Analysis

North America's Green Bond Approach Reveals Car-Centric Culture

Analysis for transport policy analysts and sustainable infrastructure investors

Mar 17, 2025 @ London

North America allocates a higher proportion of its clean transportation financing to electric vehicles than any other region, highlighting cultural preferences for personal transportation.

North America's approach to funding clean transportation through green bonds reveals its car-centric culture, showing distinctive patterns compared to other regions worldwide.

Key Findings from ClimateAligned Analytics

Using ClimateAligned's analytics, we analysed allocation data from 1,849 green and sustainable bonds (worth over $1.1T) and discovered something interesting: While North America allocates just 12.8% of its green bond proceeds to clean transportation—the lowest percentage globally—its focus within this category tells a compelling story:

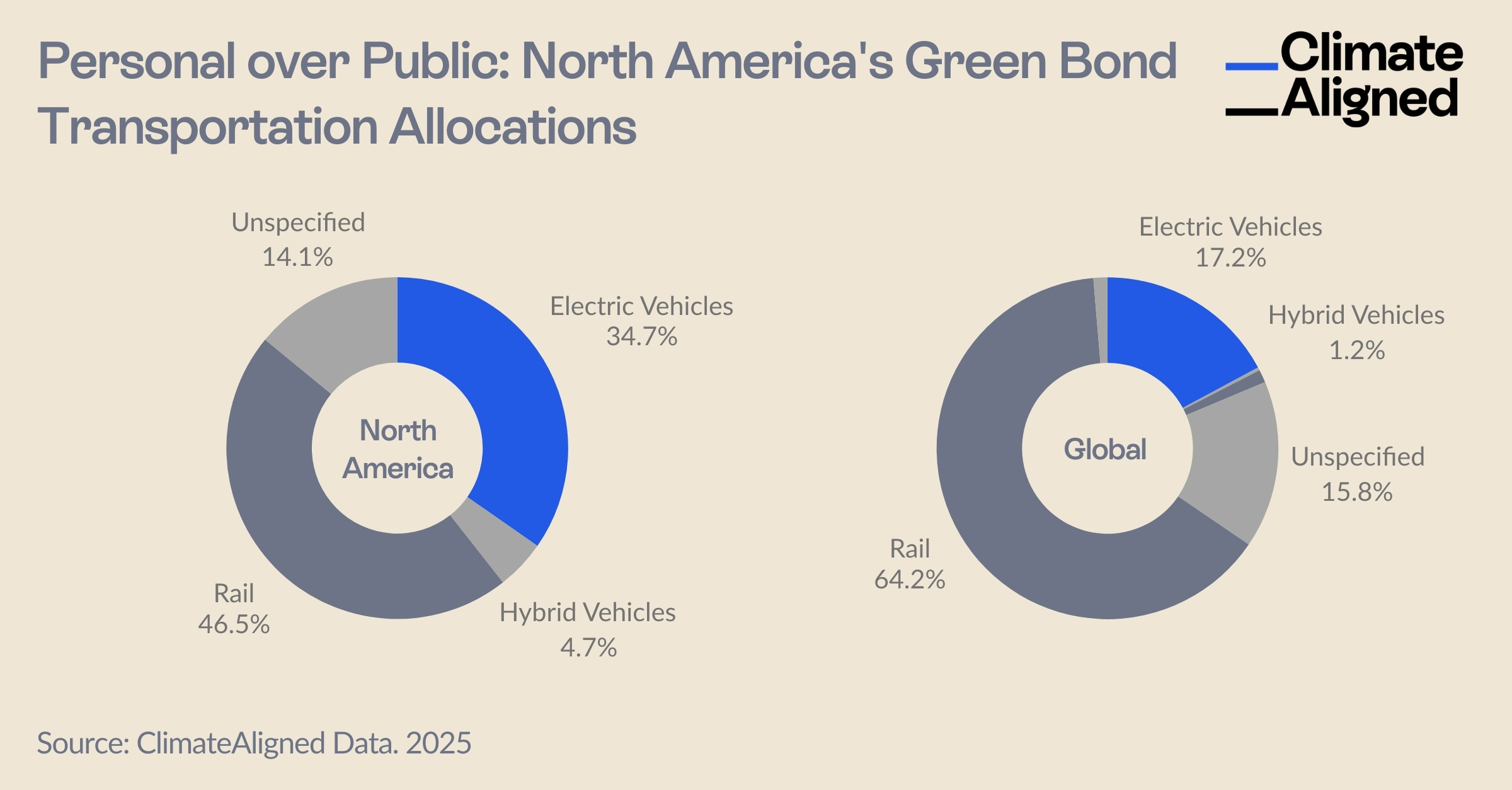

- 34.7% of North America's clean transportation financing goes to electric vehicles, compared to only 17.2% globally

- In this sample, North American issuers invested $8.8 billion in EVs—proportionally the highest of any continent and second only to Europe's $13.7 billion in absolute terms

- Only 46.5% of North America's clean transport funding supports rail infrastructure, versus 64.2% globally and 94.5% in South America

- Hybrid vehicles receive 4.7% of clean transportation allocations in North America, compared to just 1.2% worldwide

Market Size vs. Proportional Investment

Despite having the smallest proportional investment in clean transportation overall, North America still represents 14.5% of global clean transport financing in absolute terms, reflecting its larger market size.

Source: ClimateAligned Data, 2025

Source: ClimateAligned Data, 2025

Cultural Preferences Reflected in Financing

This emphasis on electric personal vehicles over mass transit systems likely reflects deep-rooted cultural preferences and existing infrastructure. While European green bonds prioritise comprehensive public transit networks, North American sustainable finance focuses on electrifying individual transportation.

Market Implications for Investors

For sustainable finance professionals and transport-focused investors, these findings highlight several important considerations:

- Infrastructure alignment matters. North America's investment patterns suggest greater opportunities in EV charging networks, battery technology, and personal vehicle electrification than in other regions.

- Cultural context shapes investment landscapes. Understanding regional preferences and existing infrastructure provides crucial context for evaluating sustainable transport investments.

- Regional specialisation creates opportunity. Each continent's distinctive approach to transport decarbonisation offers different entry points for impact investors seeking alignment with local development patterns.

- Policy influence is substantial. The stark regional differences likely reflect varying incentive structures and regulatory environments that investors should monitor for potential shifts.

The Path Forward: Bridging Regional Approaches

The regional differences in clean transport financing reflect not just different investment priorities but fundamentally different approaches to decarbonising mobility systems. Whilst North America's EV-centric approach aligns with its car-dependent infrastructure, other regions demonstrate the viability of rail and public transport solutions.

For investors and analysts evaluating sustainable transport opportunities, these patterns suggest that successful strategies will need to account for deeply embedded regional transportation cultures whilst supporting convergence toward the most efficient and sustainable systems.

As the clean transportation market evolves, tracking these nuanced investment flows remains essential for identifying opportunities, understanding regional market trends, and making informed decisions about sustainable infrastructure development across diverse geographical contexts.

Through detailed analytics of bond allocation data, investors gain unprecedented insight into how sustainable finance is being deployed across regions, sectors, and technologies—revealing both established patterns and emerging opportunities in the global transition to cleaner transportation.

ClimateAligned's technology captures pre- and post-issuance allocation data at scale and in real time, providing the transparency investors need to drive capital where it's needed most.