Analysis

UK Sets World's Most Ambitious 2035 Climate Target

Insights for sustainability analysts and portfolio managers in fixed income markets

Feb 11, 2025 @ London

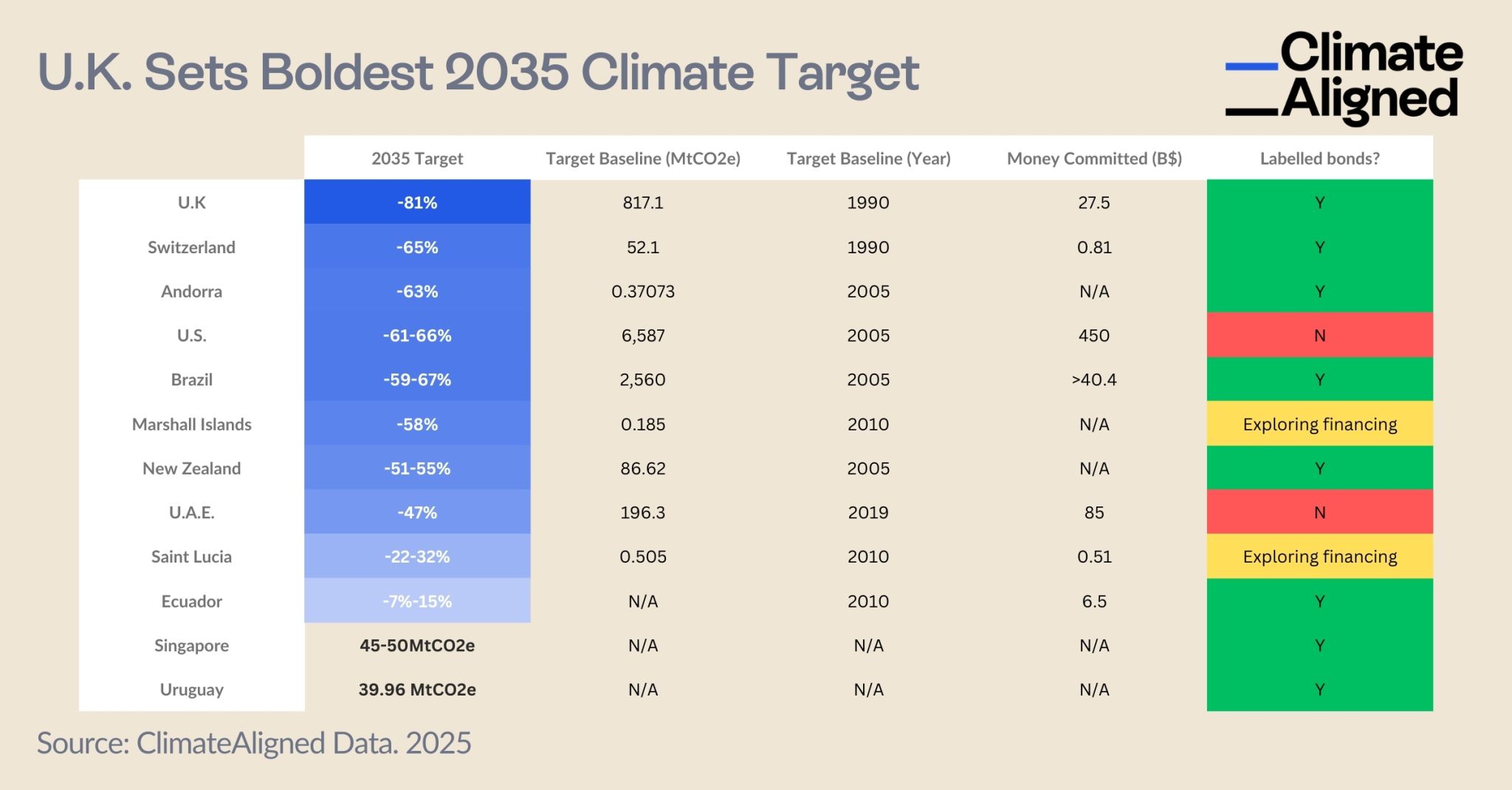

Despite 95% of countries missing their Paris Agreement Nationally Determined Contribution (NDC) submission deadlines, a select group of twelve nations demonstrated exceptional commitment by delivering their updated targets on time. Among these, the United Kingdom has established itself as a global leader in climate ambition.

While global attention often focuses on missed climate commitments, significant developments in sovereign climate ambition deserve closer examination. Despite 95% of countries missing their Paris Agreement Nationally Determined Contribution (NDC) submission deadlines, a select group of twelve nations demonstrated exceptional commitment by delivering their updated targets on time. Among these, the United Kingdom has established itself as a global leader in climate ambition.

UK's Distinguished Climate Leadership

Our analysis reveals that the UK has set the most ambitious 2035 climate target globally—an 81% emissions reduction from 1990 levels. This commitment substantially exceeds those of other major economies and positions the UK as the only large economy with a climate plan aligned with the Paris Agreement's 1.5°C temperature goal, as recently highlighted by Bloomberg.

This exceptional target reflects the UK's comprehensive approach to climate policy, combining ambitious reduction goals with substantial financial commitments and innovative financial instruments. The UK has pledged £27.5 billion to support its climate transition, creating a credible pathway for achieving its ambitious goals.

Linking Climate Ambition to Sovereign Finance

Our research indicates a strong correlation between climate policy ambition and sustainable finance leadership. Two-thirds of countries that submitted timely NDC updates have issued sovereign labelled bonds, establishing a direct link between their climate pledges and financial action.

This alignment between policy and finance creates accountability mechanisms that support the credibility of climate commitments. By issuing labelled bonds tied to their environmental objectives, these nations demonstrate a willingness to subject their climate progress to market scrutiny.

Source: ClimateAligned Data, 2025

Source: ClimateAligned Data, 2025

Varied Approaches to Climate Finance

Our comparative analysis reveals diverse approaches to financing climate transitions:

Strong Finance-Policy Alignment:

- The UK has committed £27.5 billion while issuing sovereign labelled bonds

- Brazil has allocated over $40.4 billion alongside its labelled bond programme

- Switzerland has dedicated CHF 0.81 billion to climate initiatives, complemented by labelled bonds

Policy-Finance Gaps:

- The United States has pledged $450 billion but has not issued sovereign labelled bonds

- The United Arab Emirates has committed $85 billion without sovereign labelled bonds

Emerging Approaches:

- Small island nations like the Marshall Islands and Saint Lucia are actively exploring innovative financing mechanisms to support their ambitious climate goals

- Singapore and Uruguay have set absolute emissions targets rather than percentage reductions

The Importance of Baseline Years

A crucial but often overlooked factor in evaluating climate targets is the baseline year from which reductions are measured. This technical detail substantially impacts the real-world ambition reflected in percentage targets:

- 1990 Baselines: The UK and Switzerland use 1990 as their reference point, setting more challenging targets as this precedes many emissions reduction efforts

- 2005 Baselines: Brazil, the United States, and New Zealand measure from 2005, when emissions were typically higher in many economies

- Recent Baselines: The UAE uses 2019, creating a more recent reference point that affects the interpretation of its 47% reduction target

This variation in baseline years underscores the importance of contextualising percentage reduction targets when assessing climate ambition. The UK's 81% reduction from 1990 levels represents a particularly stringent commitment given its early baseline year.

Implications for Financial Institutions

For financial institutions assessing sovereign climate risk and sustainable investment opportunities, these findings offer several important insights:

- Sovereign Risk Assessment: The alignment between climate targets and financial instruments provides valuable signals for evaluating long-term sovereign risk profiles.

- Investment Opportunities: Countries with ambitious targets backed by labelled bonds offer unique opportunities for sustainable fixed income portfolios.

- Leadership Recognition: The UK's exceptional climate ambition creates a benchmark against which other sovereign issuers may be evaluated.

- Policy Momentum Indicators: Early NDC submissions often signal broader policy momentum that may create favourable environments for sustainable investment.

Moving Forward

As global climate policy continues evolving, the leadership demonstrated by timely NDC submitters—particularly the UK—offers a template for effective climate ambition. The combination of ambitious targets, appropriate financing, and market-linked accountability mechanisms represents best practice in sovereign climate strategy.

For financial professionals navigating the transition to a low-carbon economy, understanding these nuanced differences in sovereign climate approaches provides essential context for portfolio construction and risk management.

ClimateAligned provides comprehensive sovereign climate data on financing and country transitions—including bonds, NDCs, and other policy signals—helping financial professionals make smarter, faster decisions in sustainable finance.