Analysis

Sovereign GSS+ Bonds and Climate Ambition: Financing the Transition to Paris Agreement Targets

Insights for sustainability analysts and portfolio managers in fixed income markets

Jun 14, 2024 @ London

Our analysis reveals important distinctions that impact portfolio assessment, reporting capabilities, and ultimate social outcomes.

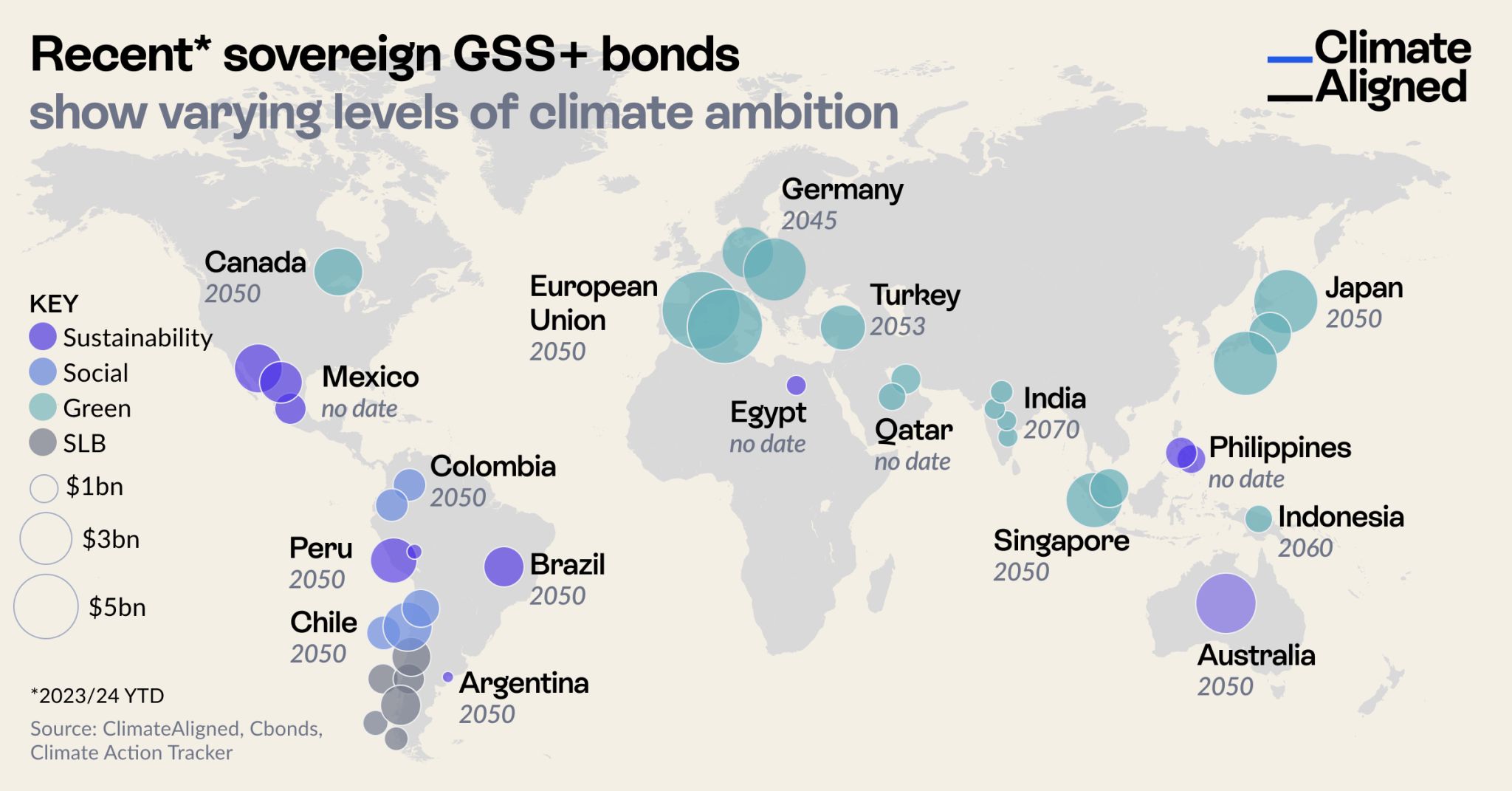

As the Bonn Climate Change Conference (SB60) concludes, discussions around climate finance have intensified with particular focus on the post-2025 climate finance goal set to be adopted at COP29 in Baku. Against this backdrop, sovereign green, social, and sustainability bonds (GSS+) emerge as critical instruments for mobilizing capital toward climate targets. New analysis reveals important patterns in how sovereign issuers are aligning their labeled bond programs with climate ambitions.

Source: ClimateAligned, Cbonds, Climate Action Tracker, 2023/24 YTD

Source: ClimateAligned, Cbonds, Climate Action Tracker, 2023/24 YTD

Sovereign GSS+ Bond Market: A Snapshot of Climate Ambition

Comprehensive analysis of recent sovereign GSS+ issuances reveals striking correlations between issuance patterns, climate targets, and economic development status. Several key patterns emerge:

Advanced Economies Lead in Volume and Ambition

The largest GSS+ bond programs originate predominantly from developed economies with Paris-aligned targets. The European Union, Japan, and Germany currently hold the top positions in issuance volume, with all three committing to net zero targets by 2050 or earlier. These investment-grade sovereign issuers have successfully tapped into strong investor demand for GSS+ instruments, establishing robust frameworks that link proceeds to their climate objectives.

The scale of these programs demonstrates the potential for sovereign GSS+ bonds to mobilize significant capital. More importantly, these established issuers hold strategic positions to expand their programs and potentially direct climate finance toward emerging markets and developing economies (EMDEs), addressing a crucial gap in global climate finance.

Emerging Markets Show Varying Levels of Alignment

Among EMDE issuers, climate ambition varies considerably. Several notable patterns emerge:

- Latin American Issuers: Countries like Chile, Colombia, and Peru have aligned their net zero targets with 2050 despite varying bond types and volumes. Brazil has also committed to a 2050 target while focusing primarily on sustainability bonds.

- Asian Variance: A significant spread exists between Asian issuers, with Singapore targeting 2050, Indonesia 2060, and India 2070. These extended timeframes raise questions about the alignment of green bond proceeds with long-term climate objectives.

- Missing Targets: Several recent issuers, including Mexico, Egypt, Qatar, and the Philippines, have not yet established clear net zero target dates, despite active participation in the labeled bond market.

This variance creates both challenges and opportunities for investors seeking to assess the alignment between sovereign issuance programs and meaningful climate action.

Strategic Implications for Market Participants

For Sovereign Issuers

The current landscape offers several strategic considerations for sovereign issuers:

Policy-Finance Integration: Advanced economy issuers with established programs have opportunities to strengthen the linkage between their Paris-aligned targets and specific use-of-proceeds categories, enhancing credibility and impact.

Target Enhancement Opportunities: For EMDE issuers with distant or unestablished net zero targets, GSS+ bond issuances present strategic moments to announce enhanced climate ambition, potentially improving financing terms while accelerating climate action.

Innovative Structures: Building on successful examples like Mexico's SDG bonds and Indonesia's green and blue bonds, sovereigns can explore structures that simultaneously address climate, biodiversity, and social objectives while committing to strengthened targets.

Regional Leadership: Middle Eastern issuers, building on Qatar's recent green bond and UAE's COP presidency, have opportunities to demonstrate leadership in aligning sovereign finance with climate ambition, potentially catalyzing regional momentum.

For Investors and Asset Managers

For fixed income investors, the analysis suggests several approaches:

Enhanced Due Diligence: Beyond evaluating bond frameworks, investors should assess the alignment between a sovereign's climate targets and their bond programs, identifying potential inconsistencies or ambition gaps.

Engagement Strategy: Investors can leverage primary market participation to engage with sovereigns on climate target enhancements, particularly for issuers with distant or unestablished net zero commitments.

Impact Measurement: Developing more sophisticated approaches to assessing the climate impact of sovereign GSS+ bonds beyond traditional metrics, incorporating policy alignment and ambition indicators.

Portfolio Construction: Considering not just the labeled bond category but also the issuer's climate ambition when constructing sustainable fixed income portfolios focused on genuine transition potential.

The Path Forward: Bridging Finance and Climate Ambition

As discussions on the New Collective Quantified Goal (NCQG) advance ahead of COP29, several developments could strengthen the connection between sovereign GSS+ bonds and climate targets:

Climate-Conditional Issuance: Sovereigns could explicitly link new or enhanced climate commitments to issuance programs, similar to sustainability-linked structures in the corporate market.

Blended Finance Models: Advanced economy issuers could develop innovative structures that leverage their own GSS+ programs to mobilize additional capital for EMDE climate projects.

Regional Cooperation: Regional issuance platforms could enable smaller sovereigns to access markets while committing collectively to enhanced climate targets.

Harmonized Impact Reporting: Strengthened reporting frameworks that explicitly connect bond proceeds to NDC implementation would enhance transparency and credibility.

These innovations could help bridge the current gap between sovereign financing activities and climate ambition, particularly as countries prepare enhanced NDCs for 2025 at COP30.

Conclusion: Financing the Paris Ratchet Mechanism

The sovereign GSS+ bond market stands at a critical juncture as the international climate finance architecture evolves. The upcoming "Finance COP" in Baku and subsequent NDC enhancement cycle present unique opportunities to strengthen the alignment between sovereign debt issuance and climate ambition.

For the market to fulfill its potential in facilitating the Paris Agreement's ratchet mechanism, both issuers and investors must increasingly view sovereign GSS+ bonds not merely as financing instruments but as strategic tools for signaling and implementing enhanced climate commitments.

As the $1.1 trillion climate finance goal proposed for 2025-2029 demonstrates, the scale of capital required necessitates that sovereign GSS+ bonds evolve beyond their current state. By more directly connecting these instruments to enhanced climate targets, the market can play a central role in financing the transition to a Paris-aligned global economy.

ClimateAligned provides comprehensive data analytics on sovereign GSS+ bonds and their alignment with climate targets and policies. Our AI-powered platform enables unprecedented visibility into the evolving relationship between sustainable finance flows and climate ambition.