling private finance in emerging markets, this analysis provides quantitative evidence that such investments can deliver unparalleled climate impact. Several policy implications emerge:

De-risking Mechanisms: Development finance institutions could expand initiatives to reduce the risk premium on emerging market green bonds, thereby increasing their attractiveness to mainstream investors.

Impact Pricing: Carbon markets and climate finance mechanisms could better recognise and reward the superior impact efficiency of emerging market climate investments.

Technical Assistance: International support for green bond framework development and verification in emerging markets could help expand this high-impact segment.

Taxonomy Alignment: Global green bond standards could incorporate impact efficiency metrics to highlight and incentivise the most effective allocations.

The Future of Impact-Efficient Green Bond Investing

Looking forward, the green bond market is likely to see greater differentiation based on impact efficiency. Several trends are emerging:

- More sophisticated impact reporting that consistently presents emissions reduction per dollar invested

- Growing investor demand for emerging market exposure specifically for impact reasons

- Development of blended finance structures to facilitate greater capital flows to high-impact projects

- Increased scrutiny of developed market green bonds with marginal impact efficiency

For portfolio managers, the message is clear: directing green investments toward emerging markets isn't merely a matter of climate equity—it represents the most effective way to reduce emissions through fixed income instruments. As the sustainable finance market matures, this impact efficiency gap is likely to become an increasingly important factor in portfolio construction and performance evaluation.

ClimateAligned provides comprehensive data analytics on green bond impact metrics, allocation patterns, and efficiency performance. Our technology delivers unprecedented visibility into which bonds and markets offer the greatest climate impact per dollar invested.