Analysis

Comparing Sovereign Green Bond Frameworks: A Global Perspective

Insights for sustainability analysts and sovereign debt specialists

Feb 28, 2025 @ London

Recent developments in the sovereign green bond market have created new opportunities for institutional investors seeking exposure to national-level climate transition strategies.

Recent developments in the sovereign green bond market have created new opportunities for institutional investors seeking exposure to national-level climate transition strategies. With China publishing its first green bond framework and Saudi Arabia issuing its inaugural sovereign green bond, the landscape of sovereign sustainable finance continues to evolve rapidly.

Global Progress in Sovereign Green Finance

The expansion of sovereign green bonds represents a significant step forward in mobilizing capital for national climate goals. Using ClimateAligned's comprehensive data platform, we've benchmarked these new frameworks against those of other major economies to provide valuable context for institutional investors.

Framework Coverage Analysis: Addressing Emissions Hotspots

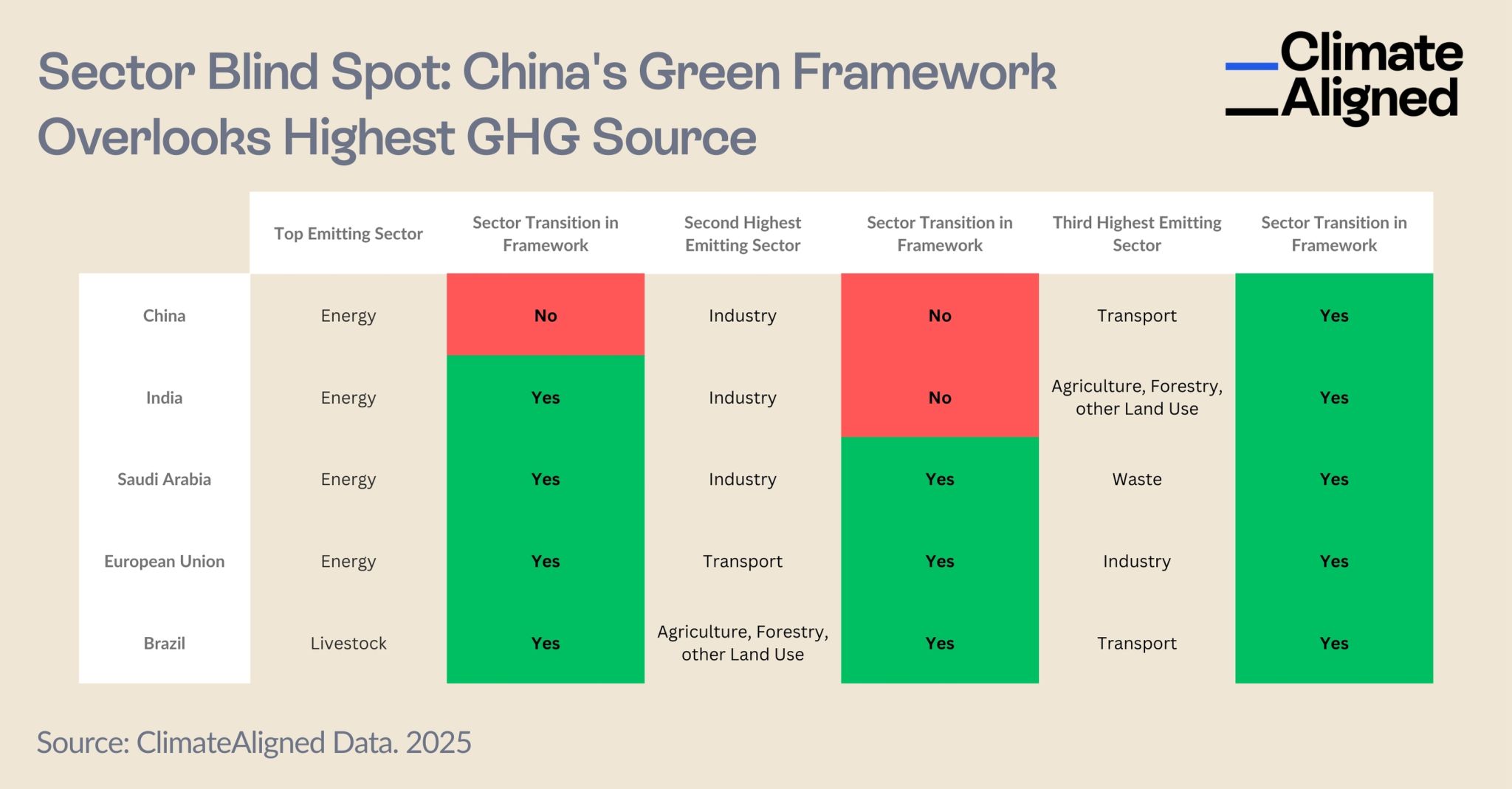

Our comparative analysis reveals interesting patterns in how different countries structure their green bond frameworks to address their respective emissions profiles.

China: Focus on Transportation and Future Growth Sectors

China's first sovereign green bond framework notably emphasizes transportation sector decarbonization while not explicitly including projects related to its two highest-emitting sectors (energy and industrials). This framework design choice merits contextualization alongside China's broader green transition efforts.

While not reflected in the bond framework, China has established itself as the global leader in renewable energy deployment and manufacturing. The country accounts for:

- 54% of global solar PV manufacturing capacity

- 70% of global battery production

- Over 50% of global electric vehicle sales in 2024

China's remarkable progress in scaling green technologies has positioned it as the world's largest producer and installer of wind and solar energy systems. In 2023 alone, China installed more solar capacity than the rest of the world combined, adding over 216 GW to its energy mix.

These achievements illustrate how China's industrial strategy and green bond framework represent complementary but distinct approaches to its energy transition. The framework's focus on transportation appears designed to accelerate progress in a sector where China already has competitive advantages in electric mobility.

Comprehensive Approaches from Other Major Economies

Other major economies have adopted frameworks with more direct alignment to their emissions profiles:

- India has prioritized renewable energy projects to address emissions from its energy sector, which represents 45% of its total emissions. This strategic focus supports India's ambitious renewable capacity addition targets.

- Saudi Arabia has incorporated both renewable energy and industrial research initiatives (including direct air capture R&D), signaling commitment to diversifying beyond its traditional oil and gas sector that accounts for 49% of national emissions.

- European Union has established comprehensive provisions for clean energy and transport projects, directly targeting sectors that collectively contribute 51.2% of EU emissions.

- Brazil has included livestock sustainability initiatives and waste management protocols, addressing its agricultural industry emissions which constitute 31% of total national emissions.

Source: ClimateAligned Data, 2025

Source: ClimateAligned Data, 2025

Investment Implications

For institutional investors evaluating sovereign green bonds, several key insights emerge from this analysis:

- Framework design reflects governance priorities. The sectors included in sovereign frameworks often reveal how governments are prioritizing different aspects of their climate transition strategies.

- Context matters for comprehensive assessment. Evaluating a framework's impact potential requires understanding a country's broader climate policy landscape and existing initiatives outside the bond framework.

- Implementation quality remains crucial. The ultimate environmental impact will depend on rigorous project selection and transparent reporting of outcomes against established metrics.

- Market evolution continues. As more countries issue sovereign green bonds and report on their impact, best practices will emerge that may influence future framework designs.

Looking Ahead

The recent entry of major economies like China and Saudi Arabia into the sovereign green bond market marks an important maturation point for sustainable finance. These frameworks will play a critical role in financing national transitions toward more sustainable economies while providing investors with new opportunities to align capital with climate objectives.

As these new sovereign green bonds move from framework to issuance and ultimately to impact reporting, ClimateAligned will continue monitoring where funds are allocated and how effectively they address each country's key emissions sources.

ClimateAligned's technology provides comprehensive data from bond frameworks, SPOs, and post-issuance reports on demand, giving investors the insights needed to make informed decisions in the rapidly evolving green bond market.