Analysis

North America Leads Global Green Bond Investments in Solar and Renewable Energy

Essential insights for portfolio managers and sustainability analysts in renewable energy markets

Mar 26, 2025 @ London

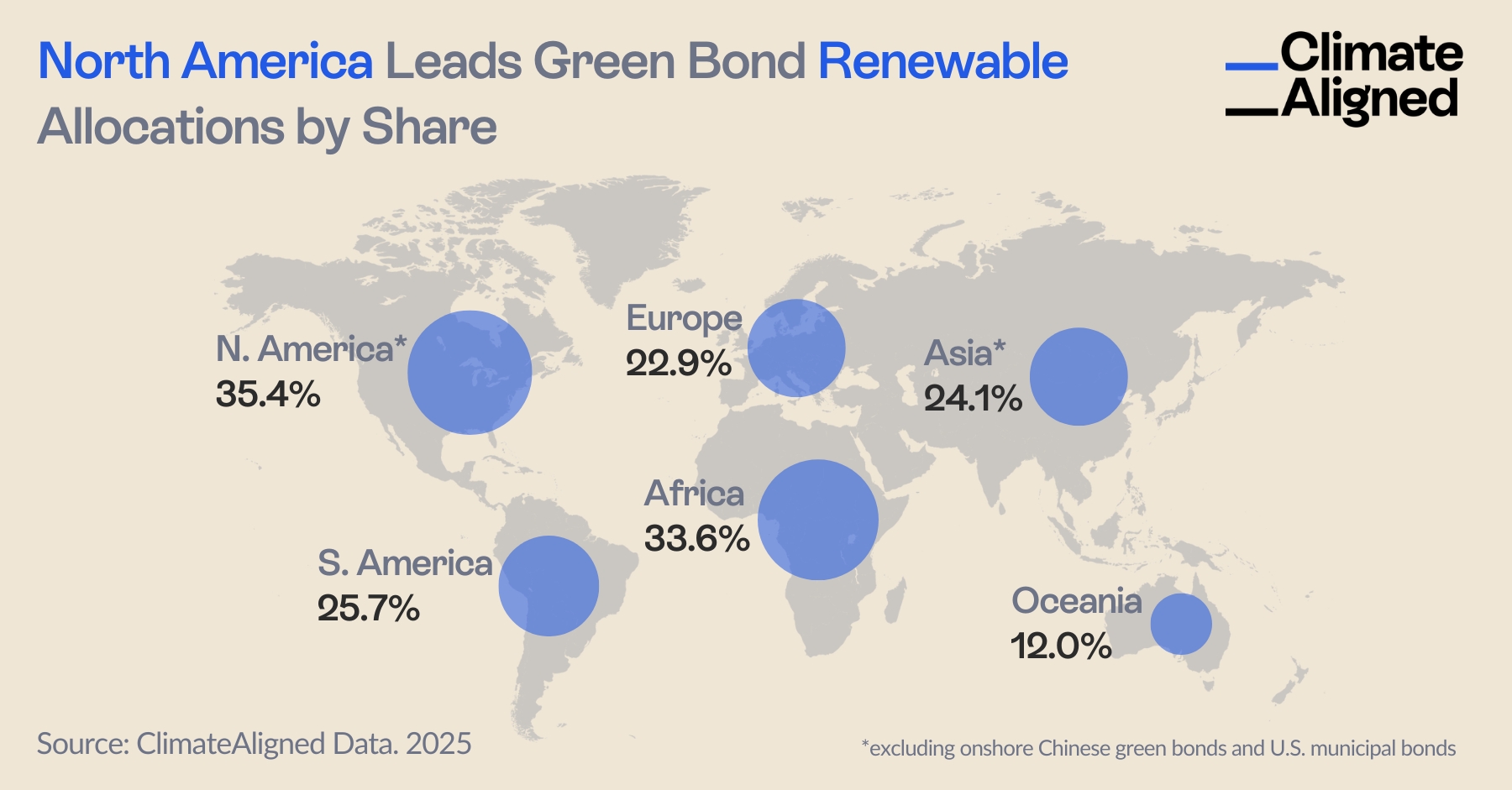

North America allocates an impressive 35.4% of its green bond proceeds to renewable energy projects—the highest proportion of any continent globally, with a particularly strong emphasis on solar projects.

The green and sustainable bond market continues to channel significant capital toward renewable energy globally, but with notable regional variations in allocation patterns. Our comprehensive analysis of 1,849 green and sustainable bonds, representing over $1.1 trillion in financing, reveals that North America stands as the global leader in directing bond proceeds to renewable energy investments, with particularly strong emphasis on solar projects.

North America's Renewable Energy Leadership

While Europe maintains the largest green bond market by volume, North American issuers demonstrate the strongest commitment to renewable energy as a percentage of total allocations. North America directs 35.42% of green bond proceeds to renewable energy projects—the highest proportion of any continent globally. This substantial allocation reflects the region's strategic focus on accelerating its clean energy transition through sustainable finance mechanisms.

The continent's renewable energy emphasis is even more noteworthy when compared to global peers:

- North America: 35.4% of proceeds to renewables

- Africa: 33.6% (second-highest regionally)

- Europe: 22.7% (despite having the largest absolute allocation at $123 billion)

- Oceania: 12.0% (lowest regional allocation percentage)

This pronounced regional variation suggests different strategic priorities within sustainable finance frameworks, with North American issuers placing particular emphasis on building out renewable energy infrastructure.

Solar Shines Brightest in North American Allocations

Digging deeper into North America's renewable allocations reveals a particularly strong emphasis on solar energy. The data shows North American green bonds have directed $17.42 billion specifically to solar projects, representing:

- 24.94% of the continent's renewable energy allocations

- 8.83% of its total green bond financing

This solar emphasis significantly outpaces other regions. Despite Europe having a much larger overall green bond market, North America's $17.42 billion in solar financing exceeds Europe's $13.26 billion. Solar captures nearly a quarter (24.94%) of North America's renewable allocations, compared to just 10.76% in Europe and 30.30% in Asia.

Source: ClimateAligned Data, 2025

Balanced Technology Approach

Despite the strong emphasis on solar, North America's approach to renewable financing demonstrates technological balance. Wind energy continues to receive the largest share of renewable allocations at 41.09%, showcasing a diversified approach to clean energy development. This balanced strategy helps mitigate technology-specific risks while capitalizing on the region's diverse renewable resources.

The strong wind and solar allocations contrast with patterns observed in other regions, such as Africa, where 49.18% of renewable allocations go to unspecified renewable categories, reflecting less detailed reporting and potentially less targeted deployment strategies.

Driving Factors Behind North America's Solar Leadership

Several key factors contribute to North America's leadership position in solar financing through green bonds:

- Policy Incentives: The Inflation Reduction Act in the United States has created substantial long-term incentives for solar development, providing investors with policy certainty that supports green bond issuances.

- Declining Technology Costs: Solar costs have fallen dramatically over the past decade, making projects increasingly viable across more North American regions and expanding the pipeline of bankable projects.

- Resource Availability: The southwestern United States and parts of Mexico offer world-class solar resources, providing natural advantages for solar development that attract green financing.

- Established Market Infrastructure: Well-developed capital markets and renewable energy financing structures make North America particularly conducive to scaling solar investments through green bonds.

Market Implications for Investors

For portfolio managers and sustainability analysts evaluating opportunities in renewable energy markets, these findings carry several important implications:

- North America offers concentrated renewable exposure: Investors seeking portfolios with high renewable energy exposure may find North American green bonds particularly attractive, offering the highest proportion of proceeds directed to clean energy projects.

- Solar represents a strategic focus: The region's emphasis on solar reflects confidence in this technology's central role in the North American energy transition, potentially offering more specialized exposure than other regional markets.

- Technology-specific allocations matter: The data highlights the importance of looking beyond broad "renewable" categories to understand specific technology allocations, as these vary significantly across regions.

- Policy stability drives investment patterns: Despite political fluctuations, capital markets continue to view North American solar as a compelling long-term investment, suggesting confidence in the sector's underlying economics and policy support.

The Path Forward

The pronounced emphasis on renewable energy in North American green bonds—particularly the strategic focus on solar and wind—represents a significant positive trend in sustainable finance. This allocation pattern suggests that green bonds are successfully channeling capital toward technologies that will play crucial roles in decarbonizing the North American energy system.

As the market continues to evolve, monitoring these allocation patterns will provide essential insights into how sustainable finance is supporting the clean energy transition across different technologies and regions. North America's leadership in renewable allocations establishes a benchmark that may influence issuers in other regions, potentially driving greater renewable investments in green bond frameworks globally.

For sustainability teams and portfolio managers, understanding these nuanced regional and technological allocation patterns remains essential for developing informed investment strategies that align financial objectives with environmental impact goals.

ClimateAligned's technology captures allocation data at scale and in real time, providing unprecedented visibility into how sustainable finance is being deployed across technologies and markets.