Educational

Labelled Bond Documents: A Comprehensive Guide for Investment Analysis

Essential knowledge for sustainability analysts and fixed income portfolio managers

Mar 24, 2025 @ London

Understanding the key documents in the labelled bond market is crucial for effective due diligence and impact assessment in sustainable fixed income investments.

The sustainable finance market has witnessed remarkable growth, with labelled bonds—including green, social, sustainability, and sustainability-linked bonds—playing an increasingly central role in channelling capital toward positive environmental and social outcomes. However, the complexity of documentation associated with these instruments presents challenges for investors seeking to conduct thorough due diligence and impact assessment.

The Documentation Ecosystem of Labelled Bonds

Unlike conventional bonds, labelled bonds come with an additional layer of documentation that outlines their sustainability credentials and commitments. Labelled bonds comprise several distinct components, each serving a specific purpose in the investment lifecycle.

Framework Documents: The Foundation

Framework documents establish the principles, processes, and criteria that guide an issuer's approach to sustainable finance. Typically ranging from 15-30 pages, these documents serve as the cornerstone of an issuer's sustainable finance programme and often cover:

- Eligibility criteria for project selection

- Process for project evaluation and selection

- Management of proceeds

- Commitment to reporting

- Alignment with international standards (e.g., ICMA Principles, EU Taxonomy)

Virtually all labelled bonds, with an exception of U.S. municipal bonds and the first green bonds issued in the early 2010s, have an associated framework document. However, though the quality and specificity of these frameworks vary significantly. The most robust frameworks provide detailed technical screening criteria and clear exclusions, while less developed ones may offer only general statements of intent.

Second Party Opinions (SPOs): External Validation

SPOs provide an independent assessment of the issuer's framework, evaluating its alignment with market standards and the credibility of the issuer's sustainability strategy. These documents, typically produced by specialised providers such as Sustainalytics, ISS ESG, or DNV GL, offer investors:

- Verification of framework alignment with international principles

- Assessment of the issuer's overall ESG performance

- Evaluation of the impact measurement methodology

- Identification of potential weaknesses or areas for improvement

While almost all labelled bonds have associated SPOs, their analytical depth can vary. The most comprehensive SPOs evaluate not just compliance with principles but also the materiality and ambition of the issuer's sustainability targets.

Pre-Issuance Investor Presentations: Marketing the Bond

Investor presentations provide a condensed overview of the bond's key features, combining financial information with sustainability credentials. These documents, typically 10-20 slides, serve as the primary marketing tool during roadshows and include:

- Summary of the framework and eligible project categories

- Highlight of the issuer's sustainability strategy and targets

- Overview of the SPO's key findings

- Financial terms and use of proceeds allocation

- Preliminary impact metrics or targets

These documents often represent the first touchpoint for investors and play a crucial role in initial screening decisions. However, our analysis indicates they typically provide less detailed information than the full framework or post-issuance reporting.

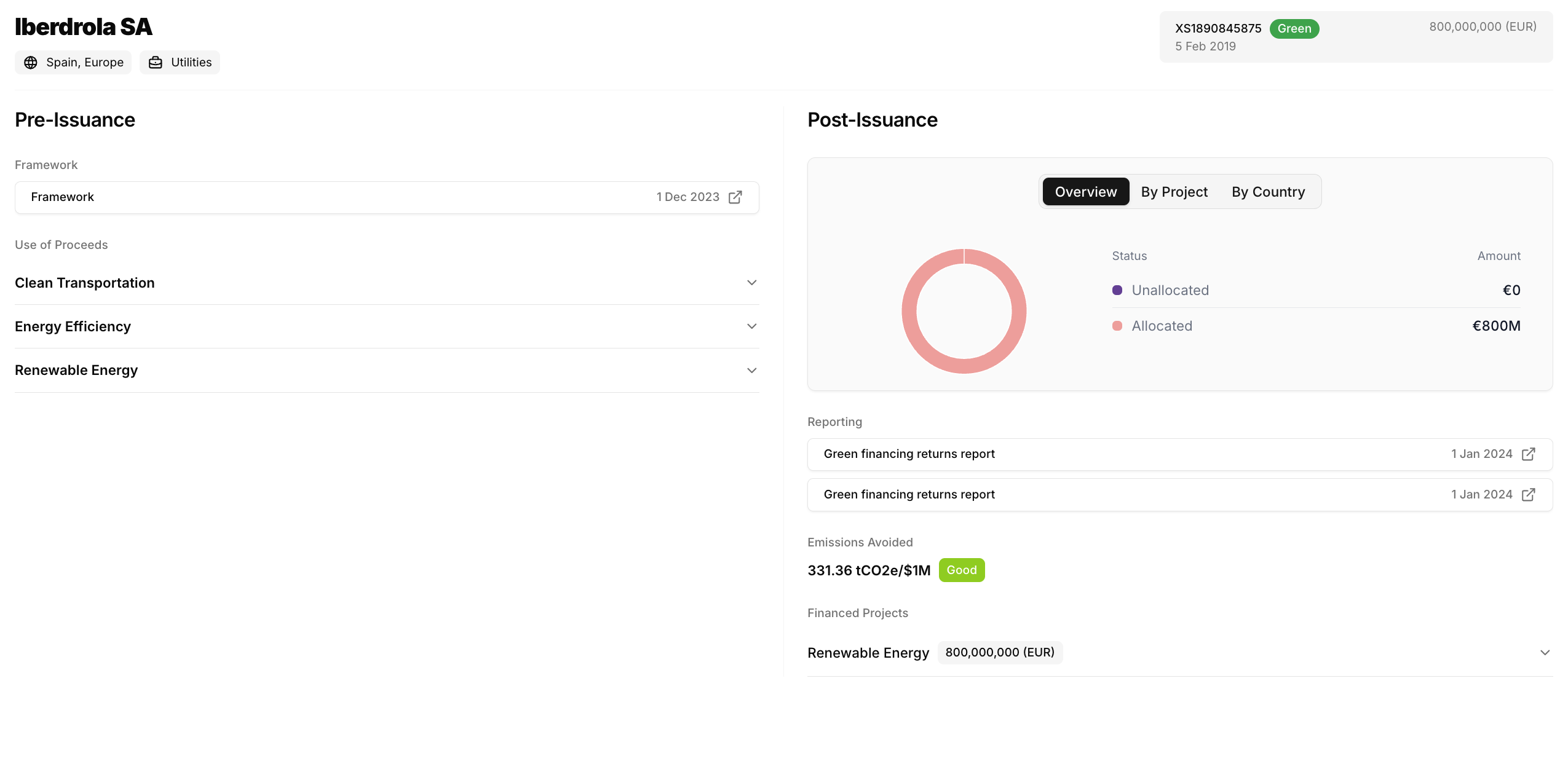

Source: ClimateAligned Platform, 2025

Post-Issuance Reports: Following the Money and Measuring Outcomes

Post-issuance reports provide crucial transparency on both how bond proceeds have been allocated and what impact they've achieved. These reports typically include two key components:

Allocation Reporting

The allocation component provides transparency on how bond proceeds have been distributed across eligible projects or assets. Typically published annually, these reports include:

- Breakdown of allocations by project category

- Geographic distribution of funded projects

- Percentage of proceeds allocated vs. managed as unallocated funds

- Timeline for full allocation (if not already achieved)

- Confirmation of compliance with the eligible categories outlined in the framework

Impact Reporting

The impact component quantifies the environmental and/or social outcomes achieved through the funded projects. These elements translate financial flows into tangible sustainability metrics such as:

- Tonnes of CO2 emissions avoided

- Renewable energy capacity installed

- Water saved or treated

- Number of beneficiaries reached through social projects

- Job creation or economic benefits

Many post-issuance reports include an external verification statement from an independent auditor, providing additional assurance regarding the appropriate allocation of proceeds. Very occasionally, these reports are produced entirely by a third party, usually the same provider that delivered the SPO.

It's worth noting that some issuers incorporate their post-issuance reporting within their broader annual sustainability report, although this practice is relatively rare and can make it more challenging for investors to isolate bond-specific information.

There can be significant disparities in reporting quality, with the best reports providing project-level allocation data and clear impact methodologies, while the least transparent offer only high-level category allocations with limited impact metrics. These methodological inconsistencies between issuers complicate comparative analysis for investors seeking to optimise impact per unit of investment.

How Investors Use Labelled Bond Documentation

Understanding how these documents are utilised throughout the investment process is crucial for both issuers seeking to attract sustainable capital and data providers supporting investment decisions.

Initial Screening and Due Diligence

At the pre-investment stage, portfolio managers and ESG analysts typically review frameworks and SPOs to:

- Determine alignment with their investment mandate

- Assess the credibility of the issuer's sustainability strategy

- Identify potential greenwashing risks

- Evaluate the specificity of eligibility criteria

- Compare against peer frameworks within the sector

While most sustainable fixed income investors conduct document-based due diligence before primary market participation, though the depth of analysis varies significantly between dedicated ESG funds and mainstream investors.

Post-Investment Monitoring

After investment, the focus shifts to allocation and impact reports, which investors use to:

- Verify compliance with the original framework

- Quantify actual environmental or social outcomes

- Identify potential gaps between commitments and execution

- Fulfil their own reporting obligations to clients or regulators

- Inform engagement strategies with issuers

The most sophisticated investors maintain centralised databases of labelled bond documentation, enabling systematic comparison of impact efficiency across their sustainable bond holdings.

Regulatory Compliance

With the implementation of the EU Sustainable Finance Disclosure Regulation (SFDR) and similar requirements globally, investors increasingly rely on labelled bond documentation to:

- Substantiate sustainability claims for Article 8 and 9 funds

- Report on Principal Adverse Impact (PAI) indicators

- Demonstrate alignment with the EU Taxonomy

- Provide evidence for taxonomy-alignment percentages

- Support climate-related financial disclosures

The standardisation challenge remains significant, with many investors citing inconsistent documentation formats as a major obstacle to efficient compliance reporting.

Market Implications and Future Trends

Several key trends are emerging in the labelled bond documentation landscape:

- Increasing standardisation: Market-led initiatives and regulatory developments are driving greater consistency in reporting formats, though significant variation remains.

- Digital transformation: Machine-readable reports and standardised data fields are becoming more common, enabling more efficient analysis and comparison. ClimateAligned's advanced AI technology can automatically extract, analyse, and structure data from diverse document formats, providing investors with consistent, comparable datasets regardless of the original document structure. This capability transforms thousands of static PDFs into dynamic, searchable data points that can inform investment decisions.

- Integration of transition planning: Forward-looking transition metrics are increasingly incorporated alongside historical impact data, particularly in sectors with challenging decarbonisation pathways.

- Enhanced verification requirements: Third-party verification of allocation and impact reports is becoming market standard, with 53% of recent issues including verification statements compared to just 37% two years ago.

- Increased granularity: Leading issuers are providing more detailed, project-level data in response to investor demand for transparency and impact measurement.

For sustainability analysts and portfolio managers, these evolving documentation practices present both challenges and opportunities. Those with access to comprehensive, well-structured data on labelled bond documentation can gain a significant edge in identifying the most credible and impactful sustainable investment opportunities.

As the market matures, we expect to see continued improvement in documentation quality and consistency, driven by regulatory developments, market standards, and growing investor sophistication. However, the ability to efficiently analyse and compare documentation across thousands of labelled bonds will remain a key competitive advantage for sustainable fixed income investors.

ClimateAligned provides automated analysis of labelled bond documentation, delivering consistent, timely insights that help investors make more informed decisions across their sustainable fixed income portfolios.