Analysis

Sustainable Waste Management Emerges as Fastest-Growing Green Bond Category in 2024

Insights for sustainability analysts and portfolio managers in fixed income markets

Jul 26, 2024 @ London

New comprehensive analysis reveals a significant surge in waste management financing, signaling an important diversification in sustainable fixed income markets.

The green bond market continues to evolve, with financing patterns shifting to address a broader range of environmental challenges beyond the energy transition. New comprehensive analysis from ClimateAligned reveals a significant surge in waste management financing, signaling an important diversification in sustainable fixed income markets.

Source: ClimateAligned, 2024.

Source: ClimateAligned, 2024.

Shifting Allocation Patterns in Green Bond Financing

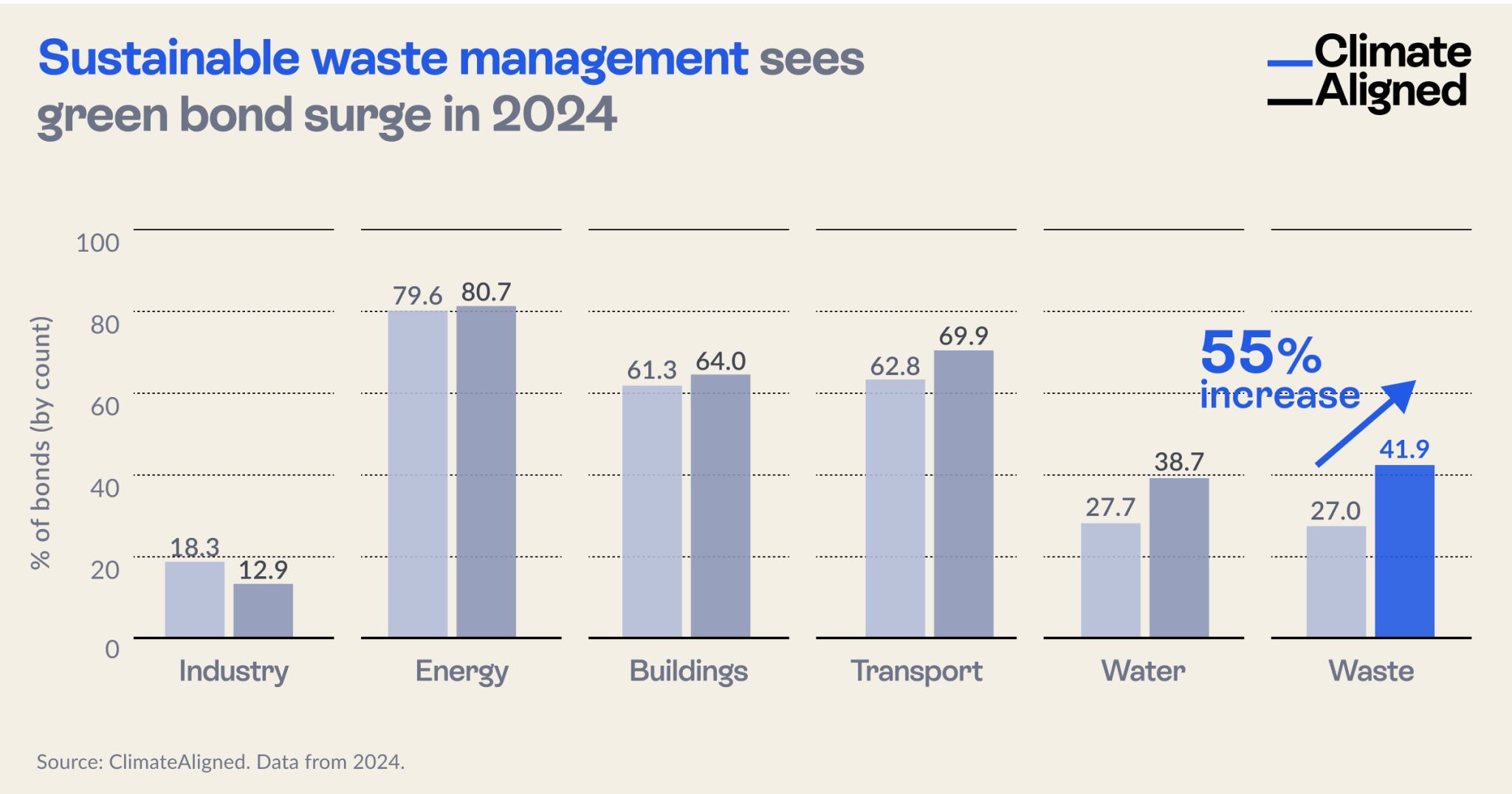

Multi-year analysis of the green bond market reveals notable changes in allocation patterns between 2023 and 2024. While energy projects remain the dominant category, waste management has emerged as the fastest-growing sector for green bond financing:

- Waste Management: 41.9% of green bonds in 2024 include waste-related projects, up from 27% in 2023—a remarkable 55% increase year-over-year

- Energy Projects: Consistently high at approximately 80% of green bonds in both years, reinforcing the continued focus on renewable energy and energy efficiency

- Transportation: A moderate increase from 62.8% to 69.9% of bonds including transportation projects

- Buildings: Slight increase from 61.3% to 64% of bonds financing green building projects

- Water: Growth from 27.7% to 38.7% of bonds including water management initiatives

- Industry: Notable decrease from 18.3% to 12.9% of bonds financing industrial projects, representing a 29% reduction

These shifts reflect evolving issuer priorities and investor interests within the green bond market, with particularly strong momentum behind waste management solutions.

Drivers of the Waste Management Financing Surge

Several factors appear to be driving the substantial increase in waste management allocations:

Circular Economy Focus: Policy initiatives globally have increasingly emphasized circular economy principles, creating regulatory drivers for waste reduction, recycling, and resource recovery investments.

Technology Maturation: Waste-to-energy, advanced recycling, and other waste management technologies have reached commercial maturity, making them more attractive for bond financing.

Portfolio Diversification: Issuers with established renewable energy projects may be expanding their green bond frameworks to include waste management as a complementary sustainability category.

Stakeholder Pressure: Growing consumer and stakeholder emphasis on plastic pollution, resource efficiency, and waste reduction has elevated these issues on corporate sustainability agendas.

Regulatory Development: Enhanced waste management regulations in key markets, particularly in Europe and parts of Asia, have created compliance-driven investment needs that align with green bond criteria.

Strategic Implications for Market Participants

For Issuers

The surge in waste management allocations offers several strategic considerations for potential green bond issuers:

Framework Development: Issuers developing or updating green bond frameworks should consider including waste management categories, as investors increasingly expect diversified use of proceeds beyond traditional renewable energy.

Impact Reporting: As waste management projects gain prominence, issuers should develop robust impact metrics that can effectively communicate the environmental benefits of these initiatives.

Cross-Category Synergies: Issuers can explore integrated projects that address multiple categories simultaneously, such as waste-to-energy initiatives that connect waste management with renewable energy generation.

Competitive Positioning: For waste management companies and municipalities with significant waste operations, green bonds offer an increasingly mainstream financing option that connects with sustainability-focused investors.

For Investors

For fixed income investors and portfolio managers, these allocation trends suggest several strategic approaches:

Sector Expertise Development: As waste management grows as a green bond category, investors may need to develop deeper expertise in evaluating these projects and their environmental impacts.

Impact Diversification: The increasing availability of waste management-focused bonds enables more diversified environmental impact within green bond portfolios.

Engagement Opportunities: Investors can engage with issuers on the quality and ambition of waste management projects, encouraging approaches that prioritize waste reduction and circular economy principles over end-of-pipe solutions.

Market Evolution Awareness: The significant year-over-year shift highlights the dynamic nature of the green bond market, suggesting that investors should regularly reassess sector allocations and emerging trends.

The Technology Enabling Multi-Year Market Analysis

Traditional market analysis has struggled to capture dynamic allocation patterns across thousands of green bonds over multiple years. The scale and complexity of the sustainable fixed income market—now exceeding $3 trillion cumulatively—makes manual trend analysis increasingly impractical.

Advanced artificial intelligence specifically designed for sustainable fixed income analysis now enables unprecedented visibility into evolving market patterns. This technological approach allows for:

- Consistent categorization of thousands of bonds across multiple years

- Precise quantification of year-over-year changes in allocation patterns

- Identification of emerging trends before they become widely recognized

- Evidence-based insights to inform issuance and investment strategies

For market participants seeking to understand the evolution of the green bond market, this data-driven approach provides objective analysis of where capital is flowing and how sustainability priorities are shifting over time.

Looking Forward: The Diversification of Green Finance

The significant growth in waste management allocations represents part of a broader maturation of the green bond market, as financing expands beyond its initial focus on renewable energy to address a more comprehensive range of environmental challenges.

This diversification trend is likely to continue, with several potential developments on the horizon:

Integration with Social Elements: Growing recognition of the social dimensions of waste management, particularly in emerging markets, may accelerate the development of sustainability bonds that address both environmental and social objectives.

Emerging Categories: Additional categories such as biodiversity conservation, sustainable agriculture, and climate adaptation may follow similar growth trajectories in coming years.

Impact Measurement Evolution: As the market diversifies, more sophisticated impact reporting frameworks will likely emerge to capture the environmental benefits of complex, multi-dimensional projects.

Geographical Expansion: The diversification of project categories may facilitate greater green bond issuance in regions where energy transition projects have been less dominant.

For issuers and investors alike, staying informed about these rapidly evolving allocation patterns will be essential to effective participation in the maturing green bond market.

ClimateAligned provides comprehensive data analytics on green bond allocation patterns across sectors and years. Our AI-powered platform enables unprecedented visibility into market trends and emerging financing priorities.