Analysis

Third-Party Assurance Becomes Standard Practice in Utilities' Green Bond Reporting: Data Analysis Reveals Industry Trends

Insights for sustainability analysts and portfolio managers in fixed income markets

Sep 6, 2024 @ London

New market analysis reveals a significant trend in the utilities sector - third-party verification has emerged as the dominant standard for impact reporting.

The quality and credibility of post-issuance reporting have become increasingly important factors for investors evaluating green bonds in their sustainable fixed income portfolios. New market analysis from ClimateAligned reveals a significant trend in the utilities sector: third-party verification has emerged as the dominant standard for impact reporting.

Source: ClimateAligned Data, 2024

Source: ClimateAligned Data, 2024

Utilities Setting New Standards for Reporting Quality

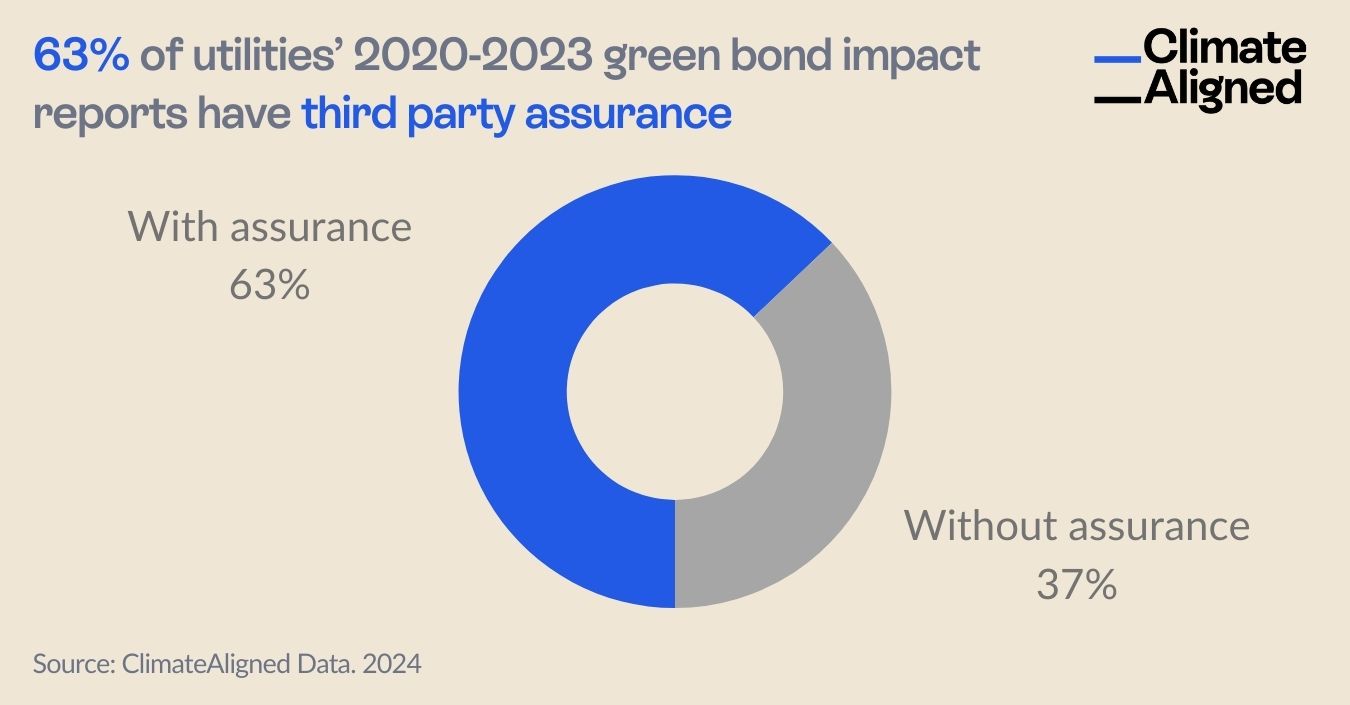

Comprehensive analysis of nearly 1,000 impact reports issued by utility companies between 2020 and 2023 shows that 63% included third-party verification or assurance. This represents a clear majority and establishes external validation as an emerging market standard rather than an exceptional practice.

This trend is particularly noteworthy in the utilities sector, which has been at the forefront of green bond issuance as companies finance the transition from carbon-intensive generation to renewable energy infrastructure. The sector's adoption of rigorous reporting standards reflects both investor pressure for transparency and issuers' recognition that external validation enhances credibility.

Strategic Implications for Market Participants

For Utility Companies and Other Issuers

The data presents clear strategic implications for green bond issuers in the utilities sector:

- Competitive Positioning: With nearly two-thirds of the market obtaining third-party assurance, issuers without external verification may find themselves at a competitive disadvantage when marketing bonds to sustainability-focused investors.

- Investor Expectations: The 63% benchmark establishes a clear market expectation that sophisticated investors are likely to apply when evaluating new issuances and ongoing reporting.

- Best Practice Evolution: What began as exceptional practice has now become standard, suggesting that reporting requirements will continue to evolve toward greater rigour and transparency.

For utilities that have not yet incorporated third-party assurance into their reporting practices, this data indicates a clear need to evaluate their approach against prevailing market standards.

For Institutional Investors and Asset Managers

For investors and portfolio managers, this trend offers several insights to inform investment decision-making:

- Due Diligence Framework: The 63% benchmark provides a quantifiable standard against which to evaluate the reporting quality of potential and existing holdings.

- Engagement Strategy: For holdings without third-party assurance, this market data strengthens the case for engagement with issuers to enhance reporting practices.

- Portfolio Screening: Asset managers may consider incorporating third-party assurance as a screening criterion when constructing sustainable fixed income portfolios.

- Risk Assessment: The absence of external verification in reporting may indicate heightened greenwashing risk that warrants additional scrutiny during the investment process.

Broader Market Implications

The utilities sector's embrace of third-party verification may signal a broader market shift toward enhanced accountability in green bond reporting. Several factors suggest this trend will continue to strengthen:

Regulatory Development: Emerging regulations such as the EU Green Bond Standard explicitly require external review, potentially accelerating the adoption of third-party assurance across markets.

Investor Sophistication: As sustainable fixed income investors develop more nuanced evaluation frameworks, reporting quality metrics are likely to gain prominence in investment decisions.

Market Maturation: The green bond market's evolution from niche to mainstream has brought greater scrutiny and higher expectations for transparency and verification.

Greenwashing Concerns: Heightened attention to potential greenwashing has elevated the importance of independent validation in establishing impact credibility.

The Technology Enabling Market Intelligence

Traditional approaches to market analysis have made it difficult for participants to understand prevailing practices or identify emerging standards. Without comprehensive data, issuers and investors have often relied on limited samples or anecdotal evidence when developing reporting strategies or evaluation frameworks.

Advanced technology and artificial intelligence specifically designed for sustainable fixed income analysis now enable unprecedented visibility into market practices. What would have previously required months of manual analysis can now be accomplished in minutes, allowing for real-time understanding of market developments.

This transformation in analytical capability enables market participants to:

- Compare reporting practices across regions, sectors, or individual issuers

- Identify emerging best practices before they become regulatory requirements

- Benchmark individual bonds against relevant peer groups

- Monitor the evolution of reporting standards over time

Looking Forward: The Evolution of Impact Reporting

As third-party assurance becomes standard practice, the focus is likely to shift toward the quality and comprehensiveness of the verification itself. Future developments may include:

- Greater standardisation of verification methodologies across providers

- More granular assessment of impact calculation methodologies

- Expanded scope of verification beyond allocation to include impact calculations

- Integration of verification with broader sustainability reporting frameworks

For utilities and other sectors actively issuing green bonds, staying ahead of these reporting trends will be crucial to maintaining market access and investor confidence. Regular monitoring of market practices and proactive enhancement of reporting quality will be essential components of successful sustainable finance strategies.

For investors, the ability to efficiently assess reporting quality across portfolios will become increasingly valuable as standards continue to evolve and differentiate issuers in a rapidly growing market.

ClimateAligned provides comprehensive data analytics on green bond post-issuance reporting practices across sectors, regions, and issuers. Our AI-powered platform enables unprecedented market visibility and real-time analysis of emerging trends.