Analysis

Biodiversity Financing Through Green Bonds: Analysis Reveals Public Sector and Banking Leadership

Insights for sustainability analysts and portfolio managers in fixed income markets

May 31, 2024 @ London

Recent analysis of 2024 green bond issuances reveals significant patterns in how different sectors are contributing to biodiversity finance, with public sector entities and financial institutions taking leading roles in channeling capital toward nature preservation.

As global initiatives to preserve biodiversity gain momentum, green bonds have emerged as a crucial financing mechanism for nature-related projects. Recent analysis of 2024 green bond issuances reveals significant patterns in how different sectors are contributing to biodiversity finance, with public sector entities and financial institutions taking leading roles in channeling capital toward nature preservation.

Source: ClimateAligned, 2024.

Source: ClimateAligned, 2024.

Leading Sectors in Biodiversity Financing

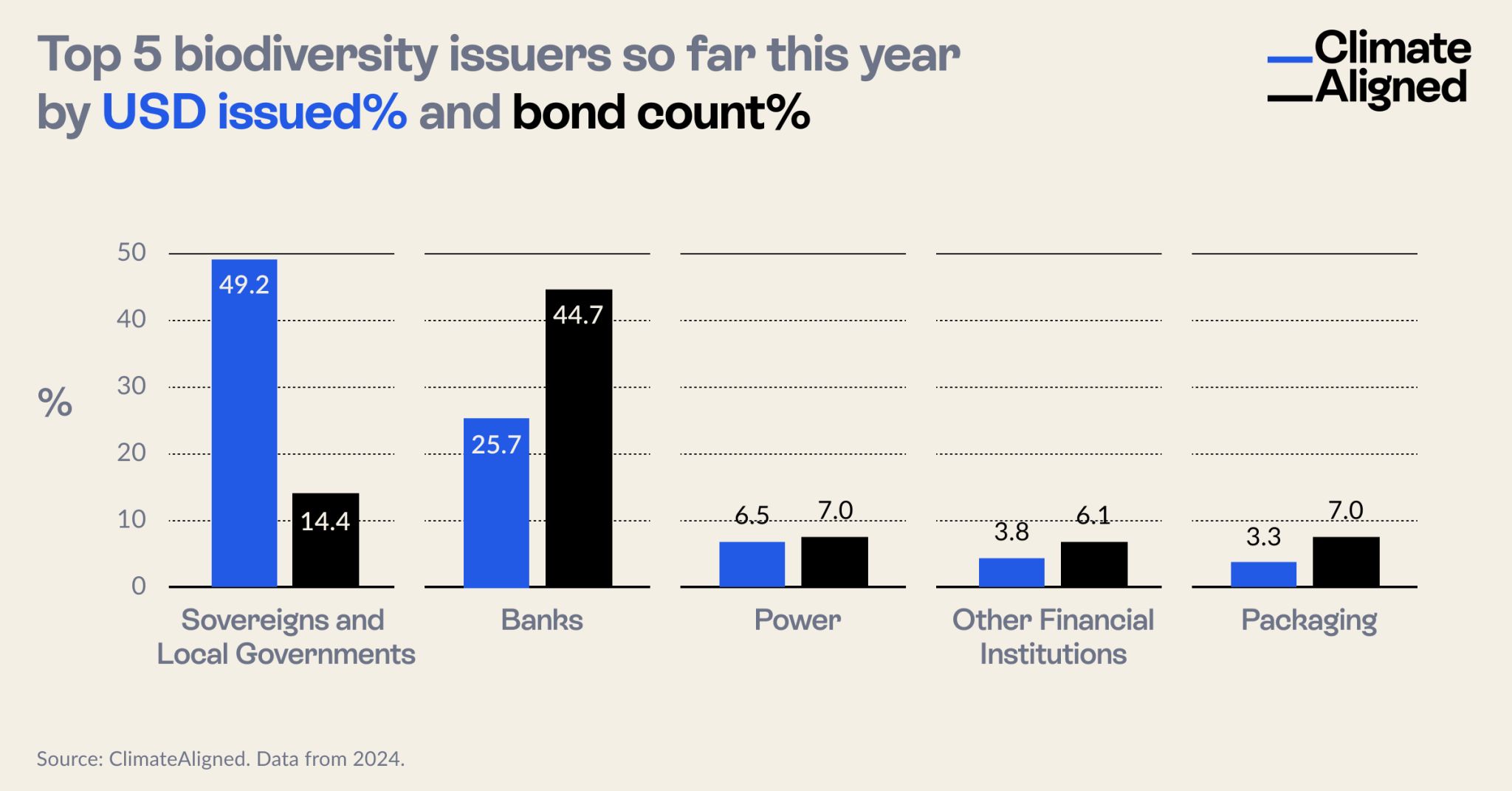

Comprehensive analysis of green bonds issued in 2024 that include biodiversity projects in their use of proceeds reveals clear sectoral leadership patterns, with notable disparities between volume share and number of issuances:

Sovereigns and Local Governments

Public sector entities have established themselves as the dominant force in biodiversity financing through green bonds, accounting for 49.2% of the total dollar volume allocated to nature-related projects. This substantial financial commitment is achieved through a relatively modest 14.4% of the total bond count, indicating that public sector issuances tend to be larger in size but fewer in number than those from other sectors.

This pattern reflects the unique position of governments in biodiversity conservation. With direct responsibility for natural resource management, spatial planning, and environmental protection within their jurisdictions, sovereign and sub-sovereign entities can develop large-scale programs that deliver meaningful biodiversity impact. Their ability to issue bonds at scale also makes them well-positioned to fund substantial conservation initiatives.

Banking Sector

Banks represent the second-largest contributor to biodiversity financing, accounting for 25.7% of the dollar volume allocated to nature-related projects. Most notably, financial institutions have issued 44.7% of all bonds containing biodiversity elements—the highest proportion by bond count among all sectors. This indicates that while banks issue more numerous bonds with biodiversity components, the average size of these allocations tends to be smaller than those from sovereign issuers.

The banking sector's prominent role aligns with their increasing focus on nature-related financial risks and the growing integration of biodiversity considerations into lending and investment policies. Many banks are utilizing green bonds to finance a portfolio approach to biodiversity, supporting diverse projects across multiple borrowers and regions.

Power Utilities

Power companies have emerged as the third most significant sector for biodiversity financing, contributing 6.5% of the dollar volume through 7.0% of bonds. The relatively balanced proportion between volume and count suggests that power utility issuances for biodiversity tend to maintain consistent sizing approaches.

The power sector's involvement in biodiversity financing often stems from the ecological impacts of energy infrastructure and the increasing recognition of nature-based solutions for climate resilience. Hydroelectric operators in particular frequently incorporate watershed management and habitat protection into their environmental programs.

Other Financial Institutions and Packaging Companies

Other financial institutions (including insurance companies, asset managers, and development finance institutions) and packaging companies round out the top five sectors, contributing 3.8% and 3.3% of biodiversity financing volume respectively. Both sectors show higher proportions of bond count relative to dollar volume, indicating smaller average allocation sizes.

The packaging sector's participation is particularly noteworthy given the direct relationship between paper-based packaging and forest resources. As companies in this sector advance sustainability commitments, green bonds have become a mechanism to finance responsible forest management practices that support biodiversity while securing sustainable fiber sourcing.

Project Types Supporting Biodiversity

The biodiversity-related projects financed through these green bonds encompass a diverse range of activities aligned with nature preservation and restoration:

Forestry Initiatives: Reforestation, afforestation, and land remediation projects represent core biodiversity investments across multiple issuer types, with particular prominence in sovereign and packaging company bonds.

Ecosystem Conservation: Projects focused on the protection and management of various ecosystem types—including forests, coastal zones, marine areas, and watersheds—feature prominently in use of proceeds allocations.

REDD Projects: Reduced Emissions from Deforestation and Forest Degradation initiatives, which combine climate mitigation with biodiversity preservation, are emerging as an important category, particularly in emerging market issuances.

Technology and Management Systems: Financing for machinery, equipment, and intelligent management systems designed specifically for ecosystem management represents a growing category that bridges technology and biodiversity objectives.

This diverse range of project types demonstrates how the concept of biodiversity financing has expanded beyond traditional conservation to encompass more integrated approaches to natural resource management.

Strategic Implications for Market Participants

For Issuers

The sectoral distribution of biodiversity financing presents several strategic considerations for organizations considering green bonds for nature-related projects:

Sectoral Benchmarking: Potential issuers can now benchmark their biodiversity allocation strategies against sector peers, with the data suggesting different norms across sectors in terms of both proportion and scale.

Cross-Sector Collaboration: The complementary roles of public and private sector issuers create opportunities for blended finance approaches that combine sovereign bonds with private sector financing to achieve larger-scale biodiversity outcomes.

Framework Development: Organizations developing new green bond frameworks can consider how to position biodiversity elements within their use of proceeds categories, with sector-specific approaches emerging as a potential best practice.

Impact Reporting Differentiation: With biodiversity financing becoming more common, issuers have opportunities to differentiate through more sophisticated impact measurement and reporting approaches specific to nature-related outcomes.

For Investors

For fixed income investors focusing on biodiversity exposure, the analysis suggests several strategic approaches:

Sectoral Diversification: Investors seeking comprehensive exposure to biodiversity financing should consider balanced allocations across the identified leading sectors, recognizing their different project emphases and scale approaches.

Public-Private Balance: Portfolio construction strategies might consider the complementary strengths of sovereign and corporate issuers, with public sector bonds offering scale while corporate issuances often provide more targeted biodiversity interventions.

Impact Assessment Methodology: Investors should develop more nuanced approaches to evaluating biodiversity impact across different issuer types, recognizing that project size doesn't necessarily correlate directly with ecological benefit.

Engagement Opportunities: The data highlights sectors where biodiversity financing remains underrepresented relative to potential impact, creating targeted engagement opportunities for investors.

Looking Forward: The Evolution of Biodiversity Finance

The current distribution of biodiversity financing across sectors likely represents an early stage in the market's development, with several trends poised to shape its evolution:

Standardization Improvements: The Taskforce on Nature-related Financial Disclosures (TNFD) and similar initiatives will likely drive greater standardization in how issuers define, measure, and report on biodiversity impacts.

Sector Expansion: Sectors currently underrepresented in biodiversity financing but with significant nature impacts—such as agriculture, extractives, and consumer goods—may increase their participation as nature-related financial risks gain prominence.

Outcome-Based Financing: Future biodiversity financing may shift toward more explicitly outcome-based approaches, potentially including sustainability-linked structures tied to verified biodiversity improvements.

Technology Integration: The intersection of digital technology and biodiversity monitoring will likely enable more sophisticated impact verification, potentially expanding investor confidence in biodiversity-focused bonds.

As the International Day for Biological Diversity reminds us of nature's fundamental importance, the green bond market's growing focus on biodiversity represents a promising development in aligning financial flows with ecological preservation. The leadership demonstrated by sovereigns, local governments, and financial institutions provides a foundation upon which more comprehensive biodiversity financing can develop.

ClimateAligned provides comprehensive data analytics on biodiversity financing through green bonds across sectors and project types. Our AI-powered platform enables unprecedented visibility into emerging financing patterns for nature-related investments.