Analysis

Renewable Energy Dominates Green Bond Proceeds: Real-Time Market Intelligence Transforms Investment Landscape

Insights for sustainability analysts and portfolio managers in fixed income markets

Dec 12, 2024 @ London

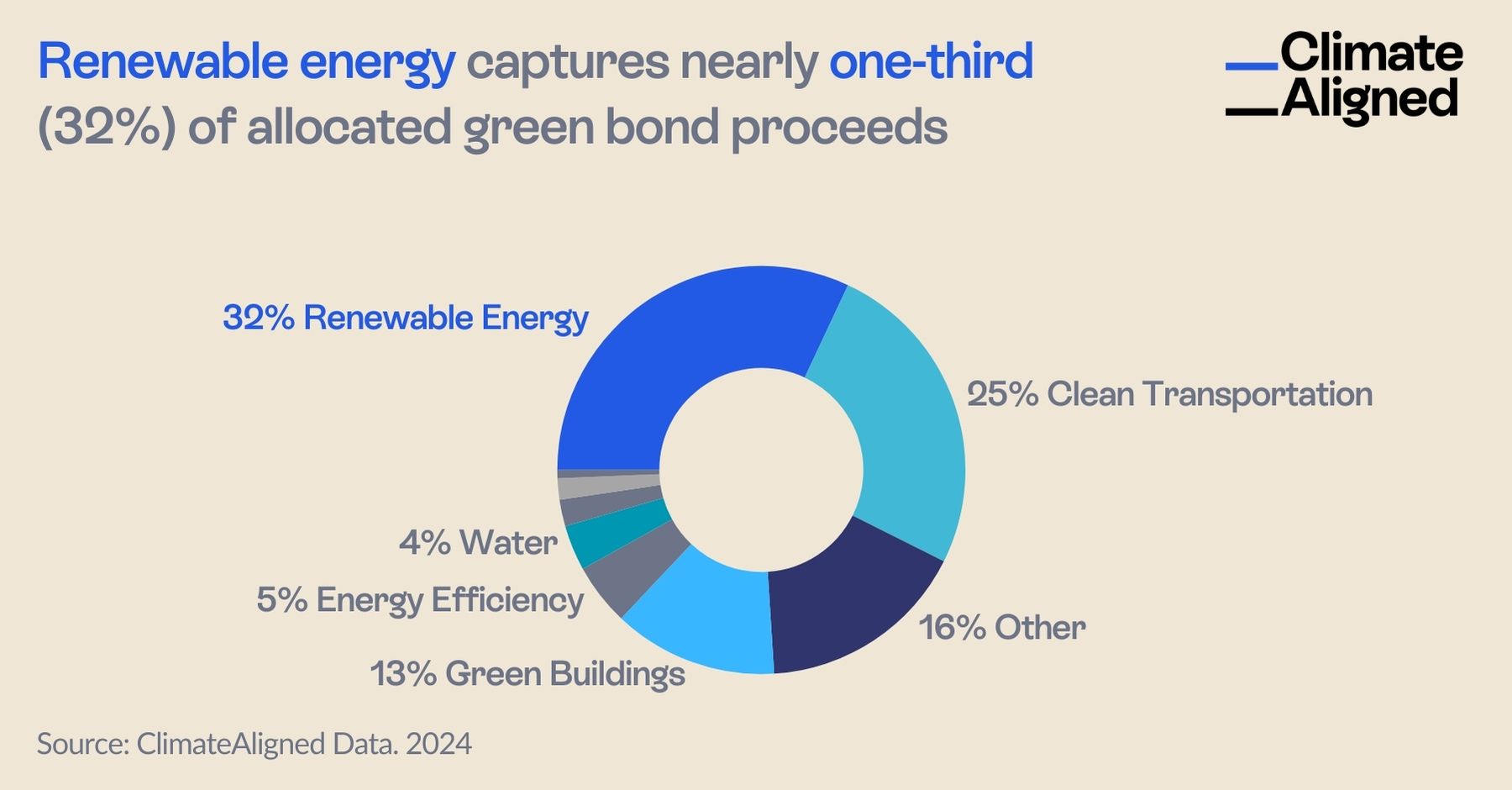

The sustainable finance market has reached a significant milestone that deserves attention from serious market participants - renewable energy now captures nearly one-third (32%) of all allocated green bond proceeds globally.

The sustainable finance market has reached a significant milestone that deserves attention from serious market participants: renewable energy now captures nearly one-third (32%) of all allocated green bond proceeds globally. This concentration represents both a market validation of renewable energy investments and a critical data point for portfolio managers seeking to understand market trends.

The Data Revolution Behind the Insight

The true significance of this finding extends beyond the statistic itself. Until recently, obtaining such comprehensive market intelligence required months of painstaking manual analysis, leaving investors to make decisions based on perpetually outdated information.

For fund managers, investors, and analysts, the process was particularly burdensome—conducting tedious research on individual bonds with no reliable way to develop a holistic market perspective. This data gap has hampered efficient capital allocation and prevented stakeholders from identifying emerging investment opportunities in the green bond market.

A Comprehensive View of the Green Bond Landscape

Our analysis reveals several noteworthy allocation patterns beyond the renewable energy segment:

- Clean Transportation: Capturing 25% of proceeds, this category has emerged as the second-largest destination for green bond capital, reflecting growing investment in electric vehicle infrastructure, public transport, and low-carbon mobility solutions.

- Green Buildings: At 13% of allocations, sustainable construction and building retrofits continue to attract significant investment, particularly in developed markets with ambitious building efficiency standards.

- Energy Efficiency: Despite its critical role in emissions reduction, energy efficiency projects receive only 5% of allocations, suggesting potential underinvestment relative to their climate mitigation potential.

- Water: Water management and conservation projects currently receive 4% of proceeds, a figure that may increase as climate adaptation gains prominence in sustainable finance frameworks.

These allocation patterns provide vital context for portfolio managers working to position their investments relative to broader market trends or seeking to identify underrepresented sectors with growth potential.

Market Intelligence Enabling Strategic Decision-Making

The ability to access real-time allocation data transforms how investment decisions can be made in several critical ways:

Portfolio Construction: Understanding market-wide allocation patterns allows portfolio managers to strategically position their holdings—either aligning with market trends or deliberately targeting underrepresented sectors.

Comparative Analysis: Fund managers can now benchmark their portfolios against market averages, identifying potential overexposure or underexposure to specific green categories.

Opportunity Identification: The data reveals potential gaps in market coverage that may represent investment opportunities—particularly in categories like energy efficiency that show strong climate impact potential but relatively low allocation percentages.

Risk Assessment: Concentration in specific sectors (such as the 32% allocation to renewable energy) can be factored into portfolio risk assessments, allowing for more nuanced diversification strategies.

From Data Collection to Strategic Insight

This transition from laborious manual research to instant market intelligence fundamentally changes the sustainable finance landscape. Portfolio managers can now focus their expertise on analysis and strategy rather than data collection, leading to more sophisticated investment approaches.

For sustainable finance analysts, the ability to see beyond individual bond documentation to identify market-wide trends enables more compelling research and client recommendations. What was once a fragmented view of individual bonds can now be a cohesive understanding of market direction.

The Future of Sustainable Bond Market Intelligence

Looking forward, we anticipate several developments in how real-time market intelligence will continue to reshape the sustainable finance landscape:

- Investors will increasingly demand granular sub-category breakdowns, wanting to understand not just "renewable energy" allocations but specific technologies receiving funding

- Allocation trend analysis will become a standard component of market outlook reports

- Regional comparisons will highlight geographical differences in green bond allocation priorities

- Integration of allocation and impact data will enable more sophisticated assessment of impact efficiency

For portfolio managers and sustainable finance professionals, the message is clear: the era of flying blind in sustainable fixed income is ending. Those who embrace comprehensive market intelligence will gain significant advantages in portfolio construction, client reporting, and strategic decision-making—ultimately contributing to more efficient capital allocation for climate action.

ClimateAligned provides instant, comprehensive sustainable bond market analytics, from individual bond details to full market insights. Our technology delivers unprecedented visibility into project allocations, key performance indicators, and detailed GHG emissions impact data.