Analysis

Social Bonds: Quality and Standardisation in a Growing Market

Insights for sustainability analysts and portfolio managers in fixed income markets

Feb 10, 2025 @ London

Our analysis reveals important distinctions that impact portfolio assessment, reporting capabilities, and ultimate social outcomes.

The social bond market has experienced remarkable growth in recent years, driven by increasing investor demand for investments that deliver measurable social impact alongside financial returns. However, as with any rapidly expanding market segment, significant quality variations exist among issuances. Our analysis reveals important distinctions that impact portfolio assessment, reporting capabilities, and ultimate social outcomes.

Market Standards and Reporting Quality

The International Capital Market Association (ICMA) Social Bond Principles and Harmonised Framework have emerged as the definitive market standards for high-quality social bonds. These frameworks establish essential guidelines for transparency, impact measurement, and standardised reporting that facilitate meaningful comparison and aggregation across issuances.

Our comprehensive assessment of the social bond market reveals a clear quality spectrum, with significant implications for investors seeking to build cohesive impact portfolios and report outcomes efficiently.

Case Study: Standardisation vs Customisation

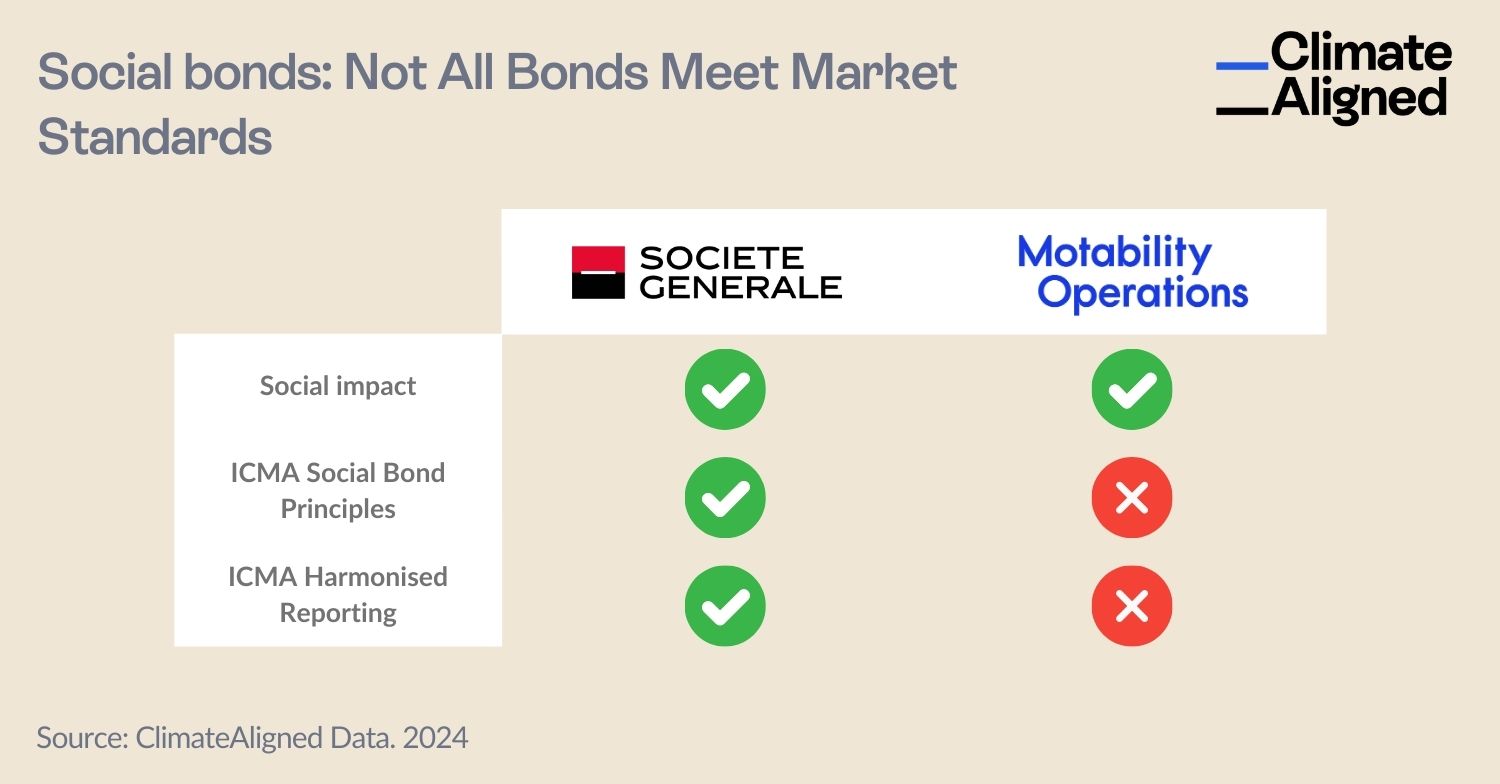

Two representative examples illustrate the practical consequences of adherence to market standards:

Société Générale: Alignment with Market Standards

Société Générale's social bonds demonstrate exemplary alignment with established market principles, characterised by:

- Full compliance with ICMA Social Bond Principles

- Rigorous adherence to the ICMA Harmonised Reporting Framework

- Standardised post-issuance reporting with consistent metrics

- Transparent disclosure of key social indicators including:

- Number of SMEs financed

- Total housing beneficiaries reached

- Regional distribution of social outcomes

This approach enables straightforward portfolio impact aggregation and facilitates efficient integration into broader ESG reporting frameworks. Investors can readily incorporate these standardised metrics into their impact dashboards and regulatory disclosures.

Motability Operations: Impact Without Standardisation

In contrast, Motability Operations' social bonds, while delivering genuine and meaningful social impact, take a more customised approach:

- Partial deviation from ICMA Social Bond Principles

- Non-adherence to Harmonised Reporting metrics

- Custom reporting focused on organisation-specific outcomes

- Measurement emphasis on internal indicators including:

- Customer satisfaction scores

- Total vehicles leased

- Service accessibility improvements

While these metrics effectively showcase Motability's mission fulfilment, they present challenges for portfolio managers seeking to aggregate impact across multiple holdings. The absence of standardised metrics complicates comparative analysis and integrated reporting.

Source: ClimateAligned Data, 2024

Source: ClimateAligned Data, 2024

Implications for Institutional Investors

For investment professionals managing diversified fixed income portfolios with social impact mandates, these variations in standardisation create several practical considerations:

- Reporting Efficiency: Bonds aligned with ICMA standards significantly reduce the reporting burden by providing consistent, comparable metrics that can be aggregated across portfolios.

- Impact Verification: Standardised frameworks facilitate more robust third-party verification and assurance of social outcomes, enhancing reporting credibility.

- Regulatory Alignment: As regulatory requirements for sustainable finance disclosures evolve, bonds adhering to established frameworks typically provide better alignment with emerging compliance needs.

- Portfolio Construction: Understanding these distinctions enables more strategic portfolio construction decisions, balancing standardised and customised approaches based on specific mandate requirements.

The Value of Comprehensive Data

For institutional investors navigating this quality spectrum, access to comprehensive data that captures both standardised metrics and customised impact indicators is essential. This combined approach enables a nuanced understanding of social outcomes while facilitating efficient portfolio-level reporting.

ClimateAligned's analyst-curated, AI-scaled data platform addresses this challenge by providing comprehensive coverage of the social bond market, from pre-issuance frameworks to post-issuance indicators. By capturing standardised metrics while also preserving issuer-specific impact data, our solution enables investors to efficiently assess quality, report impact, and make informed portfolio decisions.

Forward Outlook

As the social bond market continues to mature, we anticipate increasing convergence toward standardised reporting frameworks, driven by investor demand for comparability and regulatory pressures for consistency. However, the diversity of social challenges addressed by these instruments means that some degree of customisation will likely remain appropriate for certain issuances.

For portfolio managers and sustainability officers, navigating this evolving landscape requires access to comprehensive data that enables efficient identification of market-standard compliant bonds while capturing the nuanced impact of more customised issuances.

ClimateAligned provides comprehensive, AI-enhanced data on social bonds and the broader labelled bond market, enabling efficient impact assessment, reporting, and portfolio construction.