Analysis

Sovereign Green Bonds: Analysis Reveals Diversified Funding Approach with No Clear Priority Sectors

Insights for sustainability analysts and portfolio managers in fixed income markets

Jun 7, 2024 @ London

The sovereign green bond market has reached a significant milestone with Qatar and Australia becoming the latest entrants, bringing the total number of sovereign and regional government issuers to 55.

The sovereign green bond market has reached a significant milestone with Qatar and Australia becoming the latest entrants, bringing the total number of sovereign and regional government issuers to 55. As this market segment matures, new comprehensive analysis reveals that sovereign issuers are taking a notably diversified approach to project financing, with implications for both market participants and climate finance effectiveness.

Source: ClimateAligned, 2024.

Source: ClimateAligned, 2024.

A Diversified Allocation Strategy

In-depth analysis of sovereign green bond allocations reveals that governments are adopting remarkably broad approaches to sustainable project financing. On average, each sovereign issuer finances approximately 16 different project types under their green frameworks, resulting in widely distributed allocations with no dominant category emerging as a clear priority.

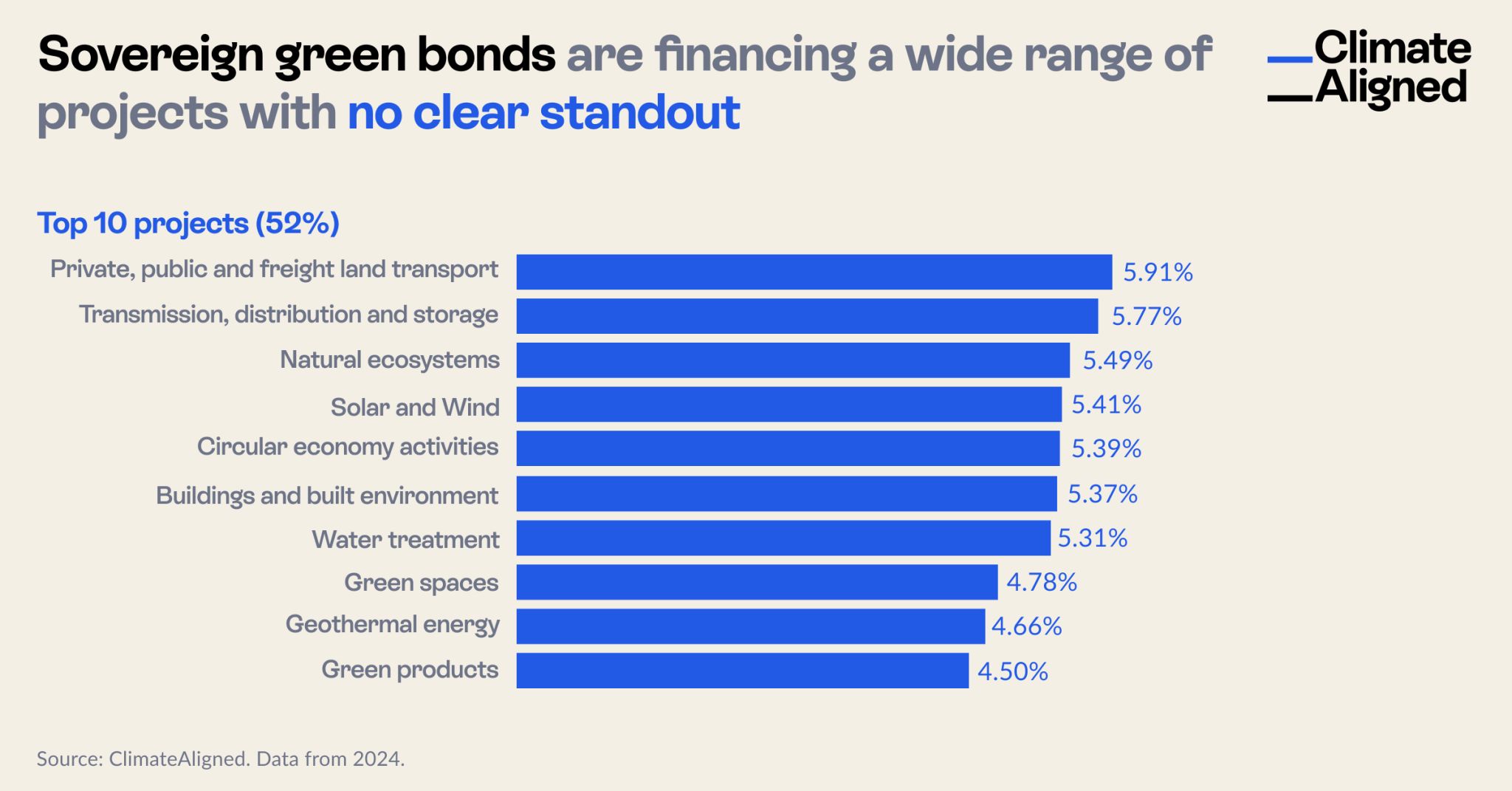

This diversification is clearly illustrated in the allocation data, where even the highest-funded project categories represent relatively modest percentages of overall issuance:

- Private, public, and freight land transport: 5.91%

- Transmission, distribution, and storage: 5.77%

- Natural ecosystems: 5.49%

- Solar and wind energy: 5.41%

- Circular economy activities: 5.39%

- Buildings and built environment: 5.37%

- Water treatment: 5.31%

- Green spaces: 4.78%

- Geothermal energy: 4.66%

- Green products: 4.50%

Collectively, these top ten categories account for just 52% of sovereign green bond allocations, highlighting the extreme diversification across project types. The remaining 48% is spread across numerous smaller categories, further reinforcing the pattern of broad distribution.

Strategic Implications of Diversified Allocations

The notably even distribution of sovereign green bond proceeds across project categories raises important strategic considerations for various market participants.

For Sovereign Issuers

For governments issuing or considering green bonds, the current market landscape presents several implications:

Framework Development Considerations: The broad allocation approach of existing issuers suggests that comprehensive frameworks covering multiple project types have become the market norm. New sovereign issuers may feel pressure to develop similarly expansive frameworks to align with market expectations.

Strategic Prioritization Opportunities: Given the lack of clear prioritization in the market overall, sovereign issuers have opportunities to differentiate their programs by developing more focused approaches aligned with specific national climate priorities or comparative advantages.

Reporting Complexity: Highly diversified allocations create additional complexity in impact reporting, as different project types require distinct measurement methodologies. Sovereigns must balance breadth of eligible categories with reporting capacity.

Alignment with NDCs: The diverse allocation patterns raise questions about how effectively sovereign green bond programs align with Nationally Determined Contributions under the Paris Agreement, which often contain more specific sectoral priorities.

For Investors and Asset Managers

For fixed income investors assessing sovereign green bonds, the diversified allocation pattern suggests several strategic approaches:

Enhanced Due Diligence: The wide variation in project types necessitates more sophisticated due diligence to evaluate environmental impact across diverse categories with different metrics and reporting approaches.

Comparative Analysis Challenges: The lack of standardization in allocation priorities makes direct comparison between sovereign issuers more complex, requiring investors to develop more nuanced evaluation frameworks.

Sector Exposure Assessment: Portfolio managers should recognize that investing in sovereign green bonds likely provides exposure to a broad range of environmental projects rather than targeted exposure to specific green sectors.

Engagement Strategy: The diversified approach creates opportunities for investor engagement to encourage greater strategic focus or enhanced allocation to underfunded high-impact categories.

Identifying Gaps in Climate Finance Allocation

Despite the broad distribution across project types, the analysis reveals certain areas that receive notably less funding from sovereign green bonds:

Waste Management: Including nuclear waste management, this category receives less than 1% of allocations despite its significant climate and environmental implications.

Power Management: Systems focused on grid stability and demand management also receive less than 1% of financing, despite their critical role in enabling higher renewable energy penetration.

Marine Renewables: While gaining modest traction at approximately 1% of allocations, marine energy remains significantly underfunded relative to its potential in many coastal nations.

These underfunded categories potentially represent areas where sovereign issuers could increase focus to address critical climate finance gaps.

Emerging Trends in Sovereign Green Bond Allocations

The analysis also reveals several emerging trends that suggest evolution in sovereign green bond priorities:

Agricultural Projects: Representing approximately 4% of allocations, agricultural initiatives are gaining prominence, reflecting growing recognition of both the sector's climate impact and vulnerability.

ICT Solutions: Digital and information technology projects focused on climate objectives have reached approximately 2% of allocations, indicating growing appreciation for the role of technology in climate solutions.

Adaptation Focus: The inclusion of categories like agriculture and water management reflects a gradual shift toward greater emphasis on climate adaptation alongside traditional mitigation priorities.

These emerging categories suggest that sovereign green bond frameworks are gradually expanding beyond traditional energy and transportation focuses to encompass broader sustainability considerations.

The Path Forward: Strategic Considerations

As the sovereign green bond market continues to mature, several developments could enhance the strategic alignment between financing and climate objectives:

Nationally-Aligned Frameworks: Sovereign issuers could develop more strategically focused frameworks that explicitly align project categories with national climate priorities and competitive advantages rather than adopting broadly inclusive approaches.

Impact-Based Prioritization: More sophisticated impact assessment methodologies could enable issuers to prioritize project categories that deliver the greatest climate benefits per unit of capital within their specific national contexts.

Enhanced Transparency: More detailed reporting on the climate and environmental impacts of diverse project types would help investors better understand the relative effectiveness of different allocation strategies.

Cross-Border Collaboration: Regional approaches to sovereign green bond issuance could enable more strategic specialization based on national strengths while still providing investors with diversified exposure.

Conclusion: Balancing Breadth and Impact

The current pattern of highly diversified allocations in sovereign green bonds represents both a strength and a challenge for the market. While it demonstrates the flexibility of the instrument to address multiple environmental objectives simultaneously, it also raises questions about whether more focused approaches might deliver greater climate impact.

As the sovereign green bond market welcomes new entrants like Qatar and Australia, the question of strategic prioritization versus diversification will likely become increasingly important. For the market to maximize its contribution to climate objectives, sovereign issuers may need to balance comprehensive frameworks with clearer strategic focus aligned with specific national climate priorities and capabilities.

ClimateAligned provides comprehensive data analytics on sovereign green bond allocation patterns and market trends. Our AI-powered platform enables unprecedented visibility into financing priorities across issuers and project categories.